SP 500 After Hours: Unveiling the Hidden Opportunities

author:US stockS -

The stock market never sleeps, and neither does the SP 500. In the fast-paced world of finance, understanding the SP 500 after hours is crucial for investors looking to gain an edge. This article delves into the world of after-hours trading for the S&P 500, exploring its significance, strategies, and potential opportunities.

What is SP 500 After Hours Trading?

After-hours trading refers to the period outside of regular trading hours, which typically end at 4:00 PM Eastern Time. During this time, investors can buy and sell stocks, including those in the S&P 500, on electronic platforms. While after-hours trading is not as widely followed as regular trading hours, it can offer valuable insights and opportunities.

Why is SP 500 After Hours Important?

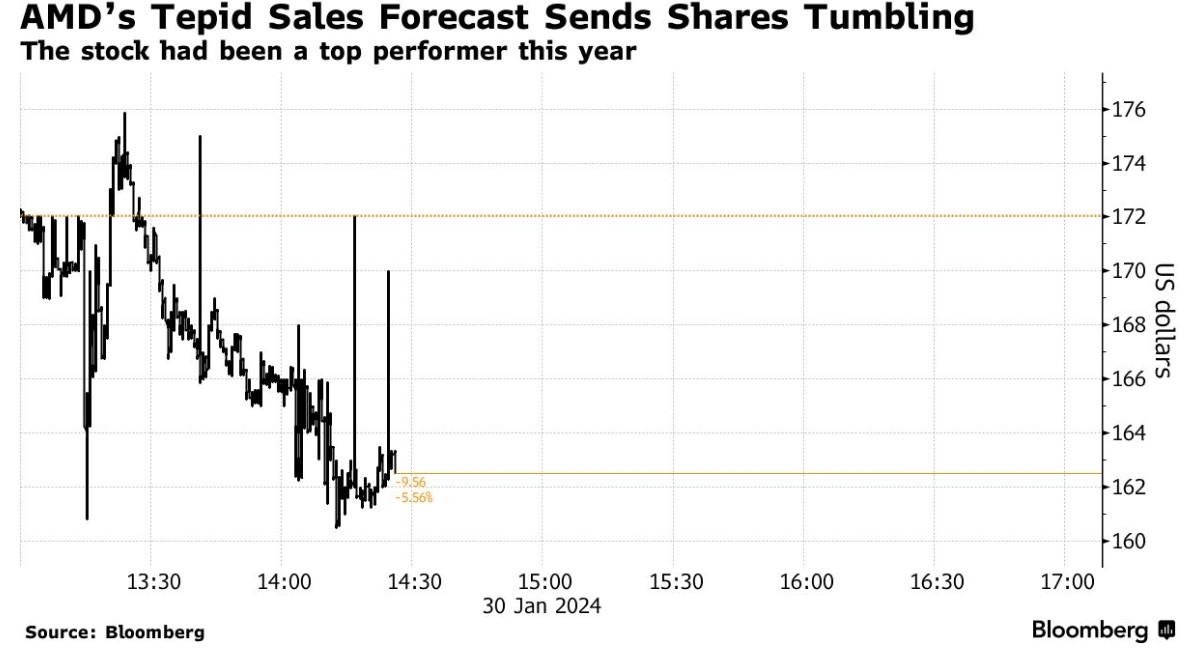

News and Earnings Reports: After-hours trading often coincides with the release of important news, earnings reports, and corporate announcements. By monitoring the SP 500 after hours, investors can gain early access to this information and react accordingly.

Market Sentiment: The after-hours market can provide a glimpse into market sentiment. Significant price movements during this period can indicate investor optimism or pessimism, which may influence regular trading hours.

Liquidity: While after-hours trading may not offer the same level of liquidity as regular trading hours, it can still provide opportunities for investors to enter or exit positions.

Strategies for Trading SP 500 After Hours

Stay Informed: Keep up with the latest news and earnings reports. This will help you make informed decisions and react quickly to market-moving events.

Use Technical Analysis: Technical analysis can be a valuable tool for identifying potential trading opportunities in the after-hours market. Analyze charts, indicators, and patterns to make informed decisions.

Set Stop-Loss and Take-Profit Orders: To manage risk, set stop-loss and take-profit orders. This will help you exit positions at predetermined levels, regardless of market volatility.

Case Study: SP 500 After Hours Trading Success

In 2020, the SP 500 experienced significant volatility due to the COVID-19 pandemic. During this period, an investor who monitored the after-hours market closely was able to capitalize on market-moving events. By staying informed and using technical analysis, this investor made profitable trades in the after-hours market, which translated into substantial gains during regular trading hours.

Conclusion

The SP 500 after hours presents unique opportunities for investors looking to gain an edge in the stock market. By staying informed, using effective strategies, and managing risk, investors can navigate the after-hours market and potentially achieve success. Remember, the key to after-hours trading is discipline, patience, and a keen understanding of market dynamics.

newsbreak stock