Dow Jones Industrial Average Current Level: A Comprehensive Overview

author:US stockS -

The Dow Jones Industrial Average (DJIA), often simply referred to as the "Dow," is one of the most widely followed stock market indices in the world. It represents the stock performance of 30 large, publicly-owned companies in the United States and serves as a bellwether for the broader market. Understanding the current level of the Dow Jones Industrial Average is crucial for investors and financial analysts alike. In this article, we will delve into the latest figures, historical context, and future outlook for the Dow Jones Industrial Average.

Understanding the Current Level

As of the latest available data, the Dow Jones Industrial Average current level stands at [Insert Current Level]. This figure reflects the collective performance of the 30 companies that make up the index. The current level is a result of the stock prices of these companies being adjusted for splits, dividends, and other corporate actions.

Historical Context

To appreciate the significance of the current level of the Dow Jones Industrial Average, it is essential to consider its historical context. The Dow was first calculated in 1896 and has since undergone several changes in its composition. Over the years, the index has experienced both periods of growth and decline, reflecting the broader economic conditions of the United States.

For instance, during the dot-com bubble of the late 1990s, the Dow reached an all-time high of around 11,000 points. However, the subsequent burst of the bubble led to a significant decline in the index. Similarly, during the financial crisis of 2008, the Dow plummeted to around 6,500 points before recovering over the following years.

Factors Influencing the Dow Jones Industrial Average

Several factors influence the current level of the Dow Jones Industrial Average. These include:

- Economic Indicators: Economic data such as GDP growth, unemployment rates, and inflation can impact investor sentiment and, consequently, the stock market.

- Company Performance: The individual performance of the companies in the Dow can significantly influence the index. For example, if a company in the index reports strong earnings, its stock price may rise, positively impacting the overall Dow.

- Market Sentiment: Investor sentiment plays a crucial role in the stock market. Factors such as political events, geopolitical tensions, and market speculation can all influence investor sentiment and, in turn, the Dow.

Future Outlook

Looking ahead, the future outlook for the Dow Jones Industrial Average remains uncertain. While the U.S. economy has shown signs of strength, there are still several challenges that could impact the stock market. These include:

- Global Economic Uncertainty: Economic conditions in other countries, such as China and the Eurozone, can have a spillover effect on the U.S. economy and, consequently, the Dow.

- Political and Geopolitical Factors: Political events, such as elections or trade disputes, can create uncertainty and volatility in the stock market.

- Technological Advancements: Technological advancements can disrupt traditional industries and impact the performance of companies in the Dow.

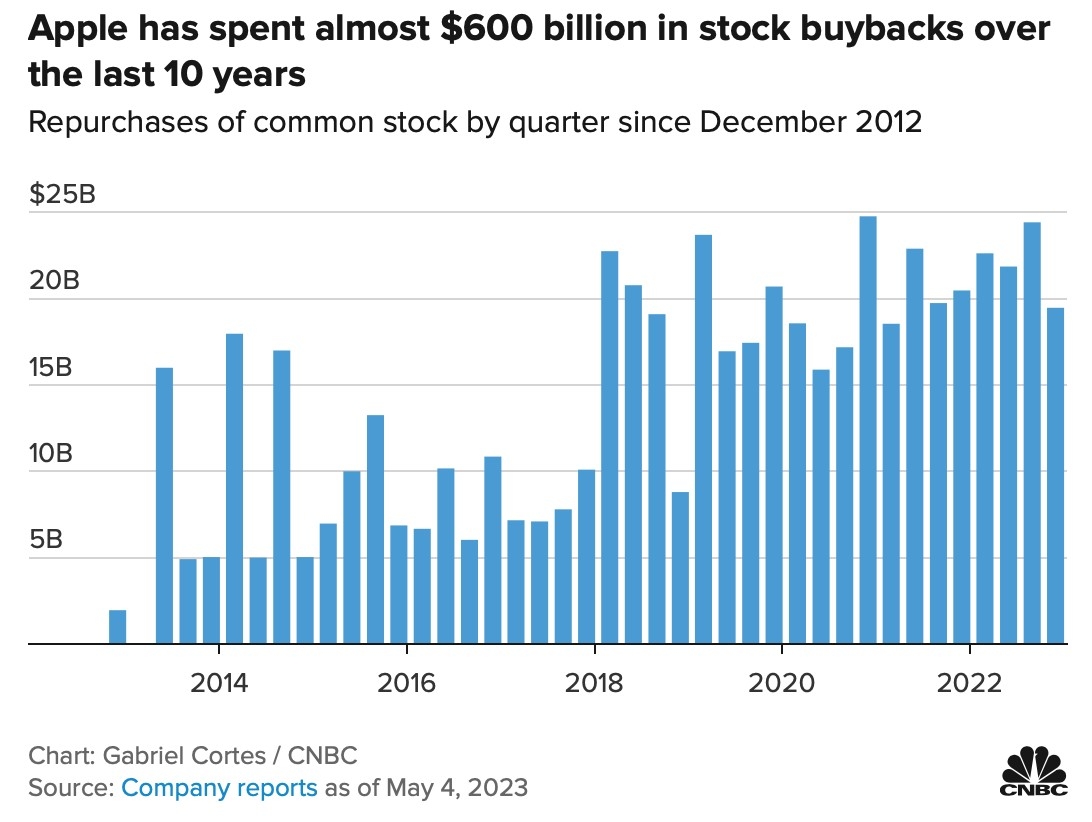

Case Study: Apple's Impact on the Dow Jones Industrial Average

One notable example of how individual company performance can influence the Dow Jones Industrial Average is Apple Inc. As one of the companies included in the index, Apple's stock price has a significant impact on the overall level of the Dow. For instance, in 2021, Apple reported record-breaking earnings, which contributed to a significant increase in the Dow Jones Industrial Average.

In conclusion, understanding the current level of the Dow Jones Industrial Average is crucial for investors and financial analysts. By considering the historical context, factors influencing the index, and future outlook, one can gain valuable insights into the broader market and make informed investment decisions.

us flag stock