Share Market Review: Key Insights and Analysis for 2023

author:US stockS -

The stock market is a dynamic and complex arena where investors seek to maximize their returns. As we delve into the share market review for 2023, it's crucial to understand the key insights and trends that have shaped the market. This article aims to provide a comprehensive overview of the share market, highlighting significant developments and offering valuable analysis.

Market Performance Overview

In 2023, the share market has experienced a mix of growth and volatility. The year started with a strong rally, driven by positive economic indicators and optimistic investor sentiment. However, the market faced several challenges, including geopolitical tensions and rising inflation, which led to periods of uncertainty and volatility.

Key Trends and Insights

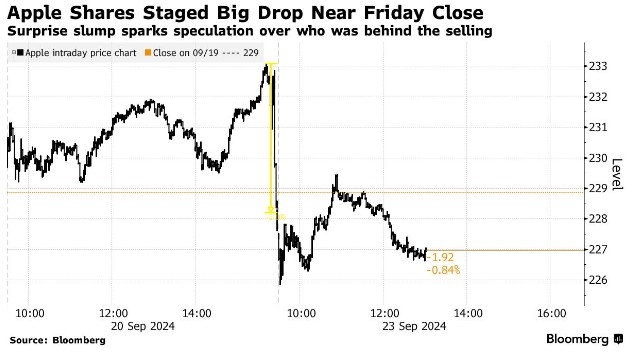

Technology Sector Dominance: The technology sector has remained a key driver of market growth, with leading companies like Apple, Amazon, and Microsoft continuing to deliver impressive results. Investors have been flocking to these tech giants, attracted by their strong fundamentals and potential for future growth.

Rising Inflation Concerns: Inflation has been a major concern for investors in 2023. Central banks around the world have been raising interest rates to combat inflation, which has led to increased volatility in the share market.

ESG Investing Gaining Traction: Environmental, Social, and Governance (ESG) investing has gained significant traction in recent years. More investors are considering the impact of their investments on the environment and society, leading to a rise in ESG-focused funds and companies.

Impact of Geopolitical Tensions: Geopolitical tensions, particularly between major economies, have added to market uncertainty. Investors need to be aware of the potential risks associated with geopolitical events and their impact on the share market.

Case Study: Tesla's Stock Performance

A notable example of market dynamics is Tesla's stock performance. The electric vehicle manufacturer has experienced a rollercoaster ride in 2023. Despite facing production challenges and regulatory hurdles, Tesla's stock has remained resilient, driven by strong demand for its products and long-term growth prospects.

Investment Strategies for 2023

Given the current market landscape, investors should consider the following strategies:

Diversification: Diversifying your portfolio can help mitigate risks associated with market volatility.

Focus on Quality: Investing in high-quality companies with strong fundamentals can provide stability and long-term growth.

Monitor Economic Indicators: Keeping an eye on economic indicators, such as inflation and interest rates, can help you make informed investment decisions.

Stay Informed: Staying updated with market trends and news can help you identify potential opportunities and risks.

In conclusion, the share market review for 2023 highlights the importance of understanding key trends and making informed investment decisions. By staying informed and adopting a strategic approach, investors can navigate the complexities of the share market and achieve their financial goals.

us flag stock