Total US Stock Market Capitalization 2025 Estimate: A Deep Dive

author:US stockS -

The total US stock market capitalization has always been a crucial indicator of the country's economic health. As we approach 2025, experts are eagerly anticipating the figure. This article will delve into the projected market capitalization and the factors that are shaping it.

Understanding Stock Market Capitalization

Before diving into the estimate for 2025, let's clarify what stock market capitalization means. It is the total value of all shares of a company's stock that are held by investors. Essentially, it's the sum of the company's shares multiplied by the current market price.

Factors Influencing Stock Market Capitalization

Several factors can influence the total US stock market capitalization. Here are some key factors to consider:

- Economic Growth: The overall economic growth of the country plays a significant role. A growing economy typically leads to higher corporate earnings and, consequently, increased stock prices.

- Interest Rates: Interest rates can affect the stock market. Lower interest rates tend to boost stock prices, as they make borrowing cheaper for companies and investors.

- Inflation: Inflation can erode purchasing power and impact stock prices. Generally, higher inflation can lead to lower stock prices.

- Technological Advancements: The rapid pace of technological advancements can drive growth in certain sectors and, in turn, increase the market capitalization of companies in those sectors.

- Political Stability: Political stability is crucial for investor confidence. Stability can lead to higher stock prices and increased market capitalization.

2025 Estimate: A Conservative Outlook

Based on various forecasts and analyses, a conservative estimate for the total US stock market capitalization in 2025 is around

Key Takeaways

- Economic Growth: A strong economic outlook is expected to drive market capitalization higher.

- Interest Rates: Continued low interest rates could support stock prices and market capitalization.

- Inflation: Controlling inflation will be crucial to maintaining the value of stocks.

- Technological Advancements: Innovations in key sectors could significantly boost market capitalization.

- Political Stability: Stability in the political landscape will be vital for investor confidence.

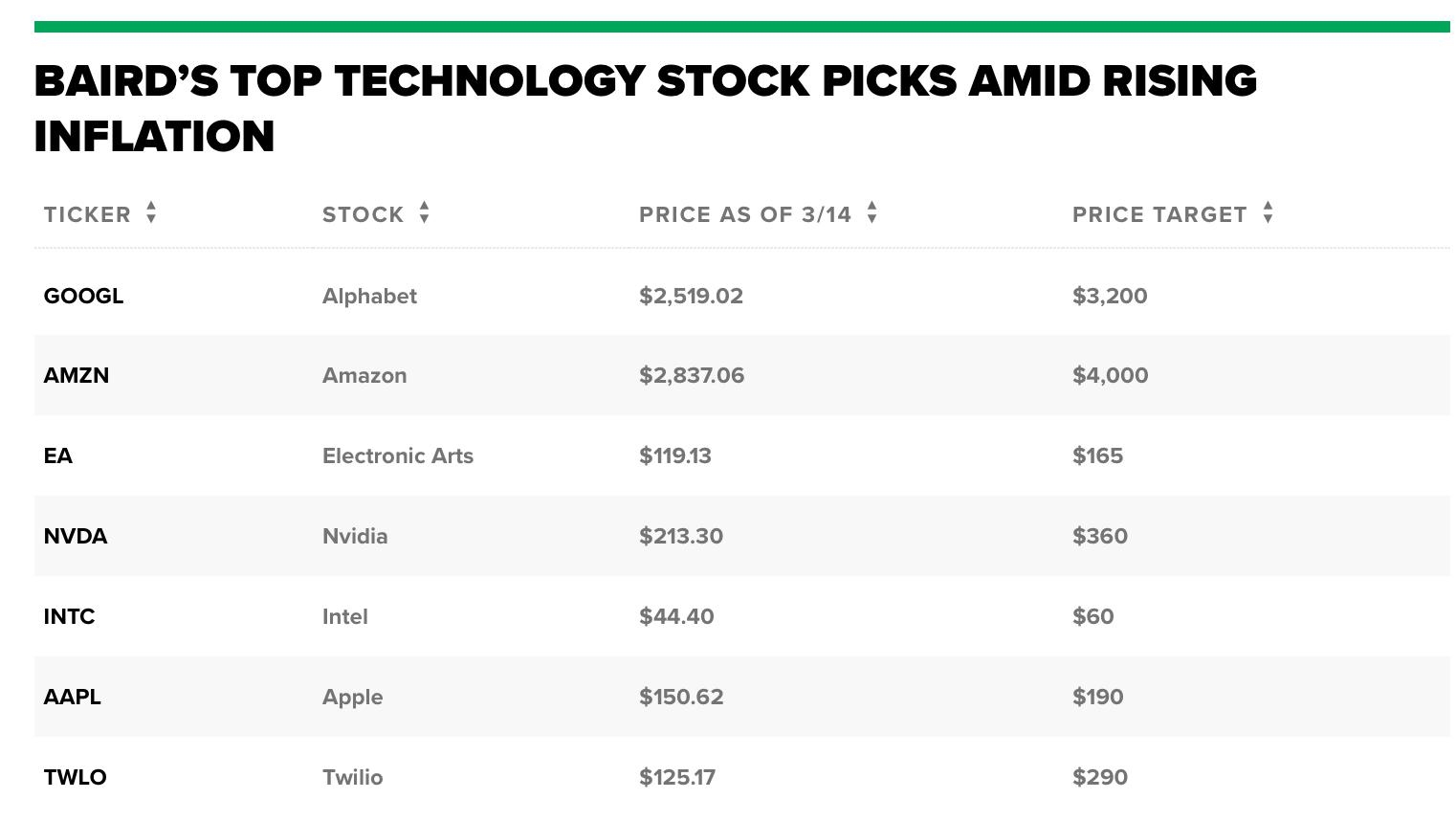

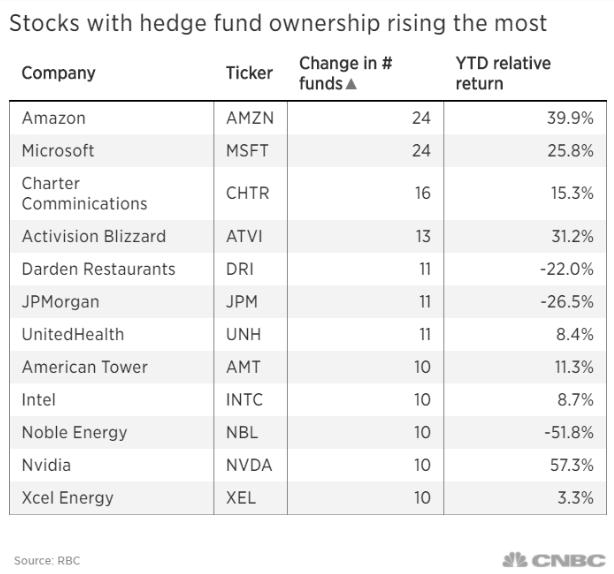

Case Study: Tech Sector Growth

One sector that is likely to contribute significantly to the total US stock market capitalization is the technology sector. Companies like Apple, Microsoft, and Amazon have seen massive growth in recent years, and this trend is expected to continue. The increasing demand for technology products and services, coupled with the rise of remote work, has created a fertile environment for tech companies to thrive.

In conclusion, the total US stock market capitalization is expected to reach around $40 trillion by 2025. While there are several factors that can influence this figure, a strong economic outlook, low interest rates, and technological advancements are likely to play a significant role.

us stock market live