Bank Stocks: A US Perspective on Investment Opportunities

author:US stockS -

Introduction

The world of finance is vast and ever-changing, with countless investment opportunities available. One area that has consistently captured the interest of investors is the banking sector. Specifically, bank stocks in the United States have become a popular choice for many investors seeking growth and stability. This article will delve into the intricacies of bank stocks in the US, exploring their potential and providing insights for investors looking to capitalize on this sector.

Understanding Bank Stocks

Bank stocks represent ownership in a financial institution that provides a range of services, including deposits, loans, and investments. Investing in bank stocks means becoming a shareholder in a bank, thereby allowing investors to benefit from the bank's success through dividends and potential capital gains.

Key Factors to Consider When Investing in Bank Stocks

Economic Conditions: The performance of bank stocks is closely tied to the broader economic conditions. During periods of economic growth, banks tend to thrive, as demand for loans increases. Conversely, during economic downturns, bank stocks may face challenges due to rising defaults on loans.

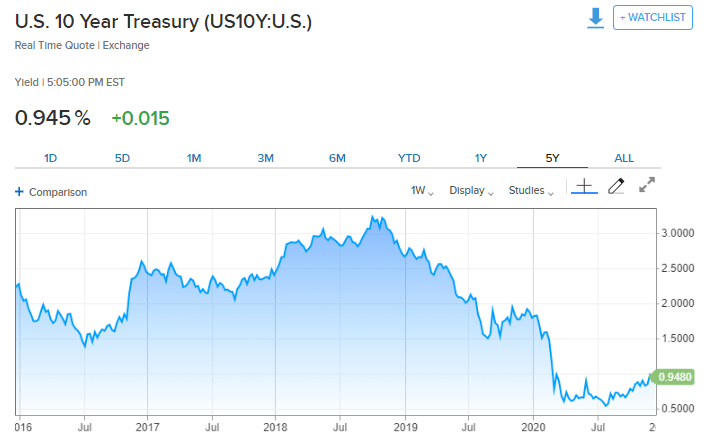

Interest Rates: Interest rates play a crucial role in the profitability of banks. Higher interest rates can lead to increased net interest margins, while lower interest rates may compress these margins. Investors should closely monitor changes in interest rates to assess the potential impact on their investments.

Regulatory Environment: The regulatory environment in which banks operate can significantly impact their performance. Changes in regulations, such as banking laws and capital requirements, can affect a bank's profitability and growth prospects.

Top Bank Stocks in the US

Several bank stocks have stood out in the US market, offering promising investment opportunities. Here are some notable examples:

JPMorgan Chase & Co. (JPM): As one of the largest banks in the US, JPMorgan Chase offers a diverse range of financial services. The bank has a strong track record of profitability and has consistently paid dividends to its shareholders.

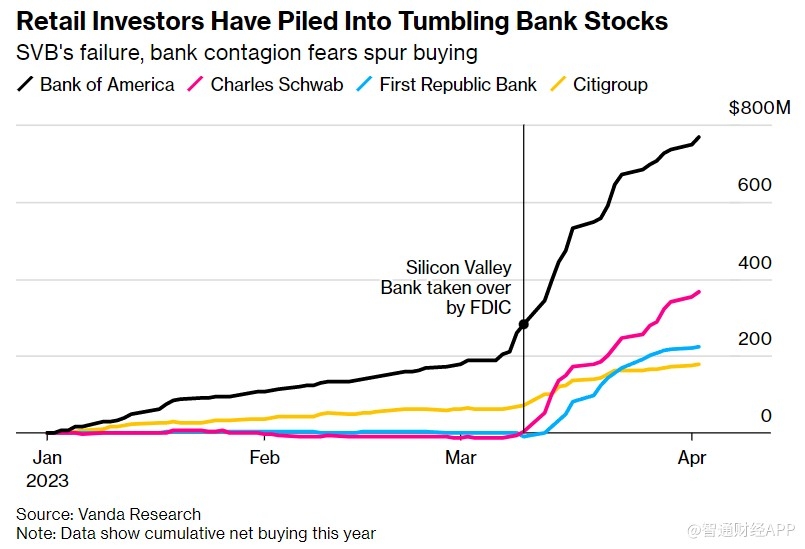

Bank of America Corporation (BAC): Bank of America is another leading financial institution with a robust portfolio of services. The bank has been focused on improving its efficiency and profitability, making it an attractive investment for many investors.

Wells Fargo & Company (WFC): While Wells Fargo has faced challenges in recent years, the bank remains a significant player in the US banking industry. Its diverse business lines and commitment to innovation make it a compelling investment opportunity.

Case Study: JPMorgan Chase & Co.

Let's take a closer look at JPMorgan Chase & Co. to understand the potential of bank stocks in the US. Over the past five years, JPMorgan Chase has delivered strong financial performance, with a consistent increase in earnings per share and dividends. The bank's robust balance sheet and diversified business lines have contributed to its resilience in the face of economic uncertainties.

Conclusion

Investing in bank stocks can be a lucrative venture for those willing to conduct thorough research and stay informed about market trends. While the banking sector is subject to various risks, including economic downturns and regulatory changes, the potential rewards make it a compelling area for investment. As the US economy continues to grow, bank stocks are expected to remain a key component of diversified investment portfolios.

newsbreak stock