Joint-Stock Venture: A Pivotal Aspect of US History

author:US stockS -

The concept of a joint-stock venture has been instrumental in shaping the economic and social fabric of the United States. From the early days of colonization to the modern corporate world, joint-stock ventures have played a pivotal role in fostering growth, innovation, and entrepreneurship. This article delves into the historical significance of joint-stock ventures in the United States, exploring their evolution and impact.

The Rise of Joint-Stock Ventures in Colonial America

The origins of joint-stock ventures in the United States can be traced back to the colonial era. The first joint-stock company in America, the Virginia Company, was established in 1606. The company was granted a charter by King James I to explore and settle the New World. This venture, which involved investors pooling their resources, was crucial in financing the early colonization efforts in Virginia.

The Role of Joint-Stock Ventures in the Development of the American Economy

Joint-stock ventures played a vital role in the economic development of the United States. The Baltimore and Ohio Railroad (B&O), chartered in 1827, is a prime example. The B&O was the first common-carrier railroad in the United States and was organized as a joint-stock company. It was instrumental in connecting the Eastern and Western parts of the country, fostering trade and economic growth.

Similarly, the Dutch East India Company (VOC) and the British East India Company (EIC) were influential in the development of American trade and commerce. These companies, established as joint-stock ventures, controlled much of the trade in the colonial period and had significant influence on the American economy.

Joint-Stock Ventures and the Industrial Revolution

The Industrial Revolution further propelled the growth of joint-stock ventures in the United States. As industries expanded and required substantial capital, joint-stock companies became the preferred vehicle for financing these ventures. The Pennsylvania Railroad (PRR), founded in 1846, is a testament to this trend. The PRR was one of the first major American corporations to be organized as a joint-stock company.

Modern Joint-Stock Ventures in the United States

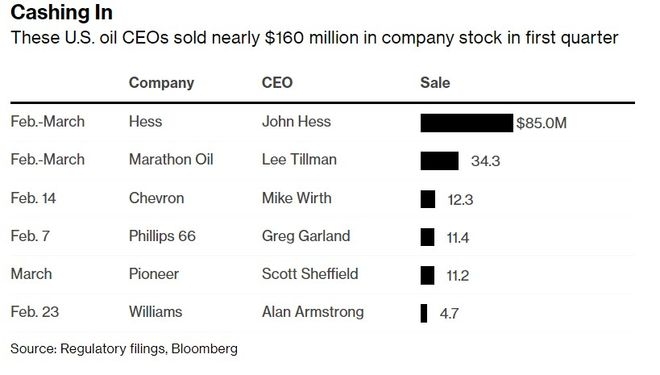

In the modern era, joint-stock ventures have become an integral part of the American corporate landscape. The Standard Oil Company (later known as ExxonMobil), founded in 1882, was one of the earliest examples of a successful joint-stock venture in the United States. It was a monopoly in the oil industry and played a significant role in shaping the American economy.

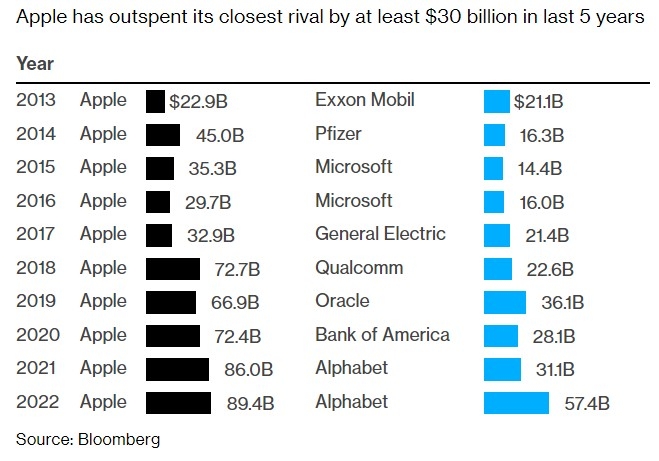

Today, joint-stock ventures continue to thrive in various sectors, including technology, finance, and healthcare. Companies like Apple, Microsoft, and Google are all joint-stock companies that have transformed the global landscape.

Case Studies: Successful Joint-Stock Ventures

The B&O Railroad: This joint-stock venture revolutionized transportation and commerce in the United States, connecting the East and West Coast.

Standard Oil: This joint-stock company became a dominant force in the oil industry, shaping the economic landscape of the United States.

Apple: A modern-day joint-stock venture that has become a global leader in technology and innovation.

Conclusion

Joint-stock ventures have been a pivotal aspect of American history, driving economic growth, innovation, and entrepreneurship. From the colonial era to the modern corporate world, these ventures have played a significant role in shaping the United States into the economic powerhouse it is today.

us stock market today live cha