Curaleaf US Stock: A Deep Dive into the Cannabis Industry Leader

author:US stockS -

The cannabis industry has been one of the fastest-growing sectors in recent years, and Curaleaf has emerged as a leading player. Curaleaf US stock has been making waves in the financial markets, and it's essential to understand what makes this company a top pick among investors. In this article, we'll explore the key factors that drive Curaleaf's stock performance, its market position, and potential future growth prospects.

Curaleaf's Market Position

Curaleaf Holdings, Inc. (NASDAQ: CURA) is one of the largest cannabis companies in the United States, operating in 23 states and the District of Columbia. The company offers a diverse range of cannabis products, including flower, concentrates, edibles, topicals, and more. Curaleaf's extensive product portfolio and strong brand recognition have helped it establish a significant market share in the industry.

Driving Factors for Curaleaf's Stock Performance

Expansion Strategy: Curaleaf has been actively expanding its operations across the United States. The company has acquired several local cannabis businesses and has been opening new retail locations to cater to a broader customer base. This aggressive expansion strategy has contributed to the growth in revenue and market share, driving Curaleaf's stock performance.

Strong Financial Performance: Curaleaf has been reporting strong financial results, with revenue and profit margins increasing year over year. The company's ability to generate substantial revenue from its operations has attracted investors, leading to a surge in Curaleaf US stock.

Regulatory Environment: The regulatory environment in the cannabis industry has been gradually improving, which has been beneficial for Curaleaf. With more states legalizing cannabis, the company has been able to expand its operations and tap into new markets, contributing to its stock's growth.

Partnerships and Collaborations: Curaleaf has formed several strategic partnerships and collaborations with industry leaders, including pharmaceutical companies and healthcare providers. These partnerships have helped the company diversify its revenue streams and expand its market reach.

Case Studies

Acquisition of Verano Holdings: In 2019, Curaleaf acquired Verano Holdings, a leading cannabis company in the Midwest. This acquisition helped Curaleaf expand its market presence and strengthen its position in the region. As a result, Curaleaf's stock experienced a significant uptrend following the acquisition.

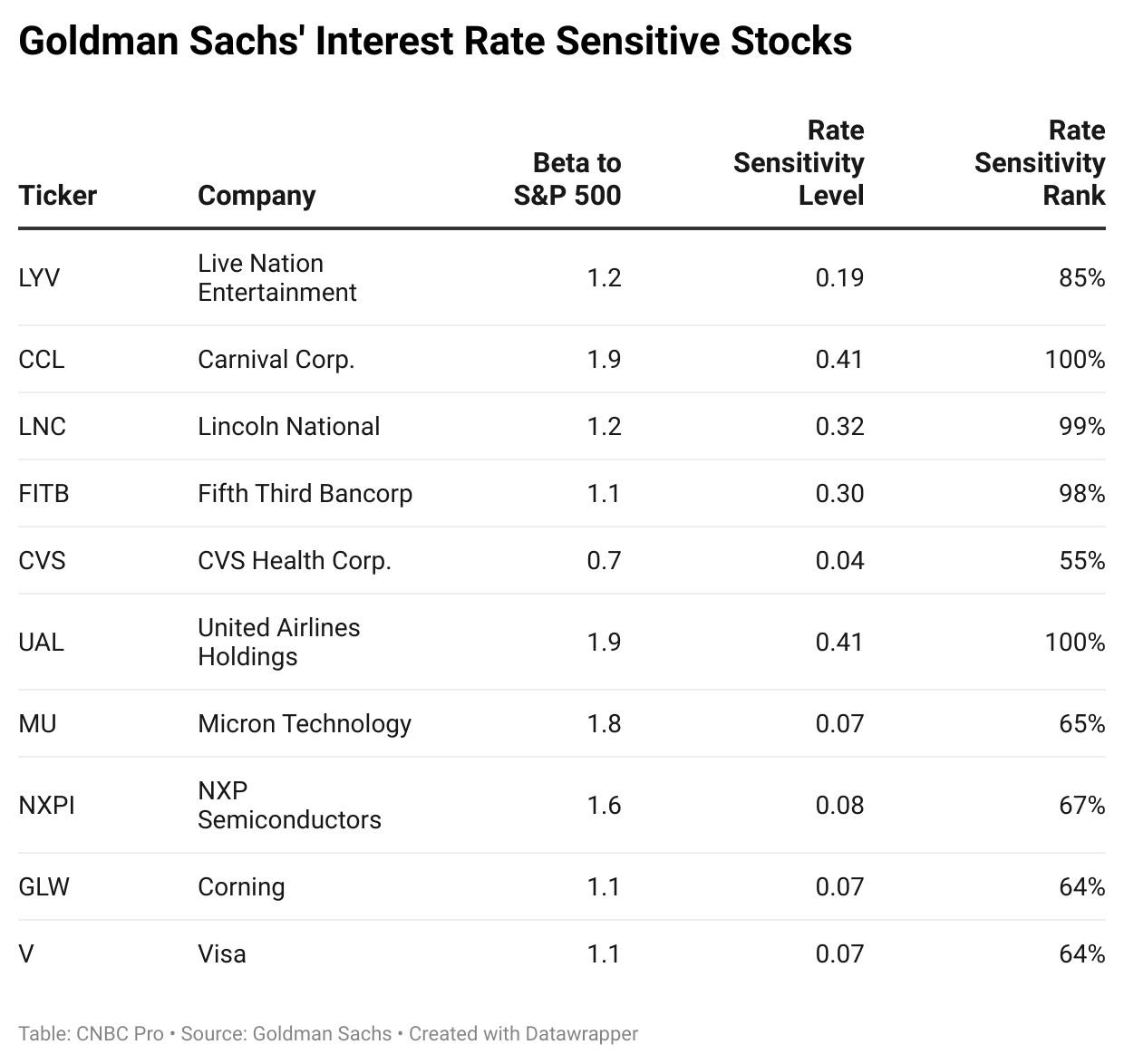

Strategic Partnership with CVS Health: In 2020, Curaleaf entered into a strategic partnership with CVS Health, which allowed the company to sell its cannabis products in over 800 CVS locations across the United States. This partnership helped Curaleaf increase its distribution network and enhance its brand visibility, positively impacting its stock performance.

Conclusion

Curaleaf US stock has been a top performer in the cannabis industry, driven by its aggressive expansion strategy, strong financial performance, and favorable regulatory environment. With a diverse product portfolio and strategic partnerships, Curaleaf is well-positioned to continue its growth trajectory. As the cannabis industry continues to evolve, Curaleaf's stock could remain a compelling investment opportunity for investors.

us flag stock