Can You Hold Us Stocks in TFSA? Understanding the Possibilities

author:US stockS -

In the world of personal finance, Tax-Free Savings Accounts (TFSA) have emerged as a popular choice for investors looking to grow their wealth while minimizing taxes. One of the most common questions among investors is whether they can hold stocks within their TFSA. In this article, we delve into the intricacies of TFSA and stocks, providing you with the knowledge to make informed decisions about your investment strategy.

What is a TFSA?

A TFSA is a registered account that allows individuals to save and invest money tax-free. Contributions to a TFSA are not tax-deductible, but any earnings, including interest, dividends, and capital gains, are not taxed when withdrawn. This makes it an attractive option for long-term savings and investment growth.

Can You Hold Stocks in a TFSA?

The answer is a resounding yes. Stocks are one of the most popular investments within a TFSA. In fact, many investors choose to hold a mix of stocks, bonds, and other assets to create a diversified portfolio. Here are some key points to consider when holding stocks in a TFSA:

1. Tax-Free Growth

One of the primary benefits of holding stocks in a TFSA is the tax-free growth. Since earnings are not taxed when withdrawn, you can potentially grow your investment without the worry of future tax liabilities.

2. Diversification

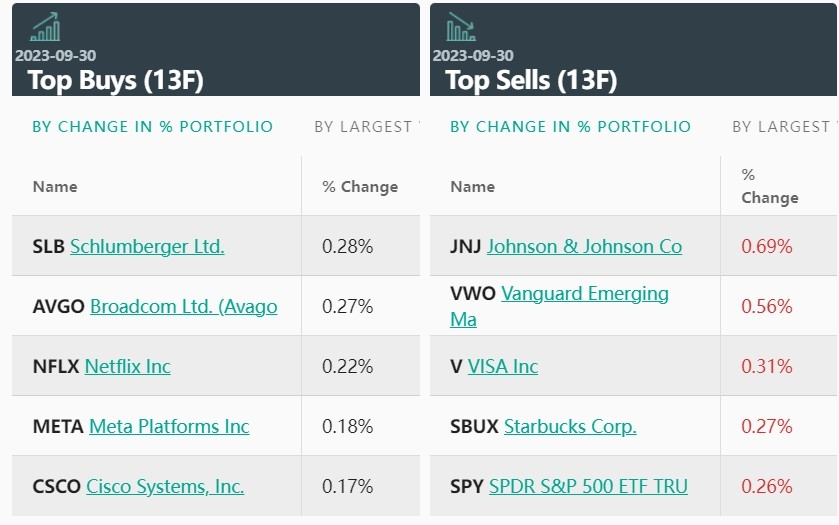

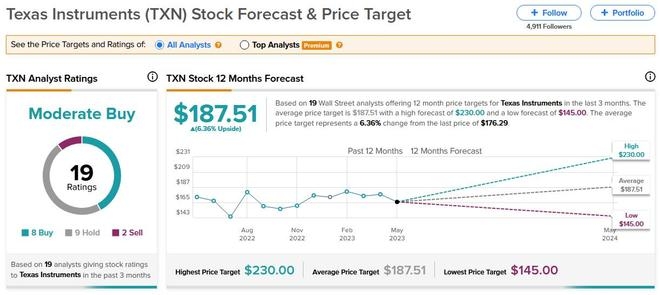

Diversifying your portfolio within a TFSA can help mitigate risk. By investing in a variety of stocks across different sectors and industries, you can reduce the impact of market fluctuations on your overall investment.

3. Access to a Wide Range of Stocks

TFSA holders have access to a wide range of stocks, including those listed on major exchanges such as the New York Stock Exchange (NYSE) and the Toronto Stock Exchange (TSX). This allows you to invest in both domestic and international companies.

4. Potential for High Returns

Historically, stocks have provided higher returns compared to other investment vehicles. By holding stocks in a TFSA, you can potentially maximize your investment growth over the long term.

5. Flexibility

One of the advantages of a TFSA is its flexibility. You can buy and sell stocks within your account without any tax implications, as long as you do not withdraw the funds prematurely.

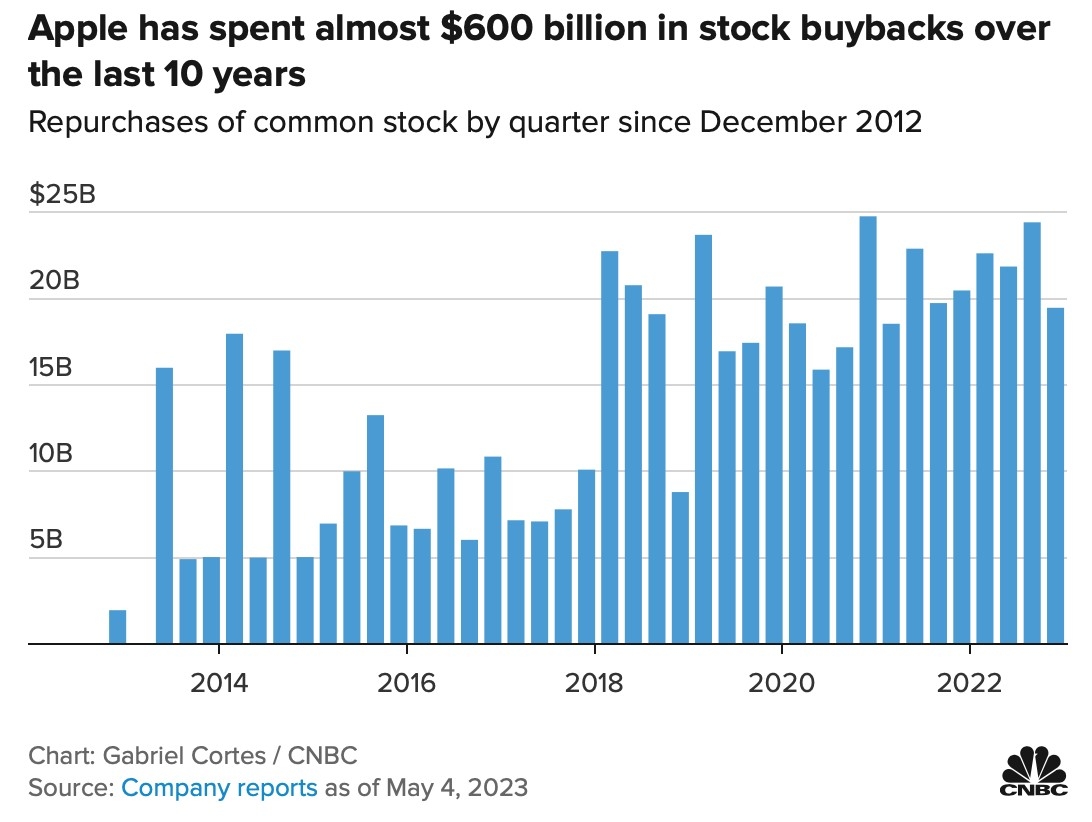

Case Study: Investing in Tech Stocks

Let's consider a hypothetical scenario where an investor decides to allocate a portion of their TFSA to tech stocks. By investing in companies like Apple, Microsoft, and Amazon, the investor can benefit from the strong growth potential of the tech industry. Assuming the investor holds these stocks for the long term, they may see significant gains within their TFSA, thanks to the tax-free nature of the account.

Conclusion

In conclusion, holding stocks in a TFSA is a viable and attractive option for investors looking to grow their wealth while minimizing taxes. With the potential for tax-free growth, diversification, and access to a wide range of stocks, a TFSA can be a valuable tool in your investment strategy. Remember to consult with a financial advisor to ensure that your investment decisions align with your financial goals and risk tolerance.

newsbreak stock