Graph of the Dow Jones: A Comprehensive Analysis

author:US stockS -

In today's fast-paced financial world, staying informed about the stock market is crucial for investors and traders alike. The Dow Jones Industrial Average, often simply referred to as the "Dow," is one of the most closely watched indicators of the overall market's health. This article aims to provide a comprehensive analysis of the graph of the Dow Jones, exploring its significance, historical trends, and potential future movements.

Understanding the Dow Jones

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks listed on the New York Stock Exchange and the NASDAQ. These stocks represent various sectors of the economy, including finance, technology, healthcare, and more. The Dow is widely considered a benchmark for the U.S. stock market, and its movements often reflect the broader market trends.

Historical Trends

To understand the current state of the Dow Jones, it's essential to look at its historical trends. Since its inception in 1896, the Dow has experienced numerous ups and downs. In the early 1900s, the Dow experienced significant growth, driven by the industrial revolution and the expansion of the railroad network. However, the stock market crash of 1929 and the Great Depression led to a massive decline in the Dow's value.

Over the next few decades, the Dow recovered and continued to grow, reaching new highs in the 1950s and 1960s. The dot-com bubble in the late 1990s and the subsequent tech crash in 2000 caused a brief setback, but the Dow eventually recovered and continued to rise. The financial crisis of 2008 again tested the Dow's resilience, but it once again showed remarkable strength and recovered to new all-time highs.

Recent Performance

In recent years, the Dow Jones has experienced a period of strong growth. From 2010 to 2020, the Dow increased by over 100%, driven by factors such as low-interest rates, stimulus measures, and strong corporate earnings. However, the COVID-19 pandemic in 2020 caused a sharp decline in the Dow, as fears of economic downturn and a global health crisis dominated market sentiment.

Since then, the Dow has recovered significantly, driven by optimism about the economic recovery and widespread vaccination efforts. As of the latest available data, the Dow has reached new all-time highs, reflecting the market's resilience and the confidence of investors.

Analyzing the Graph

Analyzing the graph of the Dow Jones involves looking at various factors, including trends, volatility, and market sentiment. Over the long term, the Dow has shown a general upward trend, with occasional setbacks. However, the short-term movements can be more volatile, influenced by economic news, geopolitical events, and company-specific developments.

For example, the 2020 COVID-19 crisis caused a sharp decline in the Dow, as investors sold off stocks amid uncertainty. However, as the pandemic situation improved and economic recovery measures were implemented, the Dow recovered and reached new highs.

Potential Future Movements

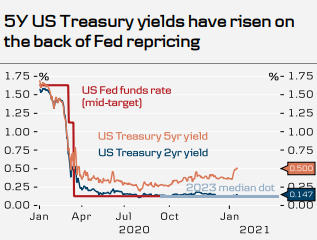

When considering the potential future movements of the Dow Jones, it's important to look at various economic indicators and market trends. Factors such as interest rates, inflation, and corporate earnings can all influence the Dow's performance.

One potential risk to the Dow is inflation, as rising prices can erode purchasing power and reduce corporate profits. Additionally, geopolitical tensions and economic uncertainty can also cause volatility in the stock market.

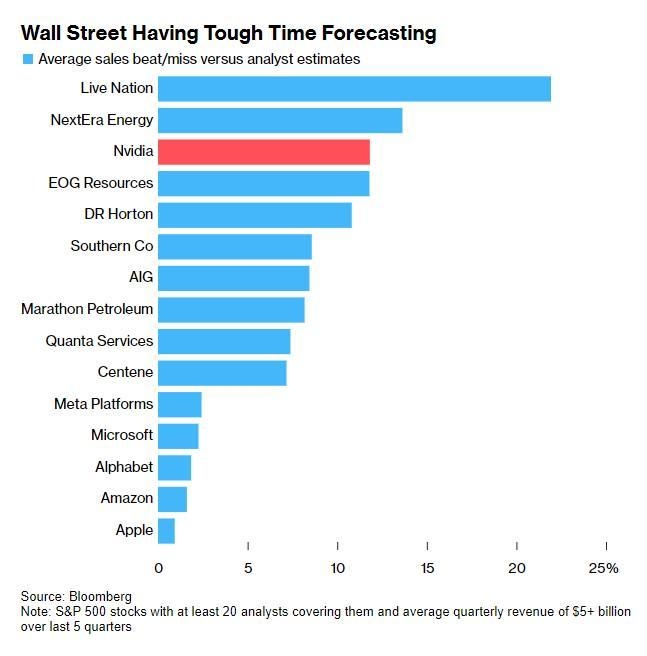

However, many experts remain optimistic about the long-term prospects for the Dow Jones. Factors such as strong corporate earnings, low unemployment, and a growing global economy all point to a potential period of continued growth.

In conclusion, the graph of the Dow Jones is a vital tool for understanding the U.S. stock market. By analyzing historical trends, recent performance, and potential future movements, investors and traders can make more informed decisions. As the market continues to evolve, staying informed and monitoring the Dow Jones will remain crucial for anyone interested in the stock market.

us flag stock