Understanding the US Stock History Chart: A Comprehensive Guide

author:US stockS -

In the world of finance, understanding the US stock history chart is crucial for investors and traders alike. This chart not only displays the historical performance of the stock market but also offers insights into market trends, economic cycles, and potential investment opportunities. In this comprehensive guide, we'll explore the key elements of the US stock history chart, how to interpret it, and its significance in investment decision-making.

The Basics of a US Stock History Chart

A US stock history chart typically presents the price movement of a stock over a specified period, usually years. It consists of various elements, including the stock price, trading volume, and technical indicators. By analyzing these elements, investors can gain a better understanding of a stock's performance and make informed decisions.

Understanding Stock Prices

The stock price is the most crucial element of the US stock history chart. It reflects the market's valuation of a company at a given point in time. A rising stock price indicates market optimism, while a falling price may signal concern or negative news. Here are some key aspects to consider when analyzing stock prices:

Trend Analysis: Look for trends such as upward or downward movements over time. An upward trend may indicate a growing company with positive fundamentals, while a downward trend may suggest potential risks or challenges.

Support and Resistance Levels: These are critical price levels where the stock repeatedly struggles to move beyond. Support levels are where the stock price tends to find buyers, while resistance levels are where sellers are prevalent. Understanding these levels can help predict future price movements.

Trading Volume

Trading volume is another essential aspect of the US stock history chart. It represents the number of shares being bought and sold over a specific period. High trading volume typically indicates strong market interest and can confirm a stock's price movements. Here are a few things to consider:

High Volume and Price Increase: This suggests that a stock's momentum is strong and that buyers are actively pushing the price higher.

Low Volume and Price Decrease: This may indicate that the stock's decline is not supported by substantial selling pressure.

Technical Indicators

Technical indicators are tools that help investors analyze price and volume data to identify patterns and predict future price movements. Some popular indicators include:

Moving Averages (MA): These represent the average price of a stock over a specified period, providing insights into short-term and long-term trends.

Relative Strength Index (RSI): This indicator measures the speed and change of price movements, helping identify overbought or oversold conditions.

Bollinger Bands: These consist of a middle band representing the stock's moving average and upper and lower bands representing standard deviations, offering a range of price levels.

Case Studies

To illustrate the importance of the US stock history chart, let's look at two case studies:

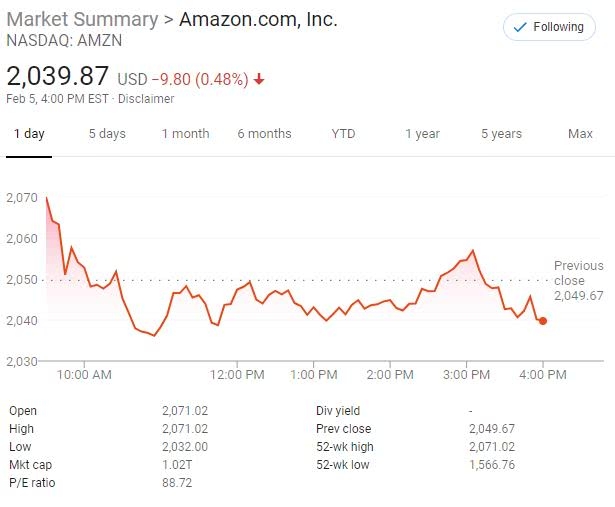

Amazon (AMZN): Over the past decade, Amazon's stock history chart has shown a strong upward trend, with several pullbacks and corrections along the way. By analyzing the chart, investors could have identified buying opportunities during pullbacks and selling opportunities during corrections.

Tesla (TSLA): Tesla's stock history chart has been volatile, with rapid price increases followed by sharp declines. Investors who analyzed the chart closely could have anticipated potential sell-offs and adjusted their positions accordingly.

In conclusion, understanding the US stock history chart is vital for making informed investment decisions. By analyzing stock prices, trading volume, and technical indicators, investors can gain insights into market trends, potential opportunities, and risks. Incorporating this knowledge into their investment strategy can lead to better decision-making and improved returns.

us stock market today live cha