US Stock Earnings Report Calendar: A Comprehensive Guide

author:US stockS -

Investing in the stock market can be a thrilling endeavor, but it's crucial to stay informed about key financial events. One such event is the release of earnings reports, which can significantly impact stock prices. To help you navigate this critical period, we've compiled a comprehensive guide to the US stock earnings report calendar.

Understanding the Earnings Report Calendar

The US stock earnings report calendar is a schedule that outlines when companies are expected to release their financial results. This calendar is vital for investors as it allows them to anticipate market movements and make informed decisions. By tracking this calendar, investors can stay ahead of the curve and potentially capitalize on market opportunities.

Key Components of the Earnings Report Calendar

Reporting Season: The earnings report calendar typically focuses on the four major reporting periods: Q1 (April), Q2 (July), Q3 (October), and Q4 (January). These periods are when companies are most likely to release their financial results.

Ex-Dividend Dates: The calendar also includes ex-dividend dates, which are the dates when a stock goes ex-dividend. This is important for investors looking to purchase shares eligible for dividends.

Earnings Announcements: Each company's earnings announcement date is listed, providing investors with a clear timeline of when to expect financial updates.

Analyst Estimates: The calendar often includes analyst estimates for earnings per share (EPS) and revenue, giving investors a benchmark to compare actual results against.

How to Use the Earnings Report Calendar

Plan Your Investment Strategy: By reviewing the earnings report calendar, you can plan your investment strategy around upcoming earnings releases. This can help you avoid making impulsive decisions based on short-term market movements.

Monitor Key Companies: Pay close attention to companies that are expected to release earnings reports during key periods. These companies can have a significant impact on the broader market.

Analyze Results: After earnings reports are released, analyze the results and compare them to analyst estimates. This can help you gain insights into a company's financial health and future prospects.

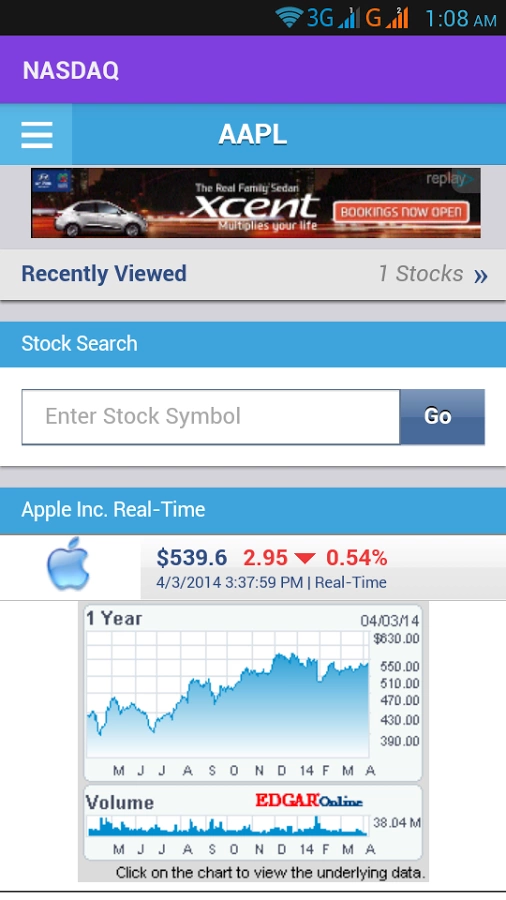

Case Study: Apple's Earnings Report

To illustrate the importance of the earnings report calendar, let's take a look at Apple's earnings report. Apple is one of the most influential companies in the stock market, and its earnings reports often cause significant market movements.

In the past, Apple's earnings reports have shown mixed results. For example, in Q1 2020, Apple reported strong revenue growth, driven by strong demand for its iPhone and services. However, in Q2 2020, the company reported a decline in revenue due to the global COVID-19 pandemic. By staying informed about Apple's earnings report date and analyzing the results, investors could have made more informed decisions about their investments.

Final Thoughts

The US stock earnings report calendar is a valuable tool for investors looking to stay informed and make informed decisions. By understanding the key components of this calendar and using it to plan your investment strategy, you can potentially capitalize on market opportunities and avoid costly mistakes. Stay tuned for more insights into the world of investing!

us stock market live