Stock Market at Closing Bell: The Ultimate Daily Wrap-Up

author:US stockS -

As the closing bell rings, the stock market concludes another day of trading. It's a moment of reflection and anticipation, where investors and traders alike analyze the market's performance and strategize for the next trading session. In this article, we delve into the intricacies of the stock market at the closing bell, providing you with an insightful wrap-up of the day's events.

Market Overview

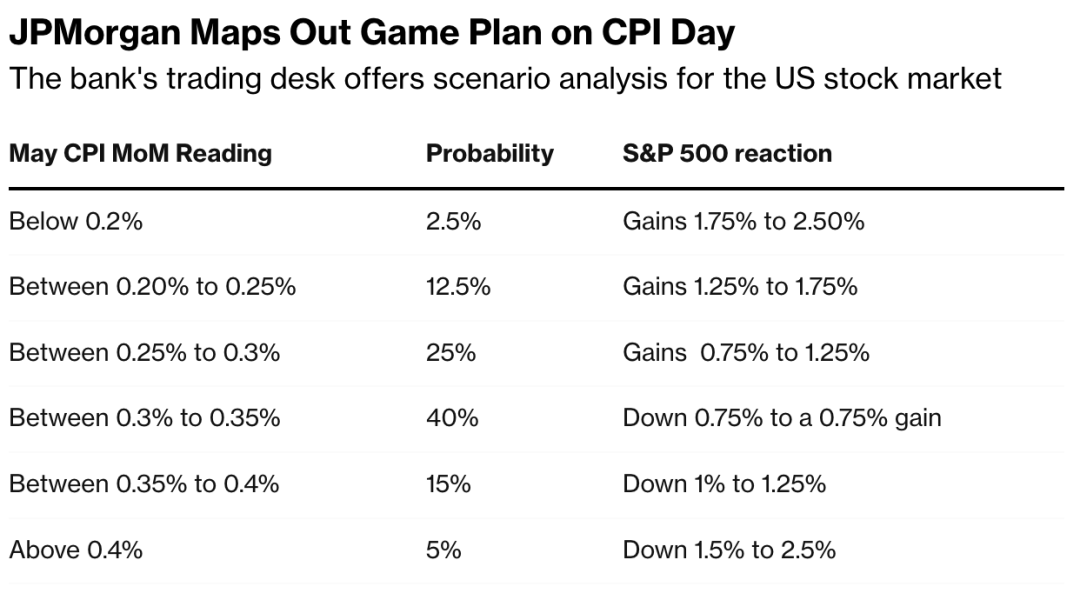

The stock market's closing bell signifies the end of a tumultuous day of trading. Market indices such as the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite provide a snapshot of the market's overall performance. As the bell chimes, these indices reflect the collective mood of investors, revealing whether the market has experienced a bullish or bearish day.

Key Factors Influencing the Market

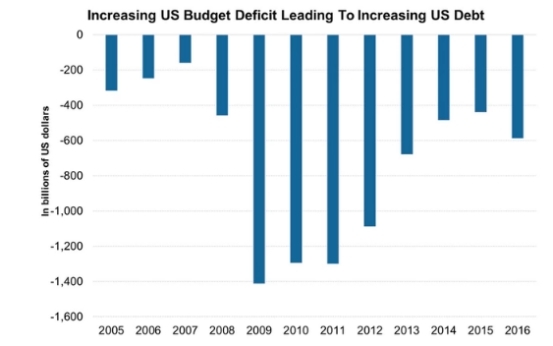

Several factors contribute to the stock market's movement at the closing bell. These include economic data, corporate earnings reports, geopolitical events, and global market trends. Economic indicators such as GDP, unemployment rates, and inflation rates play a crucial role in shaping investors' perceptions and, consequently, the market's direction.

For instance, positive economic news can boost investor confidence, leading to higher stock prices and a bullish market sentiment. Conversely, negative economic news can erode investor confidence, resulting in lower stock prices and a bearish market sentiment.

Corporate Earnings Reports

Corporate earnings reports are another significant factor that influences the stock market at the closing bell. Companies release their quarterly earnings reports, providing insights into their financial performance. Strong earnings reports can drive up stock prices, while weak earnings reports can lead to declines.

Case Study: Apple's Q4 Earnings Report

A prime example is Apple's Q4 earnings report, where the company exceeded market expectations. As a result, Apple's stock price surged, positively impacting the broader market.

Geopolitical Events

Geopolitical events, such as elections, trade wars, and international conflicts, can also sway the stock market at the closing bell. These events often create uncertainty, leading to volatility in the market.

Global Market Trends

Global market trends, such as shifts in investor sentiment and currency movements, can also influence the stock market at the closing bell. For instance, a weak US dollar can benefit companies with significant international operations, leading to higher stock prices.

Investor Sentiment and Market Volatility

The closing bell also reflects the current investor sentiment in the market. Market volatility can be attributed to a range of factors, including fear of missing out (FOMO), overconfidence, and speculative trading.

The Role of Technology

Technology has revolutionized the stock market, making it easier for investors to trade and stay informed. Online brokers and mobile trading apps have made it possible for individuals to access the market from anywhere, at any time.

Conclusion

In conclusion, the stock market at the closing bell is a pivotal moment, where investors and traders analyze the day's events and prepare for the next trading session. Understanding the factors that influence the market can help investors make informed decisions and navigate the complexities of the stock market. As the closing bell rings, it's essential to stay informed and remain vigilant in the ever-changing landscape of the stock market.

us stock market live