50/50 Allocation: Balancing US and International Stocks

author:US stockS -Allocation(1)Balancing(1)Inter(1)and(4)

In the world of investing, diversification is key to mitigating risk and maximizing returns. One popular strategy is the 50/50 allocation, which divides investments equally between U.S. and international stocks. This balanced approach offers investors the chance to capitalize on both domestic and global market trends. In this article, we'll explore the benefits of a 50/50 allocation, discuss the factors to consider when investing in international stocks, and provide a few case studies to illustrate the strategy in action.

Understanding the 50/50 Allocation

A 50/50 allocation means that half of your investment portfolio is dedicated to U.S. stocks, while the other half is invested in international stocks. This balanced approach ensures that your portfolio is not overly dependent on any single market or sector. By spreading your investments across both U.S. and international markets, you can potentially benefit from the strengths of each while minimizing the impact of any downturns.

Benefits of a 50/50 Allocation

- Diversification: As mentioned earlier, a 50/50 allocation provides diversification, which can help reduce risk. By investing in both U.S. and international stocks, you're less likely to be negatively impacted by a downturn in any one market.

- Access to Diverse Opportunities: International stocks offer exposure to different industries, market conditions, and economies. This can lead to a wider range of investment opportunities and potentially higher returns.

- Potential for Higher Returns: Historically, international markets have offered higher returns than U.S. markets. By allocating a portion of your portfolio to international stocks, you may be able to increase your overall returns.

- Hedging Against Currency Fluctuations: Investing in international stocks can help hedge against currency fluctuations. When the U.S. dollar strengthens, international stocks may offer a cushion against potential losses in U.S.-based investments.

Factors to Consider When Investing in International Stocks

- Economic Stability: It's important to research the economic stability of the countries in which you're investing. Look for countries with strong economic growth, low inflation, and stable currencies.

- Political Stability: Political instability can have a significant impact on the stock market. Consider investing in countries with stable political systems and strong government institutions.

- Regulatory Environment: The regulatory environment can affect the performance of international stocks. Look for countries with favorable regulations for foreign investors.

- Currency Risk: Be aware of currency risk when investing in international stocks. Fluctuations in exchange rates can impact the value of your investments.

Case Studies

- Apple Inc. (AAPL): Apple, a U.S.-based company, has significant operations in China. By investing in Apple, investors can benefit from both the U.S. and international markets.

- Baidu, Inc. (BIDU): Baidu is a Chinese internet company that has grown rapidly in recent years. Investing in Baidu can provide exposure to the fast-growing Chinese market.

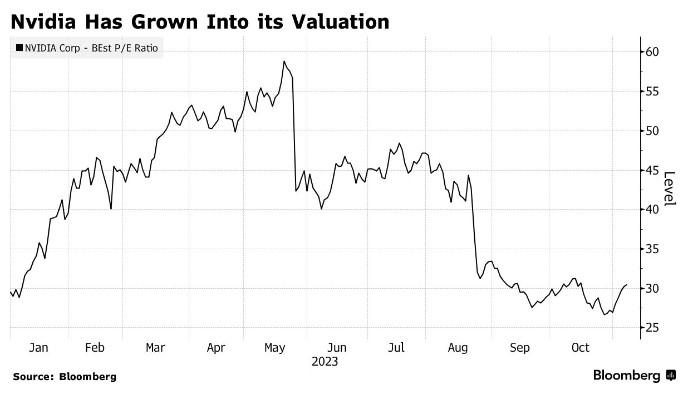

- NVIDIA Corporation (NVDA): NVIDIA is a U.S.-based company that has a significant presence in the European market. Investing in NVIDIA can offer exposure to both the U.S. and European markets.

In conclusion, a 50/50 allocation between U.S. and international stocks can be an effective strategy for diversifying your investment portfolio. By considering the benefits and factors to consider when investing in international stocks, you can make informed decisions and potentially achieve higher returns.

us flag stock