Unveiling the DJIA Features: A Comprehensive Guide

author:US stockS -

In the world of financial markets, the Dow Jones Industrial Average (DJIA) is a cornerstone index that captures the essence of the U.S. stock market. Known for its stability and diversity, the DJIA features a selection of blue-chip companies that have shaped the economic landscape. This article delves into the key DJIA features that make it a vital tool for investors and financial analysts.

The DJIA Composition

The DJIA consists of 30 large, publicly-traded companies across various sectors. These companies are not only selected for their size but also for their influence on the U.S. economy. The index is designed to represent a broad range of industries, ensuring that it reflects the overall health of the market.

Key Sectors Represented

One of the most notable DJIA features is the representation of key sectors. These sectors include but are not limited to:

- Technology: Companies like Apple and Microsoft, which have revolutionized the tech industry.

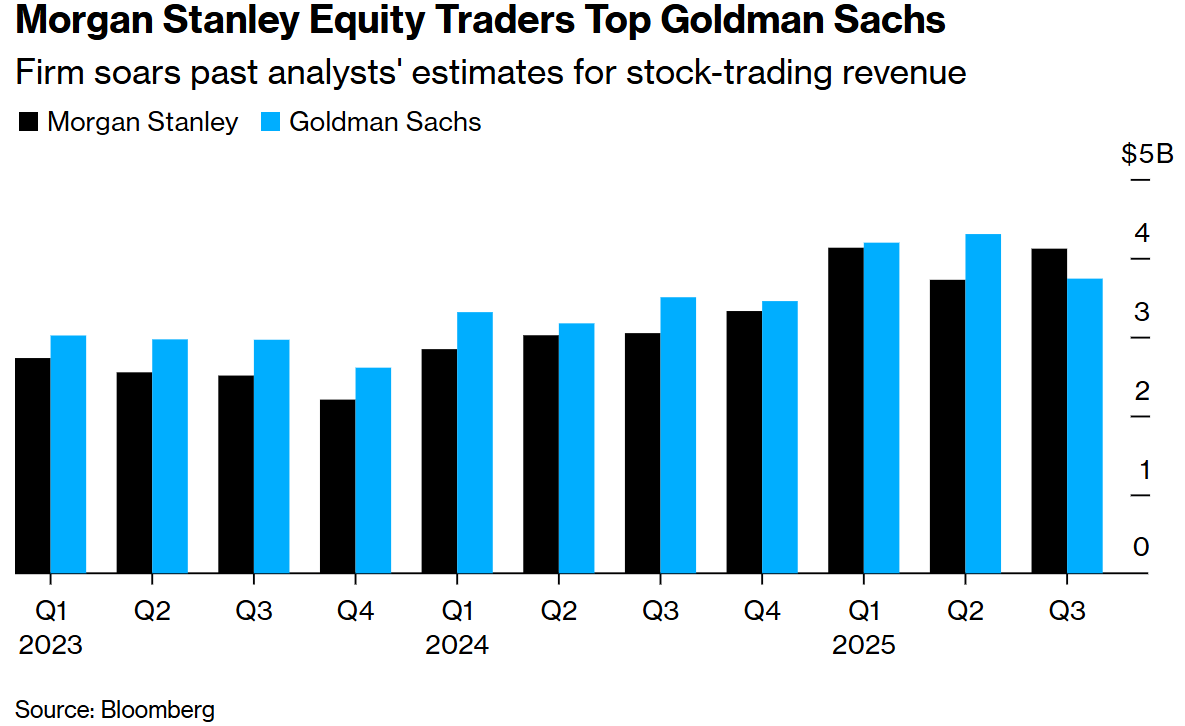

- Finance: Giants like JPMorgan Chase and Goldman Sachs, which play a crucial role in the financial sector.

- Energy: Companies such as ExxonMobil and Chevron, which are among the largest energy producers in the world.

- Consumer Goods: Brands like Procter & Gamble and Coca-Cola, which are household names globally.

Market Stability

The DJIA is often seen as a bellwether for the stock market, particularly for the U.S. economy. Its stability is one of its most appealing DJIA features. Since the index includes only the largest and most stable companies, it tends to be less volatile than other indices, making it a reliable indicator of market trends.

Historical Performance

Over the years, the DJIA has demonstrated strong historical performance. It has been able to weather various economic downturns and come out stronger. This resilience is a testament to the DJIA features that ensure its stability and reliability.

Influence on the Market

The DJIA has a significant influence on the market. Any news or event related to the companies in the index can have a ripple effect on the broader market. This makes the index a crucial tool for investors looking to gauge market sentiment.

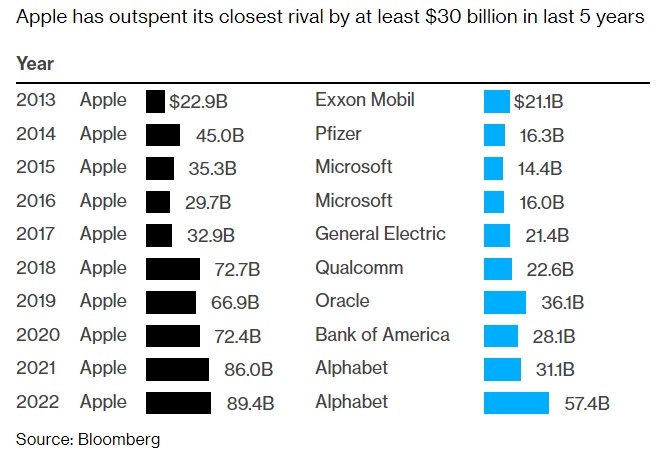

Case Study: Apple’s Impact on the DJIA

A prime example of the DJIA features in action is the inclusion of Apple. When Apple reported its earnings, it not only impacted its own stock price but also had a notable effect on the DJIA. This highlights how the index can be a reflection of broader market trends.

Conclusion

The DJIA is more than just a financial index; it is a snapshot of the U.S. economy. Its diverse composition, stability, and historical performance make it a vital tool for investors and financial analysts. Understanding the DJIA features can provide valuable insights into the market and help investors make informed decisions.

us flag stock