Unlocking the Future: A Deep Dive into Stock Market Futures

author:US stockS -

In today's fast-paced financial world, understanding stock market futures is more crucial than ever. These financial instruments allow investors to speculate on future stock prices, hedge risks, and potentially capitalize on market movements. This article delves into the intricacies of stock market futures, their role in investment strategies, and the importance of staying informed to make sound investment decisions.

What are Stock Market Futures?

Stock market futures are agreements between two parties to buy or sell a financial instrument at a predetermined price on a specified future date. These contracts are standardized, regulated, and traded on exchanges. They are often used for speculative purposes or as a hedge against market risks.

The Benefits of Investing in Stock Market Futures

Hedging Risks: Hedging is a strategy used to protect investments from adverse market movements. By entering into a futures contract, investors can lock in a price for a future transaction, thereby protecting themselves from potential price fluctuations.

Speculative Opportunities: Investors who anticipate market movements can use futures contracts to profit from price changes. For instance, if an investor believes a particular stock will increase in value, they can purchase a futures contract to make a profit if the price rises.

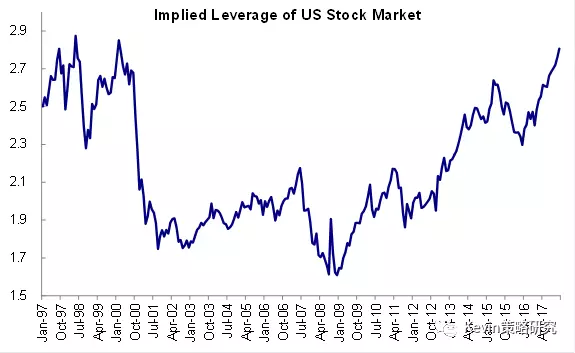

Leverage: Leverage is the ability to control a large position with a small amount of capital. Futures contracts provide high leverage, which can amplify gains but also increase risks.

Understanding the Mechanics of Stock Market Futures

Pricing: The price of a futures contract is influenced by various factors, including supply and demand, market expectations, and underlying asset performance.

Margin Requirements: To enter into a futures contract, investors must deposit margin, which is a portion of the contract value. This margin serves as collateral and can be withdrawn once the contract is closed.

Expiration: Each futures contract has an expiration date, after which it is settled. Settlement can occur through physical delivery or by closing out the position in the market.

Key Risks of Investing in Stock Market Futures

Liquidity Risk: Some futures contracts may be less liquid, making it challenging to buy or sell them without impacting the price.

Counterparty Risk: There is a risk that the counterparty to the futures contract may default, particularly in less regulated markets.

Market Risk: The price of a futures contract can be highly volatile, leading to significant gains or losses.

Case Study: The 2008 Financial Crisis and Stock Market Futures

The 2008 financial crisis serves as a stark reminder of the power of stock market futures. The crisis began with the subprime mortgage market collapse, which caused a ripple effect through the global financial system. Many futures contracts tied to financial instruments like mortgage-backed securities lost significant value, leading to massive losses for investors.

Conclusion

Investing in stock market futures can be a powerful tool for investors seeking to hedge risks, speculate on market movements, or leverage their investments. However, it is crucial to understand the mechanics, risks, and benefits associated with these contracts. By staying informed and disciplined, investors can navigate the complexities of the futures market and potentially achieve their investment goals.

newsbreak stock