Microsoft US Stock Price: Current Trends and Future Projections

author:US stockS -

The stock market is a dynamic and complex landscape, where investors and traders constantly seek insights into the performance of major companies. One such company is Microsoft Corporation, a global leader in technology. In this article, we delve into the current trends of Microsoft's US stock price and provide future projections based on various factors.

Understanding Microsoft's Stock Price

Microsoft's stock, listed as MSFT on the NASDAQ, has seen significant growth over the years. The company's strong financial performance, innovative products, and expansion into various industries have contributed to its market dominance. As of the latest available data, the stock price has been fluctuating within a certain range, influenced by various market dynamics.

Current Trends

Several factors have been impacting Microsoft's stock price recently:

Economic Factors: The global economic landscape has been witnessing fluctuations, with factors like inflation and supply chain disruptions playing a crucial role. These economic conditions can directly affect Microsoft's revenue and, subsequently, its stock price.

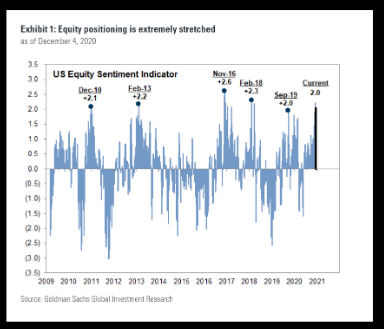

Market Sentiment: Investor sentiment towards Microsoft has been positive, driven by the company's consistent growth and profitability. However, market sentiment can change rapidly, and it's essential to keep a close eye on these trends.

Product Releases: Microsoft's product releases, such as Windows 11 and Office 365, have been well-received by the market. These releases can positively impact the company's stock price, especially if they generate significant revenue.

Strategic Partnerships: Microsoft has been actively seeking strategic partnerships to expand its market reach. These partnerships can potentially boost the company's stock price if they lead to increased revenue and market share.

Future Projections

Several factors indicate a positive outlook for Microsoft's stock price in the future:

Technology Trends: The tech industry is expected to continue growing, with increasing demand for cloud computing, artificial intelligence, and other innovative technologies. Microsoft is well-positioned to benefit from these trends.

Global Expansion: Microsoft's expansion into new markets, such as China and India, presents significant growth opportunities. The company's ability to capture these markets can positively impact its stock price.

Product Innovation: Microsoft's commitment to innovation and product development ensures that the company remains competitive in the market. This can lead to increased revenue and, consequently, a higher stock price.

Strategic Acquisitions: Microsoft's strategic acquisitions, such as the purchase of GitHub, have helped the company diversify its product portfolio and enter new markets. This diversification can contribute to a stable and growing stock price.

Case Study: Microsoft's Acquisition of LinkedIn

One notable example of Microsoft's strategic moves is its acquisition of LinkedIn in 2016. This acquisition helped Microsoft enter the professional networking space and expand its reach to over 500 million users. Since the acquisition, Microsoft's stock price has seen a steady increase, reflecting the positive impact of this strategic move.

In conclusion, Microsoft's US stock price has been influenced by various factors, including economic conditions, market sentiment, product releases, and strategic partnerships. Based on current trends and future projections, Microsoft's stock price appears poised for growth. Investors looking to invest in the tech industry should consider Microsoft as a potential investment opportunity, given its strong financial performance and growth potential.

us stock market live