Unlocking the Potential of Investing in US Stocks

author:US stockS -

In the vast and dynamic world of global investments, the United States stock market stands out as a beacon for investors seeking growth and stability. With a rich history and a diverse range of industries, investing in US stocks can be a strategic move for both seasoned investors and newcomers alike. This article delves into the intricacies of investing in US stocks, providing valuable insights and highlighting key considerations for those looking to tap into this lucrative market.

Understanding the US Stock Market

The US stock market, primarily composed of the New York Stock Exchange (NYSE) and the NASDAQ, is one of the most significant financial markets in the world. It is home to some of the most well-known and influential companies across various sectors, including technology, healthcare, finance, and consumer goods.

Key Benefits of Investing in US Stocks

Diversification Opportunities: US stocks offer a wide range of investment opportunities, allowing investors to diversify their portfolios and mitigate risks associated with investing in a single stock or sector.

Market Liquidity: The US stock market is known for its high liquidity, making it easier for investors to buy and sell stocks without significantly impacting their prices.

Potential for Growth: Many US companies have a history of strong performance and innovation, offering investors the potential for substantial growth over time.

Regulatory Framework: The US has a robust regulatory framework that protects investors and ensures fair trading practices.

How to Invest in US Stocks

Investing in US stocks can be done through various methods, including:

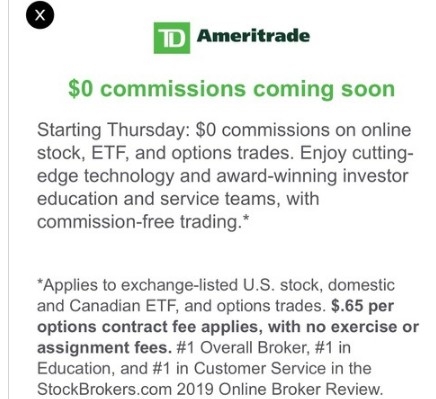

Brokerage Accounts: Investors can open a brokerage account with a reputable brokerage firm to buy and sell stocks.

Direct Investment: Some US companies allow investors to purchase their stocks directly through their investor relations websites.

Mutual Funds and ETFs: Investors can gain exposure to the US stock market through mutual funds and exchange-traded funds (ETFs), which offer diversification and professional management.

Key Considerations for Investing in US Stocks

Research and Due Diligence: It is crucial to conduct thorough research and due diligence before investing in any stock. This includes analyzing financial statements, understanding the company's business model, and assessing its competitive position.

Risk Management: Investors should understand their risk tolerance and invest accordingly. This may involve diversifying their portfolio and setting realistic investment goals.

Market Trends: Keeping abreast of market trends and economic indicators can help investors make informed decisions.

Case Studies

Apple Inc.: As one of the most valuable companies in the world, Apple has consistently delivered strong returns to its investors. Its focus on innovation and consumer electronics has solidified its position as a market leader.

Tesla Inc.: Tesla's rapid growth in the electric vehicle market has captured the attention of investors. Its commitment to sustainable energy and technological advancements has led to significant stock price increases.

Conclusion

Investing in US stocks can be a rewarding endeavor, offering a blend of growth potential and stability. By understanding the market, conducting thorough research, and managing risks effectively, investors can unlock the full potential of the US stock market. Whether you are a seasoned investor or just starting out, exploring the opportunities presented by US stocks is a step towards building a robust and diversified investment portfolio.

newsbreak stock