Fortune 500 Share Price: Insights and Analysis

author:US stockS -

In the dynamic world of business, the Fortune 500 list stands as a beacon for the most powerful and influential companies across the globe. The share price of these companies is a critical indicator of their financial health and market perception. This article delves into the factors influencing Fortune 500 share prices, providing valuable insights for investors and business enthusiasts alike.

Understanding Fortune 500 Share Prices

The share price of a Fortune 500 company is determined by a myriad of factors. These include the company's financial performance, market trends, industry dynamics, and overall economic conditions. Understanding these factors is crucial for investors looking to gauge the potential of these companies.

Financial Performance

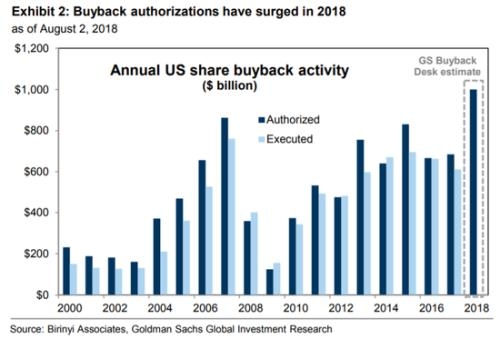

Financial performance is the cornerstone of share price analysis. Key metrics such as revenue, profit margins, and earnings per share (EPS) are closely monitored. A strong financial performance typically leads to a rise in share prices, while poor performance can result in a decline.

Market Trends

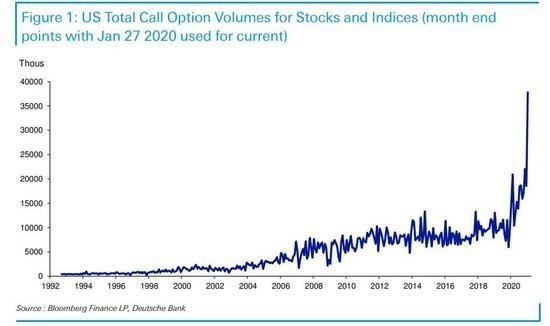

Market trends also play a significant role in determining share prices. For instance, a surge in consumer demand for a particular product or service can boost the share price of a company in that industry. Similarly, advancements in technology or regulatory changes can impact share prices.

Industry Dynamics

Industry dynamics are another crucial factor. A company operating in a rapidly growing industry is likely to see its share price rise, as investors anticipate higher returns. Conversely, a company in a declining industry may face downward pressure on its share price.

Economic Conditions

Economic conditions also have a profound impact on share prices. Factors such as inflation, interest rates, and currency fluctuations can influence the performance of Fortune 500 companies and, in turn, their share prices.

Case Studies

To illustrate these points, let's consider a few case studies:

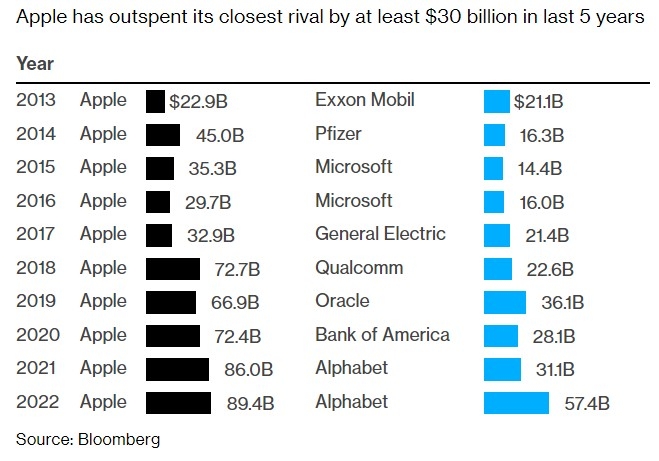

Apple Inc.: Over the past decade, Apple's share price has soared, driven by its strong financial performance and market leadership in the technology industry. The company's innovative products and services, coupled with a loyal customer base, have contributed to its success.

Walmart Inc.: Despite facing intense competition from online retailers, Walmart has managed to maintain a strong share price. The company's focus on cost efficiency, expansion into e-commerce, and diverse product offerings have helped it stay competitive.

Exxon Mobil Corporation: As an oil and gas giant, Exxon Mobil's share price has been influenced by global oil prices. While the company has faced challenges due to fluctuations in oil prices, its strong financial performance and dividend yield have attracted investors.

Conclusion

In conclusion, the share price of Fortune 500 companies is influenced by a complex interplay of factors. Understanding these factors is essential for investors looking to make informed decisions. By analyzing financial performance, market trends, industry dynamics, and economic conditions, investors can gain valuable insights into the potential of these companies.

us stock market today live cha