Understanding the Ishares US ETF Trust COMT Stock: A Comprehensive Guide

author:US stockS -

Investing in the stock market can be overwhelming, especially for beginners. With countless ETFs and stocks available, it's crucial to understand the nuances of each investment. In this article, we'll delve into the Ishares US ETF Trust COMT stock, providing you with valuable insights and information.

What is the Ishares US ETF Trust COMT Stock?

The Ishares US ETF Trust COMT stock, also known as the iShares U.S. Commodity Trust, is a popular exchange-traded fund (ETF) designed to track the returns of United States commodity futures contracts. This ETF provides investors with exposure to a diverse range of commodities, including energy, agriculture, and industrial metals.

Key Features of the Ishares US ETF Trust COMT Stock

- Diversification: By investing in the iShares US ETF Trust COMT stock, investors gain exposure to a broad array of commodities, reducing their risk in a single asset class.

- Liquidity: As an ETF, the Ishares US ETF Trust COMT stock is highly liquid, allowing investors to buy and sell shares easily throughout the trading day.

- Transparency: The iShares US ETF Trust COMT stock provides daily pricing and trading volume information, making it easy for investors to monitor their investments.

Benefits of Investing in the Ishares US ETF Trust COMT Stock

- Potential for High Returns: Commodities can be a powerful tool for diversifying a portfolio and generating high returns, especially during periods of market volatility.

- Hedging Against Inflation: Commodities often act as a hedge against inflation, as their prices tend to rise during periods of inflation.

- Access to a Wide Range of Commodities: The iShares US ETF Trust COMT stock provides access to various commodities, allowing investors to tailor their investments to their specific needs.

Case Study: Investing in the Ishares US ETF Trust COMT Stock

Let's consider an example of an investor named John, who wants to diversify his portfolio and hedge against inflation. After thorough research, John decides to invest in the iShares US ETF Trust COMT stock.

By doing so, John gains exposure to a variety of commodities, such as oil, gold, and natural gas. Over the next few years, he watches as the value of his investment grows, as the commodities he owns increase in price.

Understanding the Risks

While the iShares US ETF Trust COMT stock offers several benefits, it's essential to understand the risks involved:

- Market Risk: Commodities prices can be highly volatile, leading to significant fluctuations in the value of the ETF.

- Regulatory Risk: Changes in regulations or government policies can impact commodity prices and, consequently, the performance of the iShares US ETF Trust COMT stock.

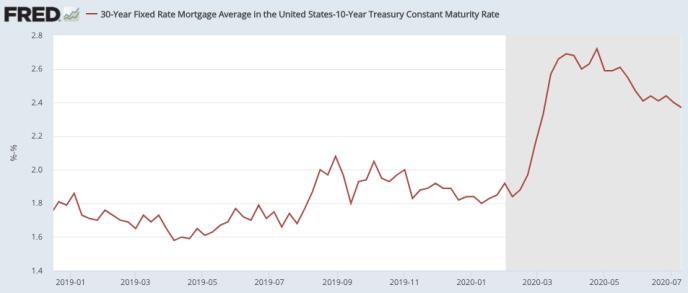

- Interest Rate Risk: High-interest rates can lead to a decrease in commodity prices, potentially affecting the performance of the ETF.

In conclusion, the Ishares US ETF Trust COMT stock is a valuable investment tool for those looking to diversify their portfolios and hedge against inflation. However, it's crucial to conduct thorough research and understand the risks involved before investing.

us flag stock