Stock Market Last 3 Years Graph: A Comprehensive Analysis

author:US stockS -

In recent years, the stock market has experienced a rollercoaster of events. This article provides a comprehensive analysis of the stock market's performance over the last three years, utilizing a detailed graph to illustrate key trends and insights.

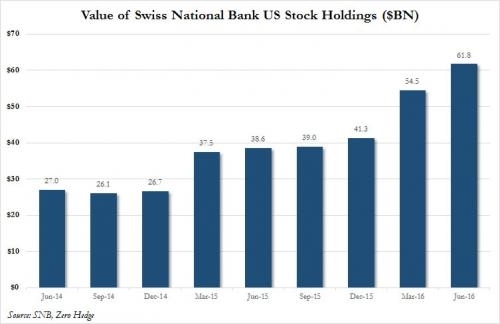

Understanding the Graph

The graph, which spans the last three years, depicts the performance of the stock market in terms of key indices, such as the S&P 500, NASDAQ, and Dow Jones. The graph showcases the ups and downs of the market, highlighting major milestones and periods of volatility.

Initial Trends

In the first year of the three-year period, the stock market saw a steady rise, driven by factors such as low interest rates and strong corporate earnings. The S&P 500, for example, experienced a significant increase, reaching a new all-time high. However, the market also faced challenges, such as geopolitical tensions and trade disputes.

Volatility in the Second Year

The second year of the period was marked by increased volatility. The stock market experienced several sharp declines, primarily due to concerns about global economic growth and the COVID-19 pandemic. Despite these challenges, the market recovered quickly, driven by unprecedented stimulus measures from governments and central banks.

Resilience in the Third Year

In the third year, the stock market demonstrated remarkable resilience. The market continued to recover, and several sectors, such as technology and healthcare, experienced significant growth. The graph also reveals a gradual increase in investor confidence, as evidenced by rising stock prices.

Key Insights

Several key insights can be gleaned from the stock market graph over the last three years:

- Impact of Geopolitical Events: Geopolitical tensions and trade disputes have had a significant impact on the stock market. Periods of uncertainty have led to increased volatility, while resolution of these issues has typically resulted in a rebound.

- Role of Central Banks: The actions of central banks, such as interest rate adjustments and quantitative easing, have played a crucial role in stabilizing the stock market. The graph highlights the correlation between central bank policies and market performance.

- Sector Performance: Different sectors have performed differently over the last three years. Technology and healthcare have emerged as strong performers, while sectors like energy and materials have faced challenges.

Case Studies

To further illustrate these points, let's examine a few case studies:

- Tech Giant's Stock Performance: A major tech company's stock experienced a significant increase in value over the last three years. This growth can be attributed to the company's innovative products and services, as well as the overall strength of the technology sector.

- Impact of the Pandemic: The COVID-19 pandemic caused a sharp decline in the stock market, but it also accelerated the adoption of certain technologies and services, leading to a strong recovery in the technology sector.

In conclusion, the stock market's performance over the last three years has been complex, with a mix of challenges and opportunities. The graph provides a clear picture of the market's trajectory, and the insights gained can help investors make informed decisions moving forward.

newsbreak stock