Echoes of Dotcom Bubble Haunt AI-Driven US Stock Market

author:US stockS -

The stock market has always been a rollercoaster ride, with bubbles and crashes occurring frequently. The dotcom bubble of the late 1990s and early 2000s is a prime example of this volatility. Now, as we witness the rise of AI-driven investments, there are eerie echoes of that era, raising concerns about the potential for another bubble. This article delves into the similarities and differences between the two, highlighting the risks and opportunities in today's AI-driven US stock market.

The Dotcom Bubble: A Brief Recap

The dotcom bubble was a period of rapid growth in the stock prices of internet companies, leading to a massive increase in investment. Many of these companies were unprofitable and lacked a clear business model, yet investors were driven by the allure of the internet and its potential. This frenzy led to a sudden burst in 2000, with the NASDAQ Composite Index plummeting by over 75% in just two years.

The AI-Driven US Stock Market: A Similar Scenario?

Today, we are seeing a similar trend with AI-driven investments. AI technology is advancing rapidly, and many companies are capitalizing on this trend by incorporating AI into their business models. However, just like the dotcom bubble, there are concerns about the potential for another bubble.

Similarities Between the Two Bubbles

- Rapid Growth: Both bubbles experienced rapid growth in stock prices, driven by speculative investment and high expectations for future returns.

- Overvaluation: Many AI-driven companies are currently overvalued, with sky-high valuations that don't reflect their profitability or long-term potential.

- Speculative Investment: Investors are driven by the allure of AI and its potential to revolutionize various industries, leading to speculative investment without a clear understanding of the risks.

Differences Between the Two Bubbles

- Market Size: The AI-driven market is currently much smaller than the dotcom market was at its peak, which could mitigate the potential for a burst.

- Regulatory Environment: The regulatory environment for AI-driven investments is more stringent than it was for dotcom companies, which could help prevent another bubble.

- Technological Maturity: AI technology is still in its early stages, and it may take several years for the market to mature and for companies to prove their long-term potential.

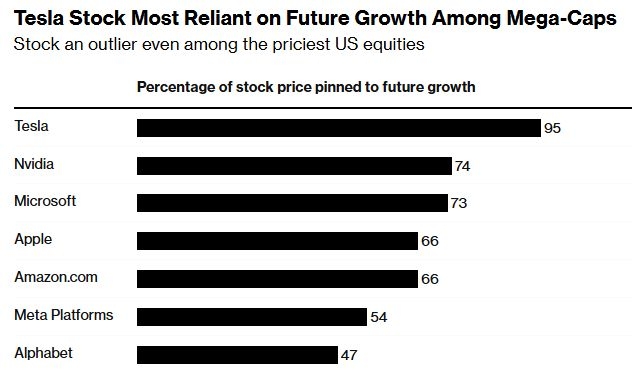

Case Study: Tesla and its AI-Driven Business Model

Tesla, a leading electric vehicle manufacturer, is a prime example of an AI-driven company. The company's use of AI in its autonomous driving technology has helped it gain a competitive edge in the market. However, Tesla's stock price has soared to record highs, raising concerns about overvaluation.

Conclusion

The rise of AI-driven investments in the US stock market is reminiscent of the dotcom bubble, with both sharing similar characteristics. While there are concerns about the potential for another bubble, the market's size, regulatory environment, and technological maturity may help prevent a major crash. Investors should approach AI-driven investments with caution, focusing on companies with solid business models and long-term potential.

us stock market live