Unlocking the Power of the S&P 500 Benchmark

author:US stockS -

Investing in the stock market can be daunting, especially for beginners. With thousands of companies to choose from, how do you determine which ones to invest in? Enter the S&P 500 benchmark, a vital tool for investors seeking to navigate the stock market. This article delves into the intricacies of the S&P 500, its significance, and how it can be utilized to make informed investment decisions.

What is the S&P 500?

The S&P 500, or Standard & Poor's 500, is a stock market index that tracks the performance of 500 large companies listed on stock exchanges in the United States. These companies are selected based on market capitalization, financial stability, and industry representation. The S&P 500 is widely regarded as a benchmark for the overall health of the U.S. stock market and is often used as a gauge for investment performance.

Why is the S&P 500 Important?

The S&P 500 is crucial for several reasons:

- Market Representation: The index represents a broad cross-section of the U.S. economy, covering various sectors and industries. This diversity ensures that the index reflects the overall market's performance rather than the performance of a single industry or company.

- Historical Performance: The S&P 500 has a long history of performance data, making it an excellent reference point for investors seeking to understand market trends and historical returns.

- Ease of Comparison: Investors can use the S&P 500 to compare the performance of their portfolios against a benchmark, providing a clear measure of their investment strategy's effectiveness.

How to Use the S&P 500 Benchmark

- Diversification: Investing in a broad index like the S&P 500 allows investors to achieve diversification, reducing their exposure to the risks associated with individual stocks.

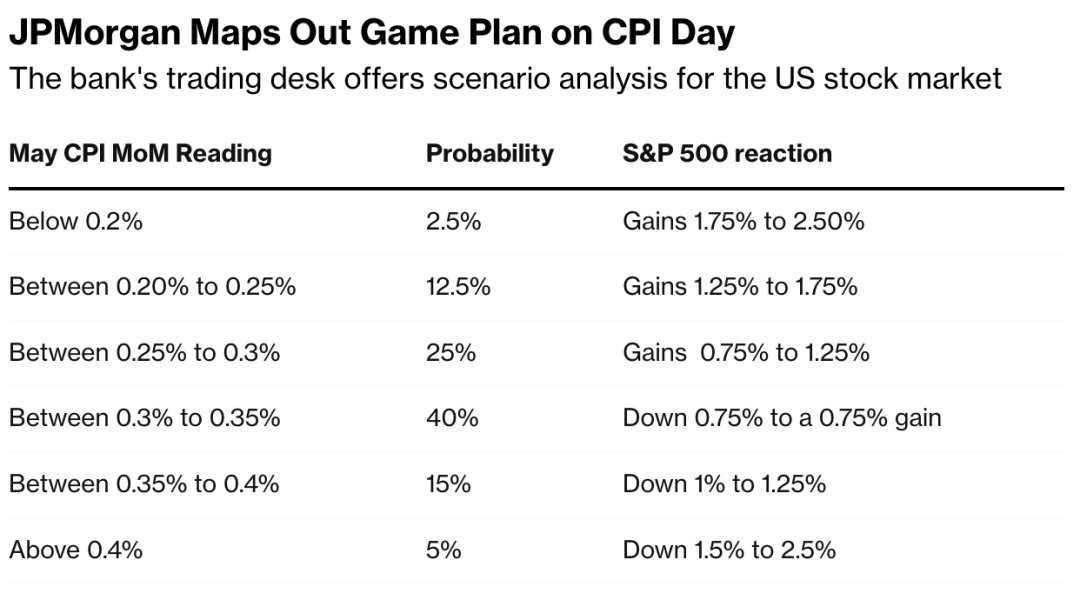

- Performance Comparison: Investors can compare their portfolio's performance against the S&P 500 to determine if they are meeting their investment goals.

- Market Trend Analysis: Analyzing the S&P 500 can help investors gain insights into market trends and potential investment opportunities.

Case Study: Apple's Performance in the S&P 500

Apple, Inc. (AAPL) is one of the largest companies in the S&P 500. Since joining the index in 1984, Apple has significantly contributed to the index's growth. By analyzing Apple's performance within the S&P 500, investors can gain insights into the company's impact on the overall market and its potential for future growth.

Conclusion

The S&P 500 benchmark is a valuable tool for investors seeking to navigate the stock market. By understanding its significance and utilizing it effectively, investors can make informed decisions and achieve their investment goals. Whether you're a beginner or an experienced investor, the S&P 500 is a must-have resource for anyone looking to succeed in the stock market.

us flag stock