Historic Stock Price: Understanding the Past to Predict the Future

author:US stockS -

In the world of investing, the historic stock price is a critical factor that can offer invaluable insights into a company's performance and potential. By examining past stock prices, investors can gain a deeper understanding of market trends, company fundamentals, and overall market sentiment. This article delves into the significance of historic stock prices, their impact on investment decisions, and how to effectively utilize this data.

The Significance of Historic Stock Prices

Historic stock prices provide a wealth of information that can be used to analyze market trends and make informed investment decisions. By studying the past, investors can identify patterns, cycles, and market anomalies that may influence future stock prices.

1. Identifying Market Trends

One of the primary uses of historic stock prices is to identify market trends. By examining the stock price history of a particular company or the broader market, investors can observe trends such as upward or downward movements, volatility, and periods of consolidation.

2. Assessing Company Fundamentals

Historic stock prices can also be used to assess a company's fundamentals. By comparing the stock price history with key financial metrics such as earnings per share (EPS), revenue, and price-to-earnings (P/E) ratio, investors can gain insights into a company's performance and growth potential.

3. Analyzing Market Sentiment

The historic stock price can reflect market sentiment. For example, a sudden spike in stock price may indicate strong investor confidence, while a sharp decline may suggest negative sentiment or concerns about the company's future prospects.

4. Predicting Future Stock Prices

While past performance is not always indicative of future results, analyzing historic stock prices can help investors predict future stock prices. By identifying patterns and trends, investors can make more informed decisions about when to buy, sell, or hold a particular stock.

Utilizing Historic Stock Price Data

To effectively utilize historic stock price data, investors should consider the following:

Data Sources: Investors can access historic stock price data from various sources, including financial websites, stock exchanges, and investment platforms. Ensure that the data source is reliable and provides accurate information.

Time Period: When analyzing historic stock prices, consider different time periods, such as monthly, quarterly, or annually. This will help you identify long-term trends and patterns.

Technical Analysis: Utilize technical analysis tools, such as moving averages, oscillators, and chart patterns, to gain further insights into market trends and potential price movements.

Fundamental Analysis: Combine historic stock price data with fundamental analysis to assess a company's financial health and growth potential.

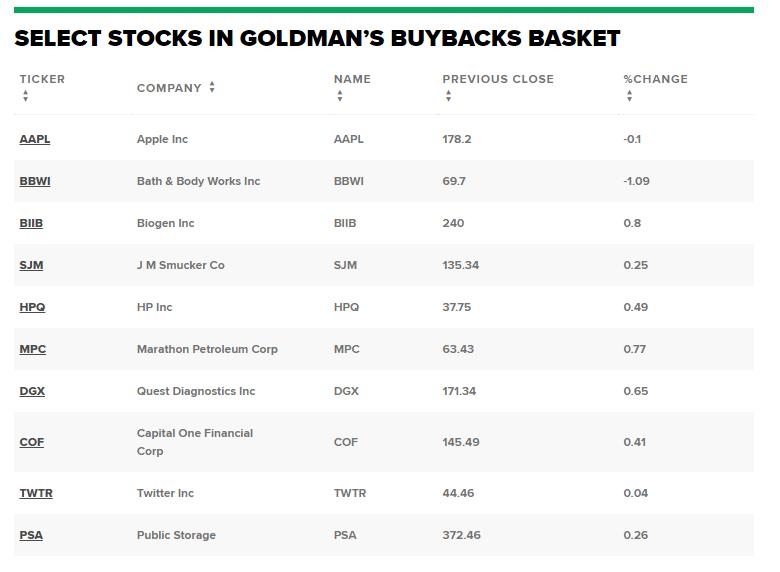

Case Study: Apple Inc. (AAPL)

Consider the case of Apple Inc. (AAPL). By examining its historic stock price, investors can observe several trends:

Long-term Growth: Over the past decade, Apple's stock price has consistently risen, reflecting the company's strong fundamentals and market dominance.

Volatility: While the stock price has experienced periods of volatility, it has generally maintained a strong upward trend.

Market Sentiment: Sudden spikes in the stock price, such as in 2020, may indicate strong investor confidence and market sentiment.

By analyzing Apple's historic stock price, investors can gain valuable insights into the company's performance and potential future movements.

In conclusion, understanding and analyzing historic stock prices is a crucial component of successful investing. By examining past performance, market trends, and company fundamentals, investors can make more informed decisions and potentially achieve better returns.

newsbreak stock