Trade US Stocks from Australia: Your Ultimate Guide"

author:US stockS -

Are you an Australian investor looking to trade US stocks? If so, you're in luck! The United States stock market is one of the largest and most liquid in the world, offering a wide range of investment opportunities. In this article, we'll explore how you can trade US stocks from Australia, including the benefits, the process, and some top tips for success.

Why Trade US Stocks from Australia?

There are several reasons why Australian investors might consider trading US stocks:

- Diversification: Investing in US stocks can help diversify your portfolio and reduce risk by spreading your investments across different markets and sectors.

- Access to Leading Companies: The US stock market is home to some of the world's most successful and innovative companies, including tech giants like Apple, Google, and Microsoft.

- Market Liquidity: The US stock market is highly liquid, meaning you can buy and sell stocks quickly and easily.

How to Trade US Stocks from Australia

Open a Trading Account: The first step is to open a trading account with a brokerage firm that offers access to the US stock market. Some popular options for Australian investors include TD Ameritrade, E*TRADE, and Charles Schwab.

Understand the Basics: Before you start trading, it's important to understand the basics of the US stock market, including how to read stock quotes, understand order types, and calculate your returns.

Research and Analyze: Conduct thorough research on the stocks you're interested in. This includes analyzing financial statements, reading news and reports, and considering the company's industry and competitive position.

Start Small: If you're new to trading US stocks, it's a good idea to start with a small amount of capital and gradually increase your investments as you gain more experience.

Stay Informed: Keep up-to-date with market news and developments, as they can have a significant impact on stock prices.

Top Tips for Trading US Stocks from Australia

- Use a Stop-Loss Order: This will help you limit your potential losses if the stock price falls unexpectedly.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversify your investments across different sectors and asset classes.

- Stay Disciplined: Stick to your investment strategy and don't let emotions drive your decisions.

- Use Tools and Resources: Take advantage of the tools and resources available to you, such as stock screeners, financial calculators, and educational materials.

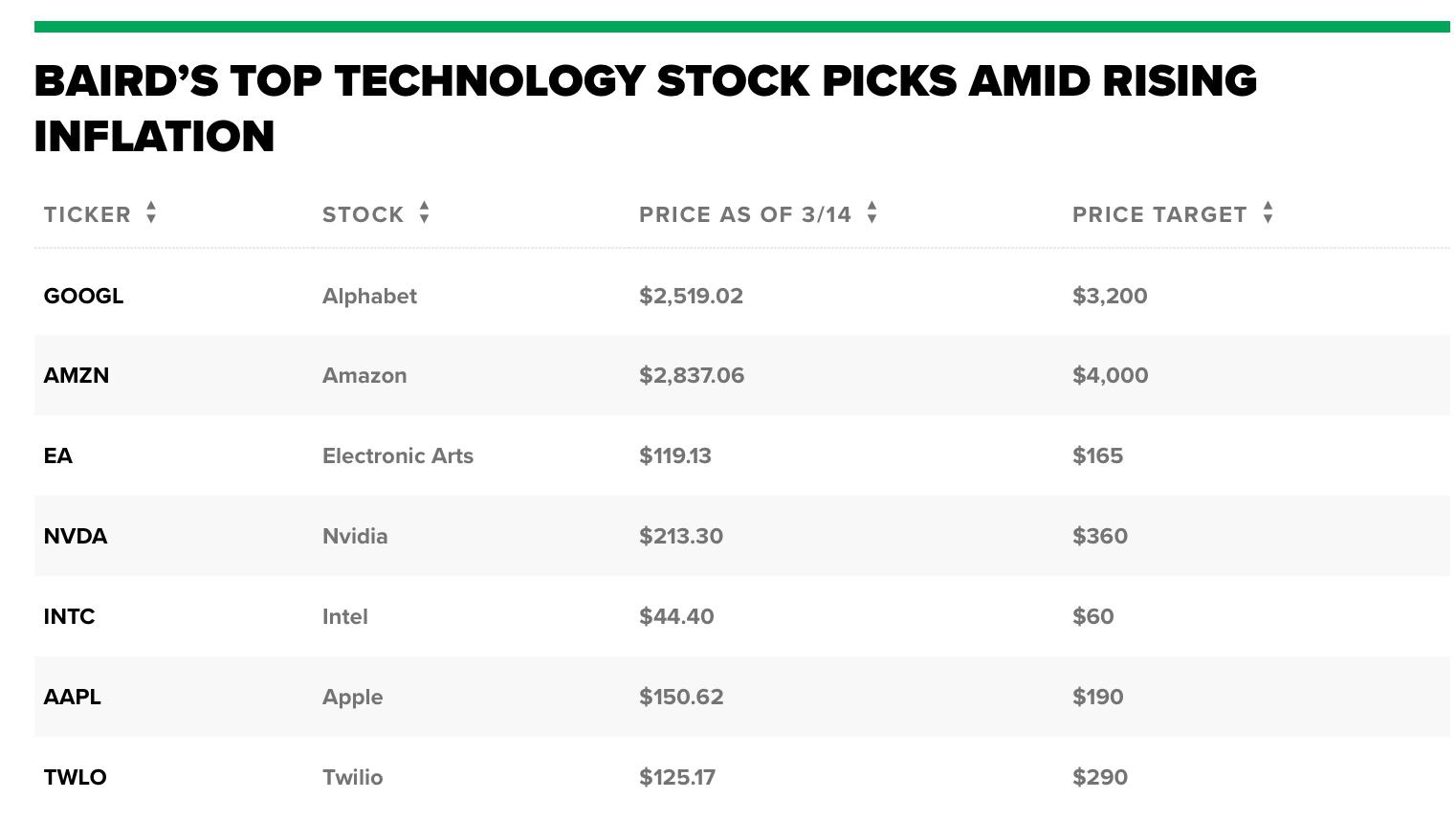

Case Study: Investing in US Tech Stocks

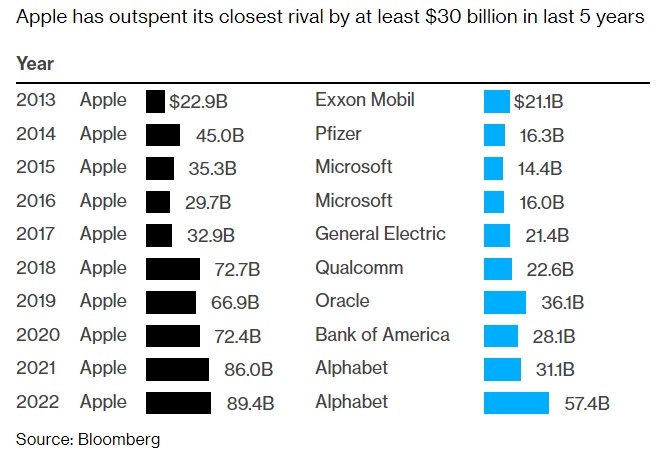

Let's say you're interested in investing in tech stocks. One of the most popular tech companies is Apple Inc. (AAPL). Over the past five years, AAPL has seen significant growth, with its stock price increasing by more than 100%.

To invest in AAPL, you would need to open a trading account with a brokerage firm that offers access to the US stock market. Once you have an account, you can place an order to buy shares of AAPL. It's important to conduct thorough research on the company and its industry before making any investment decisions.

By following these steps and tips, you can successfully trade US stocks from Australia. Remember to stay informed, stay disciplined, and keep learning to improve your investment skills.

us flag stock