How to Learn About the Stock Market: A Comprehensive Guide

author:US stockS -

Embarking on the journey to learn about the stock market can be both exhilarating and daunting. With the right approach, you can navigate this complex world and potentially reap significant financial rewards. This guide will walk you through the essential steps to understand the stock market and start making informed investment decisions.

Understanding the Basics

What is the Stock Market?

Before diving in, it’s crucial to have a clear understanding of what the stock market is. Simply put, it’s a platform where shares of public companies are bought and sold. When you purchase a stock, you become a partial owner of the company, and as the company grows, so does your share of the profits.

Key Terminology

To effectively navigate the stock market, you need to be familiar with some key terms:

- Stock: A share in a company’s ownership.

- Ticker Symbol: A unique identifier for a company’s stock, often three to five letters.

- Market Cap: The total value of a company’s shares outstanding, calculated by multiplying the stock price by the number of shares.

- Dividend: A portion of a company’s earnings paid out to shareholders.

- IPO: Initial Public Offering, the process by which a company goes public and offers its shares to the public for the first time.

Researching Companies

Evaluating Financial Statements

To make informed investment decisions, you need to evaluate a company’s financial health. This involves analyzing its balance sheet, income statement, and cash flow statement. These documents provide insights into a company’s assets, liabilities, revenues, expenses, and cash flows.

Understanding Industry Trends

It’s also important to research the industry in which a company operates. This involves analyzing industry trends, competition, and regulatory changes. By understanding the broader context, you can better assess a company’s future prospects.

Analyzing Stock Performance

Technical Analysis

Technical analysis involves analyzing historical stock price and volume data to predict future price movements. This approach uses various tools and indicators, such as moving averages, support and resistance levels, and candlestick patterns.

Fundamental Analysis

Fundamental analysis involves evaluating a company’s financial health and business prospects. This approach considers factors such as a company’s price-to-earnings ratio (P/E ratio), return on equity (ROE), and debt-to-equity ratio.

Building a Portfolio

Asset Allocation

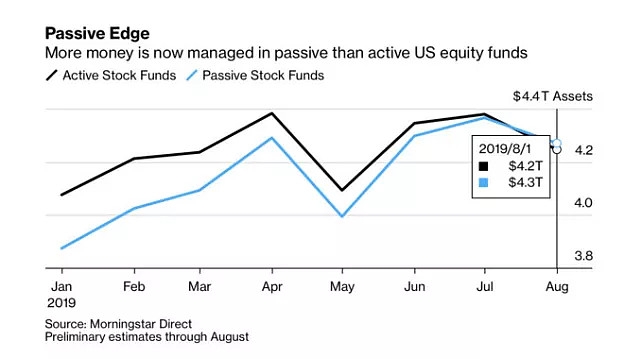

A well-diversified portfolio is essential for mitigating risk. Asset allocation involves dividing your investments among different asset classes, such as stocks, bonds, and real estate. This diversification can help protect your portfolio from market fluctuations.

Regular Rebalancing

Market conditions and your investment goals can change over time. Regularly rebalancing your portfolio ensures that it remains aligned with your risk tolerance and investment objectives.

Learning from Others

Following Experts

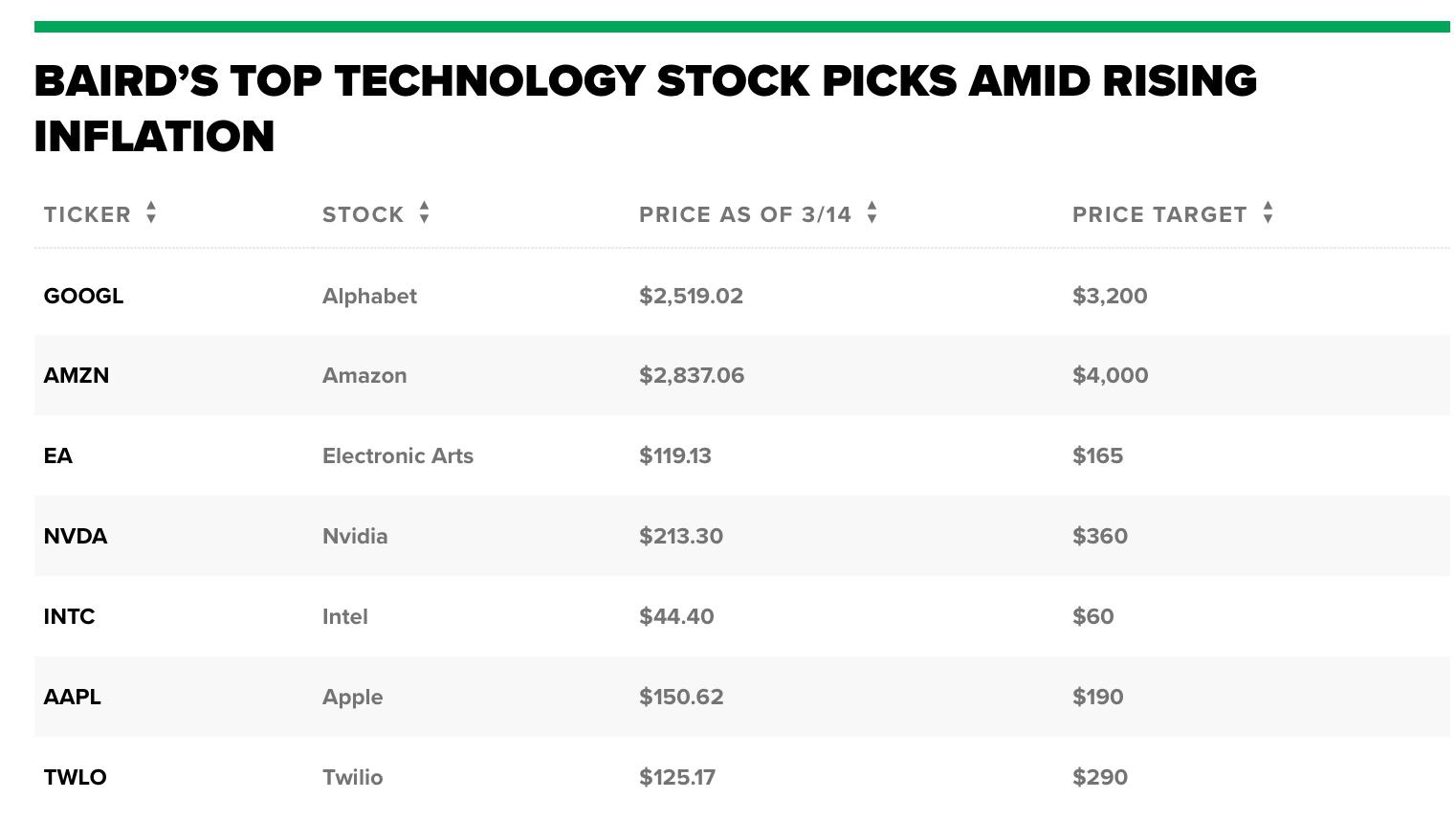

Following experienced investors and financial experts can provide valuable insights and guidance. Look for reputable sources such as financial news websites, podcasts, and blogs.

Joining Online Communities

Joining online communities can help you learn from others and stay updated on market trends. Platforms like Reddit and Twitter offer forums where investors share ideas and discuss market events.

Conclusion

Learning about the stock market requires dedication, research, and patience. By understanding the basics, analyzing companies, and building a diversified portfolio, you can improve your chances of success. Remember to stay informed, remain patient, and continuously educate yourself to stay ahead in this dynamic market.

us flag stock