Tesla Stock: Current US Price and Future Projections

author:US stockS -

In the ever-evolving landscape of the automotive industry, Tesla Inc. (NASDAQ: TSLA) has emerged as a leading force, not just in electric vehicles (EVs) but in the global stock market as well. This article delves into the current US price of Tesla stock, factors influencing its value, and future projections that could shape its trajectory.

Understanding Tesla's Stock Price

As of the latest data, the current US price of Tesla stock is hovering around $1,100 per share. However, this figure can fluctuate significantly based on various market conditions and investor sentiment. Tesla's stock has been on a rollercoaster ride over the years, reflecting both its revolutionary innovations and the challenges faced by a rapidly growing company.

Key Factors Influencing Tesla Stock Price

Revenue Growth: Tesla's revenue has been on a steady rise, driven by the increasing demand for its EVs and energy products. The company's ability to maintain and grow its revenue streams is a crucial factor in determining its stock price.

Innovation and Product Launches: Tesla is known for its groundbreaking innovations. The announcement of new models or features can significantly impact the stock price. For instance, the introduction of the Cybertruck generated a substantial buzz and a corresponding increase in the stock price.

Regulatory Environment: Government policies and regulations regarding EVs can have a substantial impact on Tesla's business and, consequently, its stock price. For example, the recent push for clean energy by the Biden administration has been positive for Tesla.

Market Sentiment: Investor confidence plays a vital role in determining stock prices. News, rumors, and public sentiment can lead to sudden spikes or drops in Tesla's stock price.

Earnings Reports: Tesla's quarterly earnings reports provide insights into the company's financial health and future prospects. Consistent positive earnings reports can bolster the stock price.

Future Projections for Tesla Stock

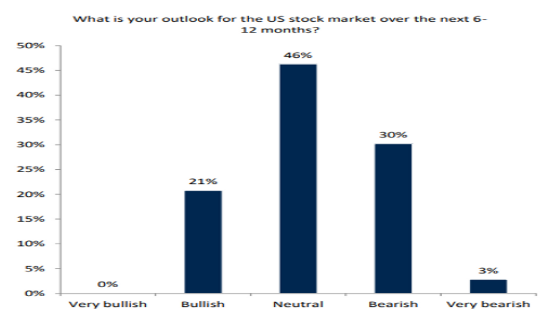

Analysts have varying opinions on the future of Tesla's stock price. Some are bullish, projecting significant growth in the coming years, while others are cautious, citing potential risks and challenges.

Bullish Outlook: Bulls argue that Tesla's strong brand, expanding product line, and growing global presence make it a solid long-term investment. The increasing demand for EVs worldwide is also seen as a positive factor.

Cautionary Notes: Skeptics point to the high costs of scaling up production, the potential for increased competition, and the volatile nature of the stock market. They also note that Tesla's high debt levels could pose a risk to its financial stability.

Case Study: Tesla's Stock Performance in 2021

One notable case study is Tesla's stock performance in 2021. Despite facing various challenges, including the global semiconductor shortage, the stock surged significantly. This surge can be attributed to Tesla's strong financial results, innovative product launches, and positive investor sentiment.

Conclusion

The current US price of Tesla stock reflects the company's position as a leader in the EV market. While there are risks and uncertainties, the potential for growth remains substantial. Investors should consider a range of factors before making decisions regarding Tesla stock, including the company's financial health, market conditions, and future projections.

newsbreak stock