Stocks and US Election: Understanding the Impact

author:US stockS -

The US election is not just a political event; it has a significant impact on the stock market. Understanding this relationship can help investors make informed decisions. In this article, we'll explore how the US election affects stocks and provide insights into potential market movements.

The Political Landscape

The US election brings a new administration and political landscape. The policies and regulations implemented by the new government can directly influence the stock market. For instance, changes in tax laws, trade policies, and regulations can impact various sectors differently.

Historical Trends

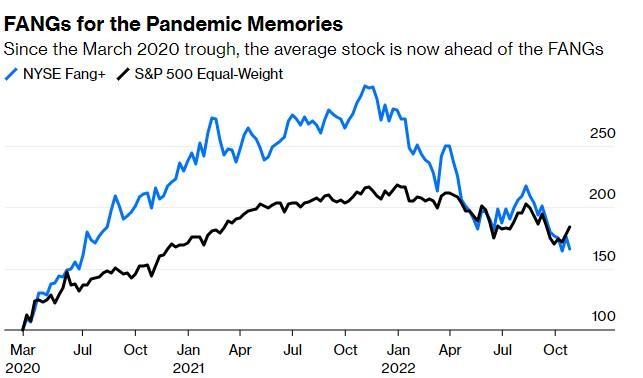

Historically, the stock market has shown mixed reactions to US elections. Some elections have been followed by market booms, while others have resulted in market corrections. For example, the election of Barack Obama in 2008 was followed by a market downturn, but it eventually recovered. Conversely, the election of Donald Trump in 2016 was followed by a significant bull market.

Sector-Specific Impacts

Different sectors of the stock market are affected differently by the US election. For instance:

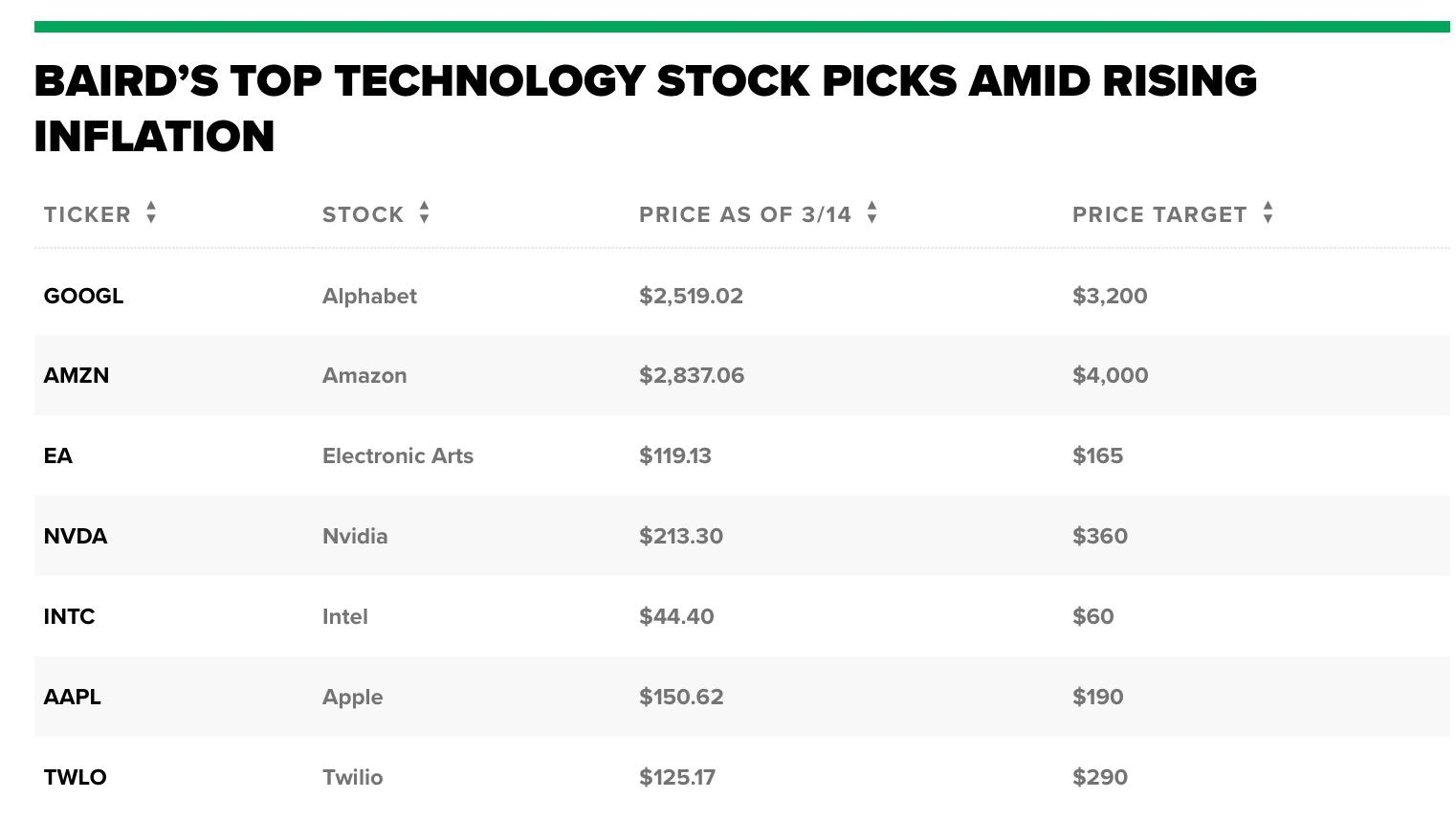

- Tech Stocks: Tech stocks often perform well under Democratic administrations due to policies that support innovation and investment in technology. Conversely, Republican administrations may be more favorable to traditional industries.

- Healthcare Stocks: Healthcare stocks can be affected by changes in healthcare policies, such as the Affordable Care Act (ACA). Democratic administrations are generally more supportive of healthcare reforms, while Republican administrations may aim to repeal or modify these policies.

- Energy Stocks: Energy stocks can be influenced by changes in environmental regulations and energy policies. Democratic administrations tend to prioritize renewable energy, while Republican administrations may favor fossil fuels.

Market Sentiment

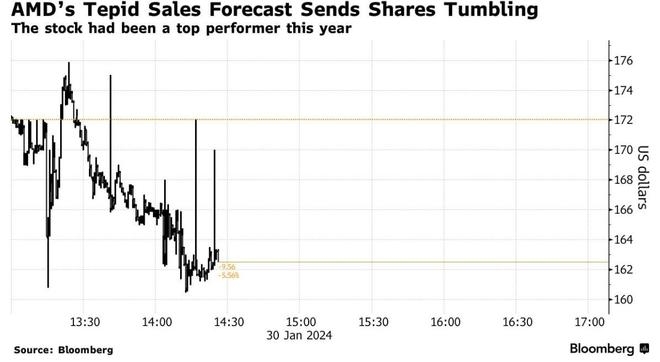

The election can also influence market sentiment. Investors often react to political uncertainty, which can lead to volatility in the stock market. For example, the 2020 US election was marked by high levels of uncertainty, which resulted in significant market volatility.

Case Studies

To illustrate the impact of the US election on stocks, let's consider a few case studies:

- Donald Trump's Election in 2016: Trump's election was seen as a positive sign for the stock market, as investors anticipated tax cuts and regulatory reforms. This led to a significant bull market, with the S&P 500 reaching record highs.

- Barack Obama's Election in 2008: Obama's election was followed by a market downturn, as investors were concerned about the economic impact of the financial crisis. However, the market eventually recovered.

Conclusion

The US election has a significant impact on the stock market. Understanding the potential effects of the election on different sectors and market sentiment can help investors make informed decisions. While the market can be unpredictable, staying informed and adapting to political changes is crucial for long-term success.

us flag stock