Strong US Dollar Stocks: A Strategic Investment Approach

author:US stockS -

In today's volatile financial markets, investors are constantly seeking opportunities to maximize their returns. One such opportunity lies in investing in stocks that benefit from a strong US dollar. This article delves into the concept of strong US dollar stocks, their advantages, and how investors can capitalize on this trend.

Understanding Strong US Dollar Stocks

A strong US dollar refers to a situation where the value of the US dollar is higher compared to other currencies. This scenario can have several positive effects on the stock market. Strong US dollar stocks are those companies that benefit from a strong dollar, either through their business operations or currency exposure.

Advantages of Investing in Strong US Dollar Stocks

Increased Earnings: Companies with significant international operations often generate a portion of their revenue in foreign currencies. When the US dollar strengthens, these companies can convert their foreign currency earnings into more dollars, leading to higher earnings per share (EPS).

Lower Input Costs: A strong dollar can make imports cheaper, benefiting companies that rely on foreign suppliers. This can lead to lower production costs and higher profit margins.

Attractive Valuations: A strong dollar can make US stocks more attractive to foreign investors, leading to increased demand and potentially higher stock prices.

Strategic Investment Approach

To capitalize on the trend of strong US dollar stocks, investors should consider the following strategies:

Identify Companies with International Exposure: Look for companies with significant revenue from international markets. These companies are more likely to benefit from a strong dollar.

Analyze Currency Exposure: Evaluate the currency exposure of each company. Companies with a higher exposure to the US dollar are more likely to benefit from a strong dollar.

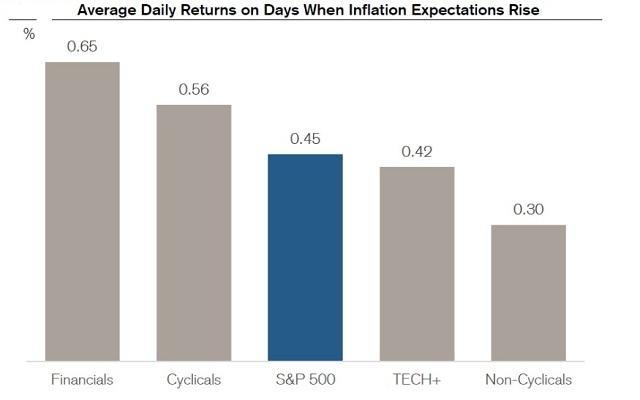

Consider Sector-Specific Opportunities: Certain sectors, such as energy, consumer discretionary, and industrials, tend to benefit more from a strong dollar. Focus on these sectors when searching for strong US dollar stocks.

Diversify Your Portfolio: Diversifying your portfolio with strong US dollar stocks can help mitigate risks associated with market volatility.

Case Studies

Apple Inc. (AAPL): As one of the largest companies in the world, Apple generates a significant portion of its revenue from international markets. A strong US dollar has helped Apple convert its foreign currency earnings into more dollars, leading to higher EPS and increased stock prices.

Exxon Mobil Corporation (XOM): Exxon Mobil, a leading oil and gas company, benefits from a strong dollar due to its extensive international operations. A strong dollar has helped reduce its input costs and increase its profit margins.

Conclusion

Investing in strong US dollar stocks can be a strategic approach to capitalize on the benefits of a strong dollar. By identifying companies with international exposure, analyzing currency exposure, and considering sector-specific opportunities, investors can potentially enhance their returns. However, it is crucial to conduct thorough research and diversify your portfolio to mitigate risks.

newsbreak stock