Understanding the Investment Market Graph: A Comprehensive Guide

author:US stockS -

In today's rapidly evolving financial landscape, staying informed about the investment market is crucial for anyone looking to make smart and profitable decisions. One of the most valuable tools for analyzing market trends and predicting future movements is the investment market graph. This article delves into the intricacies of investment market graphs, their significance, and how they can help you make more informed investment choices.

What is an Investment Market Graph?

An investment market graph is a visual representation of the performance of a financial market or asset class over a specific period. It uses various data points such as stock prices, trading volume, and market capitalization to provide a clear and concise overview of the market's performance.

The Importance of Investment Market Graphs

Trend Analysis: One of the primary benefits of investment market graphs is their ability to analyze trends over time. By plotting historical data, investors can identify patterns and trends that may indicate future market movements.

Risk Assessment: By examining the volatility and performance of an asset or market, investors can better assess the associated risks. This information is crucial for determining the suitability of an investment for their risk tolerance.

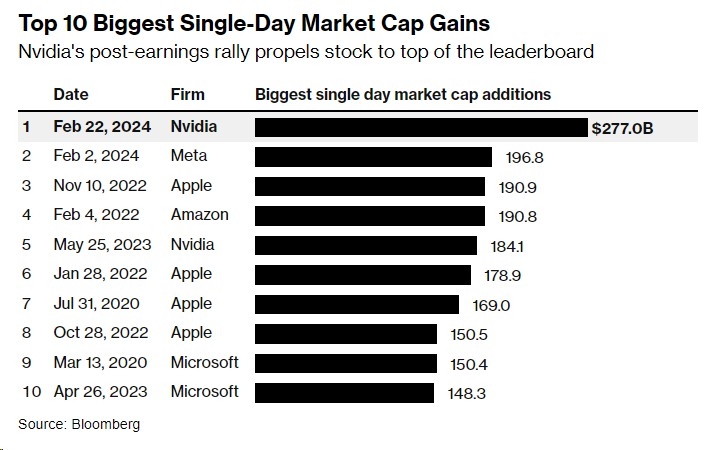

Comparison and Benchmarking: Investment market graphs allow investors to compare different assets or markets side by side. This helps in making informed decisions about which investments align with their investment goals.

Key Components of an Investment Market Graph

X-Axis: This axis typically represents time, showing the progression of days, weeks, or months.

Y-Axis: The Y-axis displays the values of the data points being analyzed, such as stock prices, trading volume, or market capitalization.

Data Points: These are the individual values that are plotted on the graph. For example, stock prices or trading volumes can be used as data points.

Charts and Graph Types: Common types include line graphs, bar charts, and candlestick charts, each providing different insights into market trends.

Case Studies:

Apple Stock Price: By analyzing Apple's stock price graph, investors can identify significant price movements and understand the factors that influence the stock's performance.

Bitcoin Volatility: The graph of Bitcoin's price volatility over time can help investors gauge the cryptocurrency's risk profile and make informed investment decisions.

Best Practices for Using Investment Market Graphs

Consistency: Use consistent time frames and data points when analyzing market graphs to ensure accurate comparisons.

Multiple Perspectives: Consider using different types of graphs to gain a comprehensive understanding of market trends.

Correlation Analysis: Look for correlations between different market indicators to identify potential investment opportunities.

Conclusion

Understanding the investment market graph is a vital skill for any investor looking to navigate the complex world of financial markets. By analyzing trends, assessing risks, and making informed decisions, investors can achieve greater success in their investment endeavors. Remember, the key to success is continuous learning and staying updated with the latest market insights.

us flag stock