Understanding the Chinese Company US Stock Market Connection

author:US stockS -In recent years, the relationship between Chinese companies and the US stock market has become increasingly significant. This article delves into this connection, exploring the opportunities and challenges that arise from this partnership.

The Growing Influence of Chinese Companies in the US Stock Market

The presence of Chinese companies in the US stock market has expanded exponentially. Many Chinese firms have chosen to list their shares on US exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ. This decision is driven by several factors, including access to a larger pool of investors, higher valuations, and greater liquidity.

Access to a Larger Pool of Investors

Listing on a US stock exchange provides Chinese companies with access to a vast network of investors. The US stock market is one of the largest and most liquid in the world, attracting investors from across the globe. This expanded investor base can lead to increased capital raising opportunities and potentially higher valuations for Chinese companies.

Higher Valuations

The US stock market is known for its high valuations. Many Chinese companies, especially those in the technology and consumer goods sectors, have achieved significant growth and are valued at a premium compared to their counterparts in China. This has made the US stock market an attractive destination for these firms.

Greater Liquidity

Listing on a US stock exchange also offers Chinese companies greater liquidity. This means that their shares can be bought and sold more easily, providing investors with the flexibility to manage their portfolios effectively. Additionally, higher liquidity can attract more institutional investors, further enhancing the company's market profile.

Challenges and Risks

While there are numerous benefits to listing on the US stock market, there are also challenges and risks that Chinese companies must navigate. One of the primary concerns is regulatory compliance. The US regulatory environment is stringent, and Chinese companies must ensure that they adhere to all applicable laws and regulations to avoid potential legal issues.

Regulatory Compliance

Chinese companies must comply with various regulations, including those related to financial reporting, corporate governance, and accounting standards. This can be a complex process, especially for companies that are accustomed to operating under different regulatory frameworks.

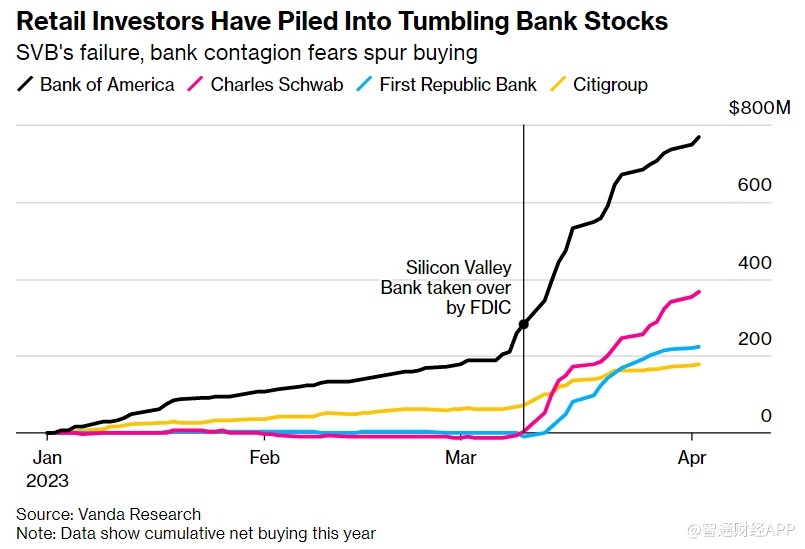

Market Volatility

Another challenge is market volatility. The US stock market can be highly volatile, and Chinese companies must be prepared for potential fluctuations in their share prices. This requires strong risk management strategies and the ability to adapt to changing market conditions.

Case Studies

Several Chinese companies have successfully listed on the US stock market, including Alibaba, Baidu, and Tencent. These companies have leveraged the benefits of the US market to achieve significant growth and increase their global presence. However, they have also faced challenges, such as regulatory scrutiny and market volatility.

Conclusion

The connection between Chinese companies and the US stock market presents both opportunities and challenges. While access to a larger pool of investors, higher valuations, and greater liquidity are significant advantages, Chinese companies must also navigate regulatory compliance and market volatility. By understanding these dynamics, Chinese companies can make informed decisions about their presence in the US stock market and maximize their potential for success.

us stock market live