Unlocking the Potential of LTCG US Stocks: A Comprehensive Guide

author:US stockS -

In the ever-evolving world of investments, LTCG US stocks have emerged as a compelling option for investors seeking long-term growth. This article delves into the intricacies of these stocks, offering valuable insights and strategies to help you make informed decisions.

Understanding LTCG US Stocks

LTCG stands for "long-term capital gains," which refers to the profits earned from the sale of stocks held for more than a year. These stocks are often chosen for their potential to deliver substantial returns over an extended period. When investing in LTCG US stocks, it's crucial to focus on companies with strong fundamentals, solid growth prospects, and a history of consistent performance.

Key Factors to Consider When Investing in LTCG US Stocks

Company Fundamentals: Look for companies with strong financial health, including robust revenue growth, healthy profit margins, and a solid balance sheet. Companies with a strong track record of innovation and market leadership are often good candidates for LTCG investments.

Sector Performance: Analyze the performance of the sector in which the company operates. A thriving sector can significantly boost the potential returns of LTCG US stocks.

Dividend Yield: Companies that pay dividends can provide a steady stream of income while your investment grows. A high dividend yield can be an attractive feature for long-term investors.

Valuation: Ensure that the stock is not overvalued. Use valuation metrics like the price-to-earnings (P/E) ratio and price-to-book (P/B) ratio to assess whether the stock is priced fairly.

Top LTCG US Stocks to Watch

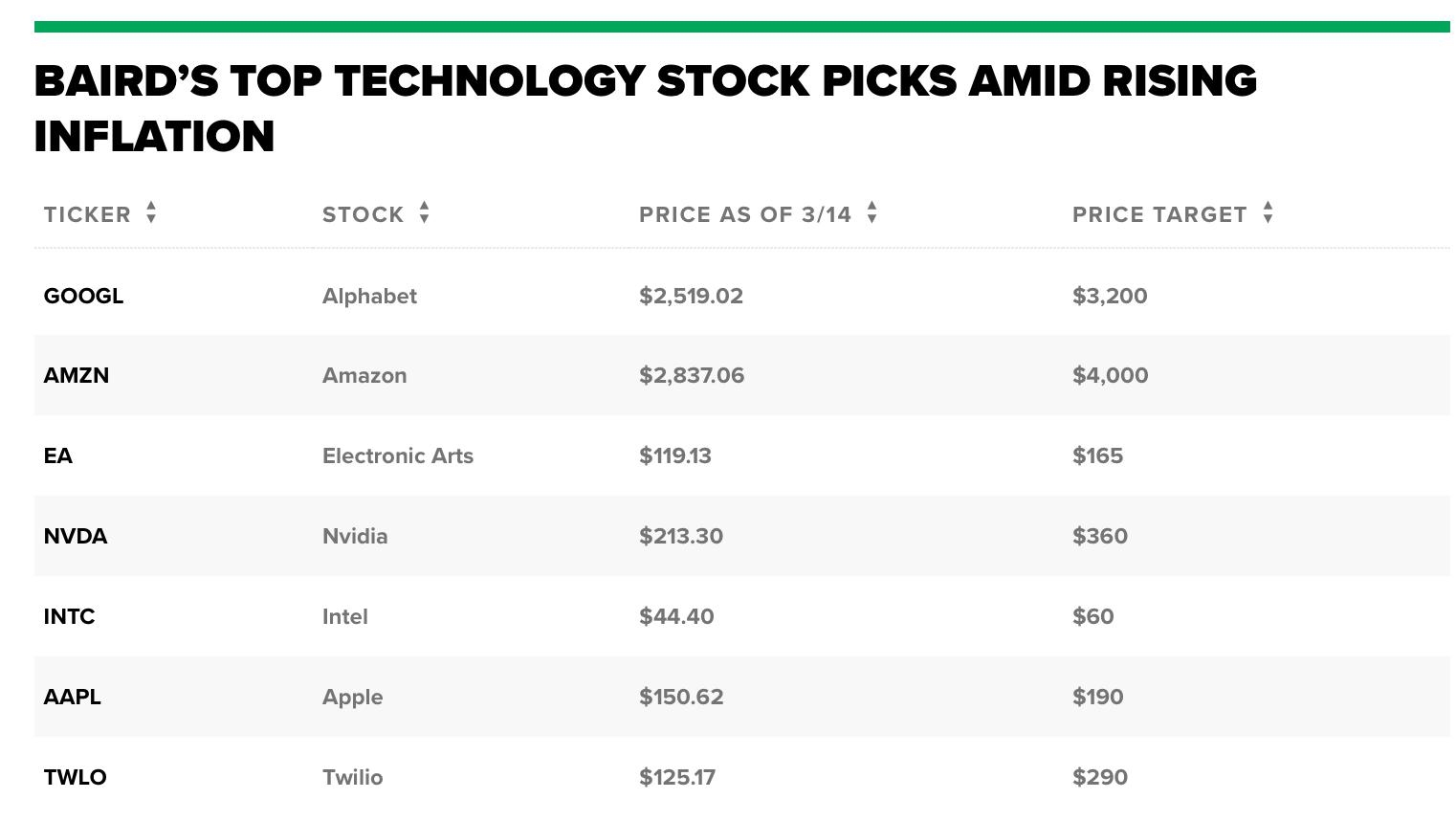

Apple Inc. (AAPL): As the world's largest technology company, Apple has a strong track record of innovation and market leadership. Its diverse product portfolio and robust financials make it a compelling LTCG investment.

Microsoft Corporation (MSFT): Microsoft is a leader in the software industry, with a strong presence in cloud computing, gaming, and productivity tools. Its consistent revenue growth and dividend payments make it an attractive LTCG investment.

Amazon.com, Inc. (AMZN): Amazon has revolutionized the retail industry and continues to expand its footprint in various sectors, including cloud computing and streaming services. Its strong growth prospects and potential for long-term gains make it a compelling LTCG investment.

Johnson & Johnson (JNJ): As a diversified healthcare company, Johnson & Johnson offers stability and growth potential. Its strong brand reputation and consistent dividend payments make it an attractive LTCG investment.

Case Study: Investment in Apple Inc.

Consider an investor who purchased 100 shares of Apple Inc. at

Conclusion

Investing in LTCG US stocks can be a powerful strategy for long-term growth. By focusing on companies with strong fundamentals, solid growth prospects, and a history of consistent performance, investors can potentially achieve substantial returns. Remember to conduct thorough research and consider your risk tolerance before making any investment decisions.

us flag stock