Nasdaq Futures: A CNBC Deep Dive

author:US stockS -

In the ever-evolving world of financial markets, staying ahead of the curve is crucial. One of the key indicators that traders and investors watch closely is the Nasdaq futures, as reported by CNBC. This article provides an in-depth analysis of what Nasdaq futures are, how they are traded, and their significance in the global financial landscape.

Understanding Nasdaq Futures

Firstly, let's define what Nasdaq futures are. Nasdaq futures are financial contracts that allow investors to speculate on the future price of the Nasdaq-100 index, which tracks the performance of the 100 largest non-financial companies listed on the Nasdaq Stock Market. These futures are traded on the Chicago Mercantile Exchange (CME) and are a popular tool for hedging and speculation.

Trading Nasdaq Futures

Trading Nasdaq futures is relatively straightforward. Investors can buy or sell these contracts based on their market outlook. For example, if an investor expects the Nasdaq-100 index to rise, they can buy a Nasdaq futures contract. Conversely, if they anticipate a decline, they can sell a contract. The value of these contracts is based on the current price of the underlying index.

Significance of Nasdaq Futures

The Nasdaq futures, as reported by CNBC, play a crucial role in the global financial markets. Here are a few key reasons why they are so important:

Market Sentiment Indicator: The movement of Nasdaq futures can provide valuable insights into market sentiment. For instance, a surge in Nasdaq futures may indicate optimism in the tech sector, while a decline could signal concern.

Hedging Tool: Investors can use Nasdaq futures to protect their portfolios against market downturns. By taking a short position in Nasdaq futures, they can offset potential losses in their stock portfolios.

Speculation: Traders can speculate on the future direction of the Nasdaq-100 index by trading these futures. This can be a lucrative opportunity for those who have a keen understanding of market trends.

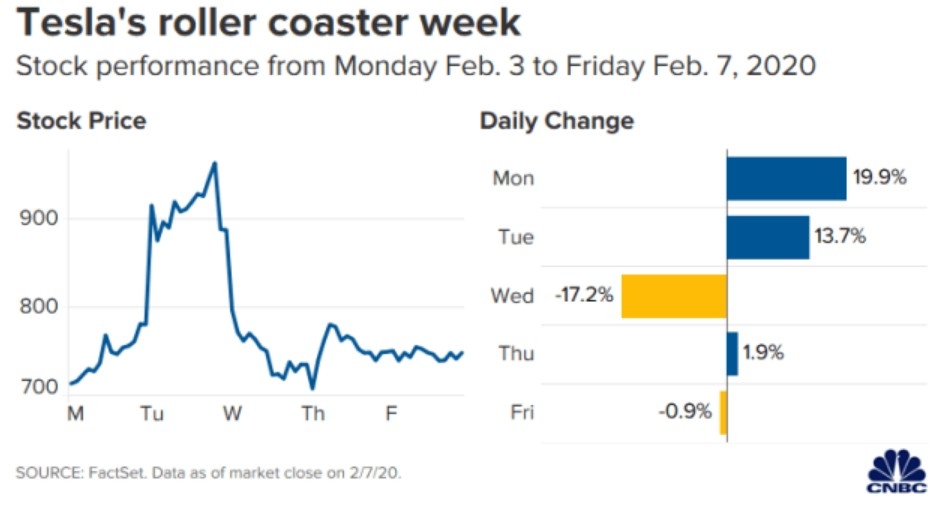

Case Study: Tesla and Nasdaq Futures

One notable example of the impact of Nasdaq futures is the case of Tesla, Inc. (TSLA). In 2020, Tesla's stock price surged significantly, and its inclusion in the Nasdaq-100 index was anticipated. As a result, Nasdaq futures for Tesla experienced a substantial increase in trading volume and price. This highlighted the importance of Nasdaq futures in anticipating market movements.

Conclusion

In conclusion, Nasdaq futures, as reported by CNBC, are a vital tool for investors and traders. By understanding the intricacies of these futures and their significance in the global financial landscape, investors can make informed decisions and stay ahead of market trends. Whether you are looking to hedge your portfolio or speculate on market movements, Nasdaq futures are a valuable asset in your trading arsenal.

us flag stock