Understanding the Pre-Market Dow: A Comprehensive Guide

author:US stockS -

The pre-market Dow is a term that has gained significant attention among investors and traders. It refers to the trading activity that occurs before the official opening of the stock market. This period is crucial for several reasons, as it can provide early insights into market trends and potential movements. In this article, we will delve into what the pre-market Dow is, its significance, and how it can impact your investment decisions.

What is the Pre-Market Dow?

The pre-market Dow is a trading session that takes place before the official opening of the New York Stock Exchange (NYSE). During this period, investors and traders can buy and sell stocks, futures, and other financial instruments. The pre-market Dow is typically active from 8:30 AM to 9:30 AM Eastern Time, but it can vary depending on the day and market conditions.

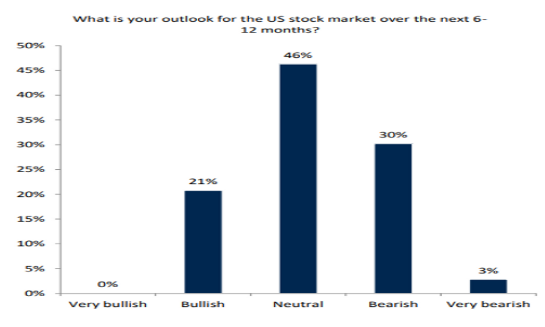

One of the key aspects of the pre-market Dow is that it provides an early indication of market sentiment. By analyzing the movement of the Dow Jones Industrial Average (DJIA) during the pre-market session, investors can gain valuable insights into the potential direction of the market.

Significance of the Pre-Market Dow

Market Sentiment: The pre-market Dow is often a reflection of market sentiment. If the Dow is rising during the pre-market session, it may indicate optimism among investors. Conversely, a falling Dow may suggest pessimism or uncertainty.

Early Indicators: The pre-market Dow can act as an early indicator of market movements. For example, if a major company reports earnings during the pre-market session and the stock price rises significantly, it may have a positive impact on the broader market.

Trading Opportunities: The pre-market Dow offers trading opportunities for investors who want to get a head start on the day's trading. By participating in the pre-market session, investors can potentially capitalize on early market movements.

How to Access the Pre-Market Dow

To access the pre-market Dow, investors need to use a platform that supports pre-market trading. Many online brokers offer access to the pre-market session, allowing investors to trade stocks, futures, and other financial instruments.

It is important to note that the pre-market Dow is not as heavily traded as the regular trading session. Therefore, it may be more volatile and subject to wider price swings.

Case Study: Pre-Market Dow Impact on Stock Prices

Consider a scenario where a major technology company reports better-than-expected earnings during the pre-market session. If the stock price of the company rises significantly, it may lead to a positive impact on the broader market, as investors interpret the earnings report as a sign of strength in the industry.

Conclusion

The pre-market Dow is a valuable tool for investors and traders looking to gain an early understanding of market trends and potential movements. By analyzing the pre-market Dow, investors can make informed decisions and potentially capitalize on early market movements. However, it is important to approach pre-market trading with caution, as it can be more volatile and subject to wider price swings.

newsbreak stock