Unlocking the Secrets to the Highest Stock Price Achievements"

author:US stockS -

In the ever-evolving world of finance, understanding what drives the highest stock prices is crucial for investors and traders. This article delves into the factors that contribute to a stock reaching its peak value, offering insights that can help you make informed decisions in your investment journey.

Market Dynamics and Economic Factors

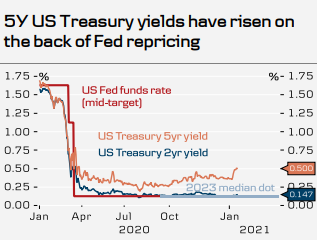

The highest stock prices are often a reflection of a company's strong fundamentals and the broader market conditions. Economic indicators, such as GDP growth, interest rates, and inflation, play a significant role in determining stock prices. Companies that can navigate these economic factors effectively tend to see higher valuations.

Strong Financial Performance

One of the primary drivers of high stock prices is robust financial performance. Companies with consistent revenue growth, strong profit margins, and a solid balance sheet are more likely to attract investors, pushing their stock prices higher. Revenue growth and profitability are key metrics that investors closely monitor.

Unique Business Models and Competitive Advantage

Unique business models and a competitive advantage can significantly impact a company's stock price. Companies that offer innovative products or services, have a strong brand, or operate in high-growth industries often see their stock prices soar. For instance, tech giants like Apple and Microsoft have achieved record-high stock prices due to their groundbreaking products and strong market positions.

Case Study: Apple Inc.

Apple Inc. is a prime example of a company that has reached the highest stock prices due to its unique business model and competitive advantage. The tech giant's ability to innovate and create highly desirable products has driven its stock price to unprecedented levels. From the iPhone to the Apple Watch, Apple has consistently delivered products that resonate with consumers, making it one of the most valuable companies in the world.

Strong Management and Corporate Governance

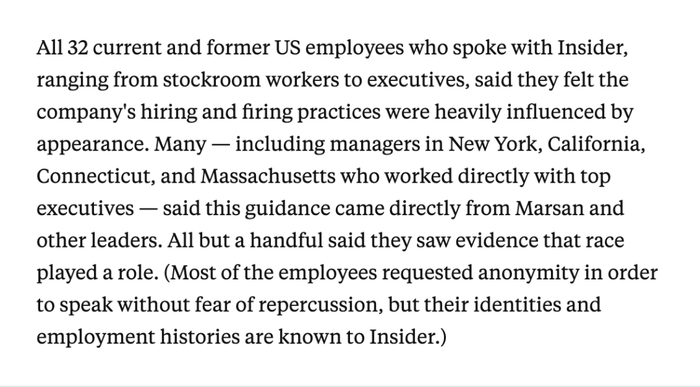

The quality of a company's management and corporate governance can significantly impact its stock price. Investors tend to favor companies with experienced leadership, a clear vision, and a commitment to transparency. Effective corporate governance helps build trust among investors, leading to higher stock prices.

Case Study: Amazon.com Inc.

Amazon.com Inc. is another company that has achieved remarkable stock price growth due to its strong management and corporate governance. Under the leadership of Jeff Bezos, Amazon has become a global powerhouse in e-commerce and cloud computing. The company's commitment to innovation and customer satisfaction has helped it maintain its position as a market leader, driving its stock price to new heights.

Market Sentiment and Speculation

While fundamentals and economic factors play a significant role, market sentiment and speculation can also drive stock prices to unprecedented levels. In some cases, investors may bid up the price of a stock based on optimism or speculation, leading to bubble-like conditions. However, this can be risky, as stock prices can plummet once the bubble bursts.

Conclusion

Achieving the highest stock prices is a complex process that involves a combination of strong fundamentals, market dynamics, and investor sentiment. By understanding these factors, investors can better navigate the stock market and make informed decisions. Whether you're a seasoned investor or just starting out, staying informed and vigilant is key to unlocking the secrets to the highest stock price achievements.

us flag stock