Can You Invest in US Stocks from the Philippines?

author:US stockS -

Investing in the United States stock market from the Philippines has become increasingly accessible in today's digital age. With the right information and resources, Filipinos can tap into the potential of the American stock market. This article will explore the possibilities, benefits, and steps involved in investing in US stocks from the Philippines.

Understanding the US Stock Market

The US stock market is one of the largest and most influential in the world. It includes the New York Stock Exchange (NYSE) and the NASDAQ, where some of the most successful and well-known companies trade. These markets offer a wide range of investment opportunities, from blue-chip stocks of established companies to emerging growth stocks.

Benefits of Investing in US Stocks

Investing in US stocks from the Philippines offers several advantages:

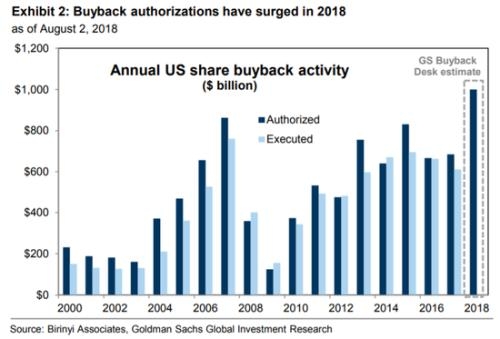

- Higher Returns: The US stock market has historically provided higher returns compared to the Philippine market.

- Diversification: Investing in US stocks allows Filipinos to diversify their portfolio, reducing the risk associated with investing solely in the Philippine market.

- Currency Exposure: Investing in US stocks can potentially benefit from currency fluctuations, as the returns are in US dollars.

How to Invest in US Stocks from the Philippines

Open a Brokerage Account: The first step is to open a brokerage account with a reputable brokerage firm that offers access to the US stock market. Many online brokers, such as TD Ameritrade, E*TRADE, and Charles Schwab, offer services to international investors.

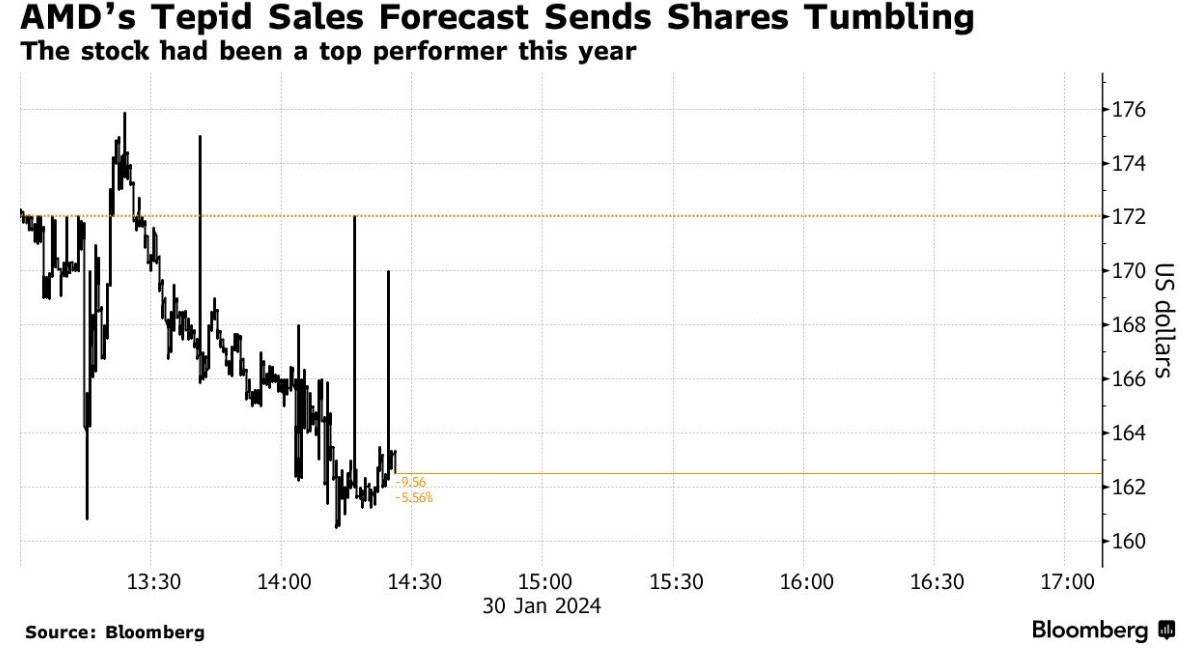

Understand the Risks: Before investing, it's crucial to understand the risks involved, including market volatility, currency exchange rates, and regulatory differences.

Research and Select Stocks: Conduct thorough research to identify potential investments. Consider factors such as the company's financial health, market position, and growth prospects.

Monitor Your Investments: Regularly monitor your investments to stay informed about market trends and company news. Use online platforms and financial news sources to keep up-to-date.

Case Study: Investing in US Stocks from the Philippines

Let's consider a hypothetical scenario. John, a Filipino investor, decides to invest $10,000 in US stocks. He selects a mix of blue-chip stocks, including Apple, Microsoft, and Google, as well as some emerging growth stocks.

After one year, John's investments are up by 15%. This translates to a gain of $1,500, which is equivalent to 15% of his initial investment. Assuming John's Philippine peso strengthened against the US dollar during this period, he may experience additional gains when converting his returns back to pesos.

Conclusion

Investing in US stocks from the Philippines is a viable option for Filipino investors seeking higher returns and diversification. By understanding the process, conducting thorough research, and managing risks, Filipinos can successfully invest in the US stock market and potentially benefit from its growth.

us flag stock