Momentum Stocks Recent Performance: A Deep Dive

author:US stockS -

In the fast-paced world of investing, momentum stocks have always been a topic of interest. These stocks, known for their rapid price increases, have been capturing the attention of traders and investors alike. This article delves into the recent performance of momentum stocks, analyzing their trends, and providing insights into what might lie ahead.

Understanding Momentum Stocks

Momentum stocks are those that have seen a significant increase in their share price over a short period. These stocks often outperform the market and are favored by traders who believe in the continuation of their upward trend. The key to identifying momentum stocks lies in their price action and volume.

Recent Performance Trends

In recent months, momentum stocks have shown mixed performance. While some have continued to soar, others have faced challenges. Let's take a closer look at some of the key trends:

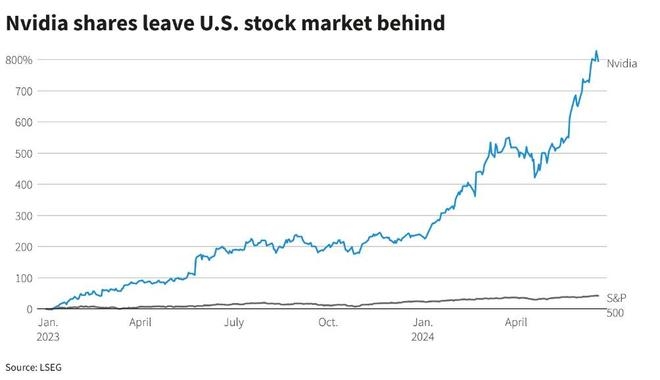

1. Tech Stocks

Tech stocks have been a major driver of momentum in recent years. Companies like Tesla and NVIDIA have seen their share prices skyrocket, driven by strong fundamentals and market optimism. However, the recent regulatory scrutiny and market uncertainty have led to some volatility in these stocks.

2. Biotech Stocks

The biotech sector has also been a hotbed for momentum stocks. Companies working on groundbreaking therapies and vaccines have seen their share prices surge. Moderna and Regeneron are two examples of biotech stocks that have experienced significant growth.

3. Small-Cap Stocks

Small-cap stocks have been another area where momentum has been strong. These stocks often have high growth potential and can see rapid price increases. However, they also come with higher risk, and investors need to be cautious.

4. Declining Stocks

Not all momentum stocks have performed well. Some, like WeWork and Zoom Video Communications, have faced challenges and seen their share prices decline. This highlights the importance of conducting thorough research before investing in momentum stocks.

Factors Influencing Momentum Stocks

Several factors influence the performance of momentum stocks:

- Market Sentiment: The overall market sentiment plays a crucial role in the performance of momentum stocks. Positive sentiment can lead to higher prices, while negative sentiment can cause reversals.

- Economic Indicators: Economic indicators, such as GDP growth and unemployment rates, can impact the performance of momentum stocks.

- Regulatory Changes: Changes in regulations can have a significant impact on momentum stocks, especially in sectors like tech and biotech.

Case Studies

Let's take a look at a couple of case studies to understand the recent performance of momentum stocks better:

- Tesla: Tesla has been a poster child for momentum stocks. Its share price has soared over the years, driven by strong fundamentals and market optimism. However, the recent regulatory scrutiny and market uncertainty have led to some volatility in the stock.

- Moderna: Moderna's share price has seen significant growth due to its groundbreaking COVID-19 vaccine. However, the stock has also faced challenges, including concerns about its long-term sustainability.

Conclusion

The recent performance of momentum stocks has been mixed, with some stocks soaring and others facing challenges. Investors need to be cautious and conduct thorough research before investing in these stocks. By understanding the factors that influence momentum stocks and staying informed about market trends, investors can make informed decisions and potentially benefit from the strong performance of these stocks.

us stock market live