Mastering the Art of Managing Your Stocks

author:US stockS -

In the ever-evolving world of finance, managing your stocks effectively is crucial for maximizing returns and mitigating risks. Whether you're a seasoned investor or just starting out, understanding the nuances of stock management can make a significant difference in your financial journey. This article delves into the key strategies and best practices for managing your stocks, ensuring you make informed decisions that align with your investment goals.

Understanding Stock Management

Stock management involves monitoring and maintaining your portfolio of stocks to achieve your financial objectives. This includes researching potential investments, analyzing market trends, and making strategic decisions to optimize your portfolio. Effective stock management requires a combination of knowledge, discipline, and a long-term perspective.

Research and Analysis

The foundation of successful stock management is thorough research and analysis. Before investing, it's essential to understand the company you're considering. Analyze its financial statements, including the income statement, balance sheet, and cash flow statement. Look for signs of strong fundamentals, such as consistent revenue growth, solid profitability, and a healthy balance sheet.

Additionally, consider the industry in which the company operates. Is it a growing industry with high potential for future expansion? Or is it a mature industry with limited growth prospects? Assessing industry trends and competitive positioning can provide valuable insights into a company's potential for success.

Diversification

One of the most crucial aspects of stock management is diversification. By spreading your investments across different sectors, industries, and geographical regions, you can reduce the risk associated with any single stock or sector. Diversification helps protect your portfolio from the volatility of individual stocks and can lead to more stable returns over time.

When diversifying your portfolio, consider factors such as your risk tolerance, investment goals, and time horizon. Allocate your investments accordingly to ensure a well-diversified and balanced portfolio.

Risk Management

Risk management is a critical component of stock management. Identify and assess the risks associated with your investments, such as market risk, credit risk, and liquidity risk. Develop a risk management strategy that aligns with your investment goals and risk tolerance.

One effective risk management strategy is to use stop-loss orders. These orders automatically sell a stock if it reaches a predetermined price, helping to limit potential losses. Additionally, consider diversifying your portfolio across different asset classes, such as stocks, bonds, and real estate, to further mitigate risk.

Active vs. Passive Management

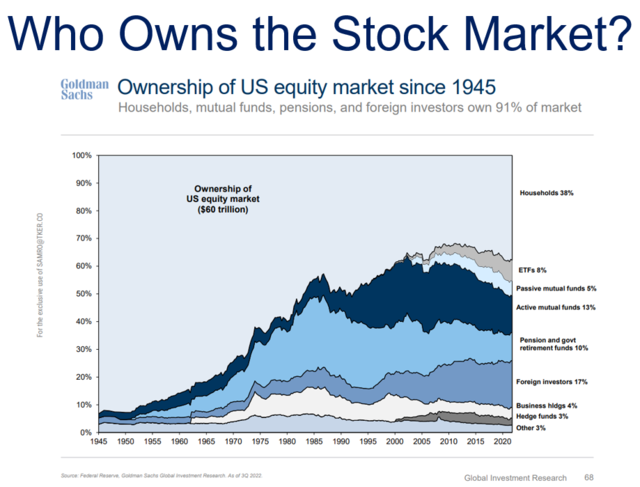

Another key consideration in stock management is whether to pursue an active or passive management strategy. Active management involves actively monitoring and adjusting your portfolio to capitalize on market opportunities and mitigate risks. Passive management, on the other hand, involves investing in index funds or ETFs and holding them for the long term, without frequent adjustments.

The choice between active and passive management depends on your investment goals, risk tolerance, and time commitment. Active management can offer higher returns, but it also requires more time and expertise. Passive management is more cost-effective and requires less active management, but it may offer lower returns.

Case Studies

Consider the case of investor John, who invested in a tech stock without conducting thorough research. The stock quickly skyrocketed in value, but John sold it prematurely, missing out on even greater gains. This example highlights the importance of thorough research and analysis in stock management.

Another case involves investor Sarah, who diversified her portfolio across various sectors and asset classes. When the tech industry experienced a downturn, Sarah's diversified portfolio helped mitigate the impact, allowing her to maintain stable returns.

Conclusion

Managing your stocks effectively requires a combination of research, analysis, diversification, risk management, and a well-defined strategy. By understanding these key principles and applying them to your investment decisions, you can achieve your financial goals and navigate the complexities of the stock market with confidence.

us flag stock