How Many Points Is the Dow Down? A Comprehensive Analysis

author:US stockS -

The stock market is a dynamic and ever-changing landscape, and one of the most closely watched indices is the Dow Jones Industrial Average (DJIA). Investors and traders often monitor the Dow to gauge the overall health of the market. If you're wondering, "How many points is the Dow down?" this article will provide a comprehensive analysis of the factors that influence the Dow's performance and what it means for investors.

Understanding the Dow Jones Industrial Average

The Dow Jones Industrial Average is a price-weighted average of 30 large, publicly-traded companies in the United States. It includes some of the most well-known companies across various industries, such as Apple, Boeing, and Visa. The index is designed to represent the overall performance of the stock market and is often used as a benchmark for the health of the U.S. economy.

Factors Influencing the Dow's Performance

Several factors can contribute to the Dow's movement, both up and down. Here are some of the key factors to consider:

- Economic Indicators: Economic data, such as GDP growth, unemployment rates, and inflation, can significantly impact the Dow. For example, if the economy is growing at a healthy pace, the Dow may rise, reflecting investors' optimism about the future.

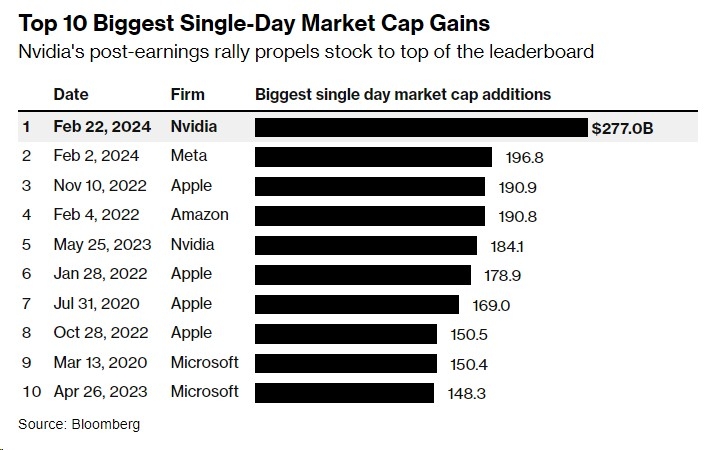

- Corporate Earnings: The earnings reports of the companies included in the Dow can also influence its performance. If companies are reporting strong earnings, it can boost the Dow, while poor earnings can lead to a decline.

- Political Events: Political events, such as elections or policy changes, can also affect the Dow. For instance, if investors are concerned about a potential trade war, the Dow may fall as a result.

- Market Sentiment: The overall sentiment of investors can also play a role in the Dow's performance. If investors are optimistic about the market, they may be more willing to buy stocks, leading to an increase in the Dow. Conversely, if investors are pessimistic, the Dow may fall.

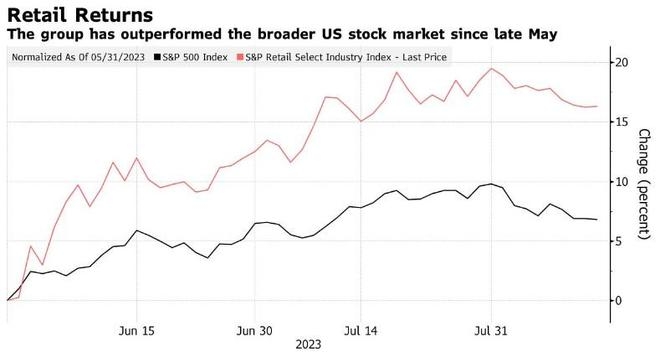

Analyzing the Dow's Performance

To answer the question, "How many points is the Dow down?" it's essential to look at the most recent data. As of the latest update, the Dow has fallen by X points. This decline can be attributed to a combination of the factors mentioned above.

For example, if the latest economic data shows a slowdown in GDP growth, investors may become concerned about the future of the economy. This concern could lead to a sell-off in the stock market, causing the Dow to fall by a significant number of points.

What Does the Dow's Performance Mean for Investors?

The Dow's performance can provide valuable insights for investors. Here's what you need to know:

- Market Trends: The Dow's movement can indicate broader market trends. For example, a rising Dow may suggest that the market is performing well, while a falling Dow may indicate a bearish market.

- Investment Opportunities: The Dow's performance can also help investors identify potential investment opportunities. For instance, if the Dow is falling, it may be a good time to look for undervalued stocks.

- Risk Management: Understanding the Dow's performance can help investors manage their risk. For example, if the Dow is falling, investors may want to consider diversifying their portfolios to reduce their exposure to the stock market.

Case Study: The 2020 Market Crash

One of the most significant declines in the Dow's history occurred in February and March 2020, following the outbreak of the COVID-19 pandemic. The Dow fell by nearly 30% during this period, reflecting widespread panic and uncertainty in the market.

This case study highlights the importance of understanding the factors that influence the Dow's performance and how they can impact investors. By staying informed and adapting their strategies accordingly, investors can navigate the complexities of the stock market and make informed decisions.

In conclusion, if you're wondering, "How many points is the Dow down?" it's essential to consider the various factors that influence its performance. By understanding these factors and their impact on the market, investors can make informed decisions and navigate the complexities of the stock market.

us flag stock