Free Stock Tips: Your Ultimate Guide to Investment Success

author:US stockS -

Are you looking to get started in the stock market but unsure where to turn for reliable advice? Don't worry; you're not alone. With the vast amount of information available, it can be overwhelming to determine which free stock tips are worth following. In this article, we'll explore the best free stock tips to help you make informed investment decisions and achieve financial success.

1. Start with a Strong Foundation: Educate Yourself

Before diving into the stock market, it's crucial to understand the basics. Familiarize yourself with terms like "stock," "bond," "ETF," and "dividend." You can find numerous free resources online, including articles, videos, and podcasts that provide valuable insights into investment fundamentals.

2. Diversify Your Portfolio

Diversification is key to managing risk and maximizing returns. Instead of putting all your money into a single stock, consider investing in a mix of assets, such as stocks, bonds, and ETFs. This approach ensures that if one investment underperforms, others may help offset the loss.

3. Focus on Companies with Strong Financials

When researching free stock tips, pay attention to a company's financial health. Look for companies with solid revenue growth, strong profit margins, and manageable debt levels. Some key metrics to consider include return on equity (ROE), price-to-earnings (P/E) ratio, and debt-to-equity ratio.

4. Keep an Eye on Market Trends

Monitoring market trends can provide valuable insights into which sectors and stocks are likely to perform well. For example, the technology sector has seen significant growth in recent years, driven by companies like Apple and Microsoft. However, it's essential to stay informed about potential risks and market downturns.

5. Follow Industry Experts and Analysts

Many experts and analysts provide free stock tips and recommendations. While it's important to do your own research, following industry leaders can offer a wealth of knowledge. Some popular sources include The Motley Fool, Seeking Alpha, and Wall Street Journal.

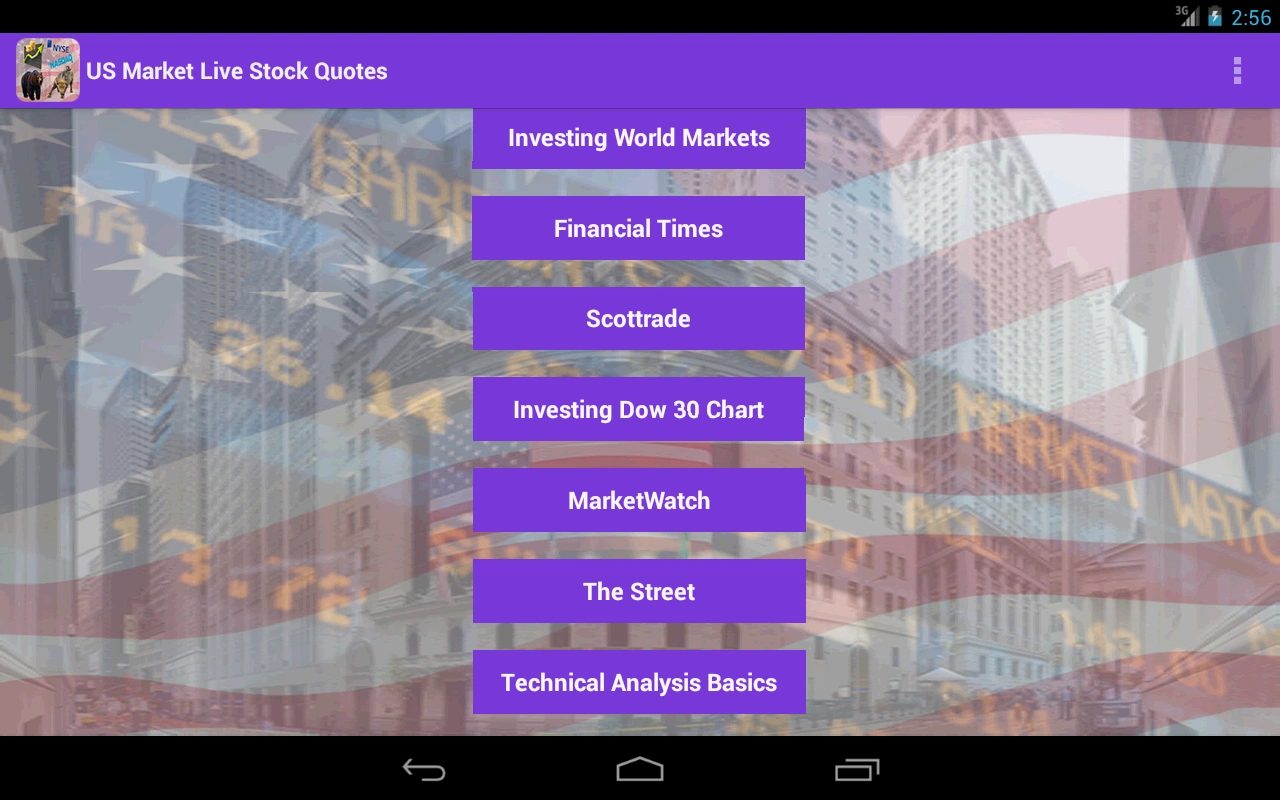

6. Utilize Free Stock Screening Tools

Free stock screening tools can help you identify potential investments that meet specific criteria, such as market capitalization, industry, and financial metrics. Websites like Finviz and Yahoo Finance offer a variety of screening tools to help you narrow down your search.

7. Stay Disciplined and Patient

The stock market can be unpredictable, and it's essential to stay disciplined and patient. Avoid making impulsive decisions based on short-term market movements. Instead, focus on your long-term investment goals and stick to your strategy.

8. Case Study: Apple Inc. (AAPL)

Apple Inc. (AAPL) has been a strong performer over the years, providing investors with substantial returns. By focusing on free stock tips that highlighted the company's strong financials and market position, investors were able to capitalize on this growth. For example, in 2018, Apple's stock price surged after it reported strong revenue and earnings growth, driven by increased demand for its products, such as the iPhone and iPad.

9. Case Study: Microsoft Corporation (MSFT)

Microsoft Corporation (MSFT) has also been a solid investment over the years, with a consistent track record of growth. By following free stock tips that emphasized the company's strong financials and market position, investors were able to benefit from Microsoft's expansion into new markets, such as cloud computing and gaming.

In conclusion, utilizing free stock tips can help you make informed investment decisions and achieve financial success. By educating yourself, diversifying your portfolio, and staying disciplined, you can navigate the stock market with confidence. Remember to conduct your own research and stay informed about market trends to make the best possible investment choices.

newsbreak stock