In the fast-paced world of finance, staying informed about the gold price is crucial for investors and traders. Google Finance has emerged as a go-to platform for tracking the latest gold price trends and market data. This article will delve into the details of how to access the gold price on Google Finance, its significance, and strategies for analyzing it effectively.

Understanding the Gold Price on Google Finance

Google Finance is an online platform that offers real-time stock prices, financial news, and market data. The gold price is one of the most closely watched commodities, and Google Finance provides a convenient way to track its fluctuations.

To access the gold price on Google Finance, simply visit the website and search for "gold price" in the search bar. You will be presented with a detailed overview, including the current price, historical data, and related news and analysis.

The Significance of the Gold Price

The gold price is influenced by various factors, including global economic conditions, geopolitical events, and investor sentiment. Understanding these factors is crucial for making informed investment decisions.

1. Economic Factors

Economic conditions, such as inflation, interest rates, and currency fluctuations, play a significant role in determining the gold price. In times of economic uncertainty, investors often turn to gold as a safe haven, driving up demand and prices.

2. Geopolitical Events

Political instability and geopolitical tensions can also impact the gold price. Countries with high political risk may experience increased demand for gold as investors seek to diversify their portfolios.

3. Investor Sentiment

Investor sentiment can influence the gold price significantly. For example, during periods of market volatility, investors may sell stocks and invest in gold, leading to a rise in gold prices.

Strategies for Analyzing the Gold Price on Google Finance

Analyzing the gold price on Google Finance can help investors make informed decisions. Here are some key strategies:

1. Historical Data

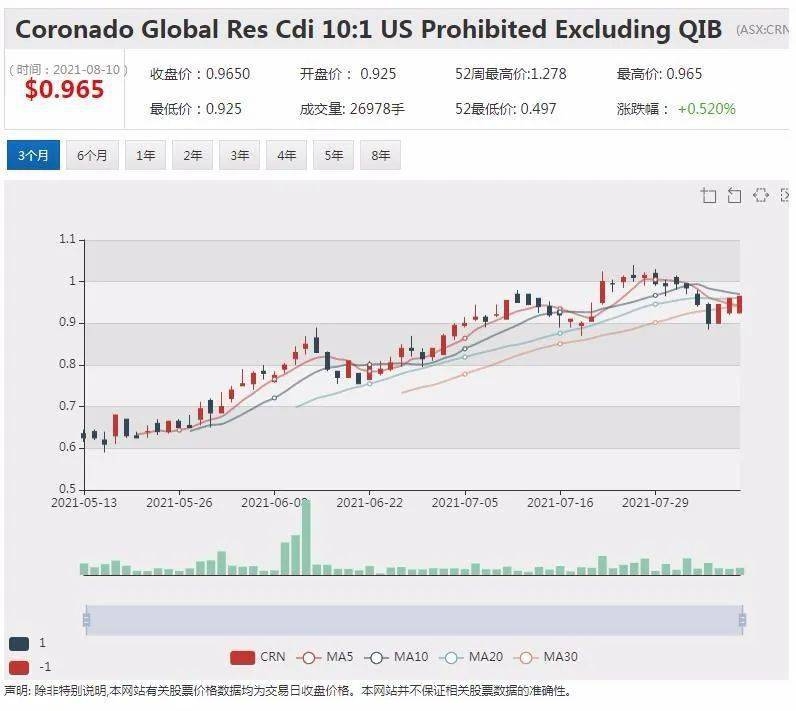

Reviewing historical data can provide insights into the gold price trends and patterns. Look for any patterns or correlations with economic and geopolitical events.

2. Technical Analysis

Technical analysis involves studying price charts and using various tools to identify potential buying and selling opportunities. Google Finance offers tools like moving averages and candlestick charts that can be used for technical analysis.

3. Fundamental Analysis

Fundamental analysis involves studying economic indicators, geopolitical events, and other factors that influence the gold price. This approach can help identify long-term investment opportunities.

Case Studies

Let's consider a few case studies to illustrate the impact of economic and geopolitical factors on the gold price.

1. Economic Downturn

During the 2008 financial crisis, the gold price skyrocketed as investors sought a safe haven. Google Finance data shows that the gold price increased significantly during this period.

2. Geopolitical Tensions

In 2020, geopolitical tensions in the Middle East and Eastern Europe led to a surge in gold prices. Google Finance data indicates that the gold price reached a new high during this period.

Conclusion

The gold price on Google Finance is a valuable tool for investors and traders. By understanding the factors that influence the gold price and analyzing the data effectively, you can make informed investment decisions. Stay informed and keep an eye on the gold price to stay ahead in the dynamic world of finance.

newsbreak stock