Understanding the Current Valuation of the US Stock Market

author:US stockS -The stock market is a complex entity that reflects the economic health of a nation. The United States, being the world's largest economy, has a stock market that attracts investors from around the globe. In this article, we delve into the current valuation of the US stock market, examining its key components and factors that influence its performance.

Stock Market Valuation: A Quick Overview

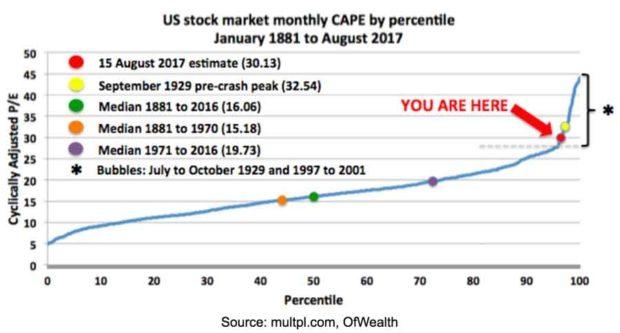

Stock market valuation refers to the process of determining the value of a company's stock. It is an essential aspect for investors looking to make informed decisions. There are several methods to value stocks, including the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield.

The P/E ratio compares a company's stock price to its earnings per share (EPS). A high P/E ratio suggests that investors are willing to pay a premium for the company's earnings. Conversely, a low P/E ratio may indicate undervaluation.

The P/B ratio compares a company's stock price to its book value per share. The book value represents the company's assets minus its liabilities. A high P/B ratio may indicate overvaluation, while a low P/B ratio may suggest undervaluation.

Dividend yield measures the return on investment in the form of dividends. A high dividend yield may attract income-focused investors, while a low dividend yield may indicate growth potential.

Current Valuation of the US Stock Market

As of the latest data, the US stock market is currently valued at approximately $34.5 trillion. This valuation is based on the total market capitalization of all publicly traded companies listed on major exchanges such as the New York Stock Exchange (NYSE) and the NASDAQ.

Several factors have contributed to the current valuation of the US stock market. These include:

- Economic Growth: The US economy has been growing steadily over the past few years, driven by factors such as low unemployment rates and strong consumer spending.

- Corporate Profits: Companies in the US have been reporting strong profits, which has helped to boost stock prices.

- Low Interest Rates: The Federal Reserve has kept interest rates low, making borrowing cheaper for companies and encouraging investment in the stock market.

Key Sectors Driving the US Stock Market

Several key sectors have been driving the US stock market's performance. These include:

- Technology: The technology sector has been a major driver of the US stock market's growth, with companies like Apple, Microsoft, and Amazon leading the way.

- Healthcare: The healthcare sector has also been a significant contributor, with pharmaceutical companies and biotech firms performing well.

- Finance: The finance sector, including banks and insurance companies, has been experiencing steady growth.

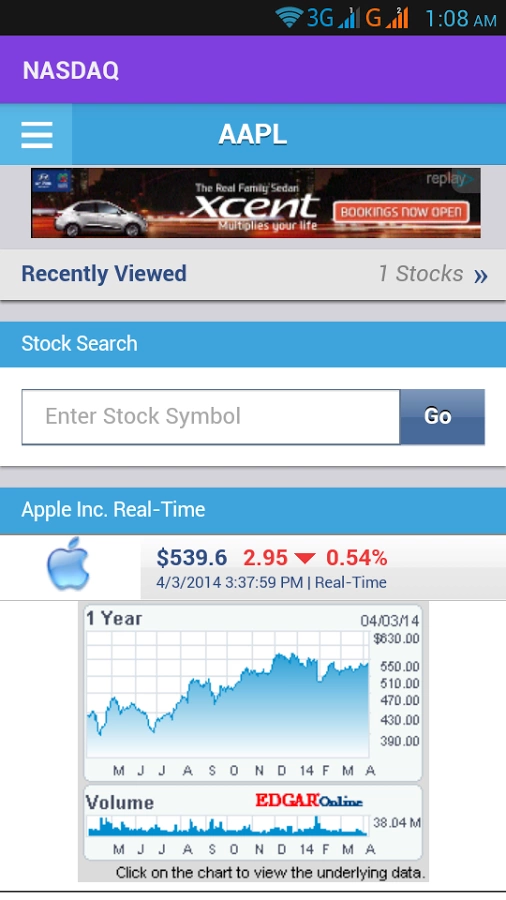

Case Study: Apple Inc.

Apple Inc. is a prime example of a company that has contributed significantly to the current valuation of the US stock market. With a market capitalization of over $2 trillion, Apple is the most valuable company in the world.

The company's strong performance can be attributed to its innovative products, such as the iPhone, iPad, and Mac. Apple's focus on product innovation and customer satisfaction has helped it maintain its leading position in the technology sector.

Conclusion

The current valuation of the US stock market reflects the strong economic performance and growth potential of the nation. As investors continue to seek opportunities in the stock market, it is essential to understand the various valuation methods and key sectors driving market performance. By staying informed and making informed decisions, investors can capitalize on the potential of the US stock market.

us stock market live