Canadian TFSA: Investing in US Stocks - A Comprehensive Guide

author:US stockS -

Are you a Canadian investor looking to expand your portfolio with U.S. stocks? If so, a Tax-Free Savings Account (TFSA) is an excellent way to do so. In this guide, we'll explore how to invest in U.S. stocks within a Canadian TFSA, the benefits of doing so, and some tips to help you get started.

Understanding the TFSA

A Tax-Free Savings Account is a tax-advantaged savings account available to Canadian residents. Contributions are not tax-deductible, but the earnings and withdrawals are tax-free. This makes it an ideal vehicle for long-term savings and investment growth.

Investing in U.S. Stocks within a TFSA

To invest in U.S. stocks within your TFSA, you have several options:

- Brokers: Many Canadian brokers offer access to U.S. stocks within a TFSA. This allows you to buy and sell U.S. stocks directly through your brokerage account.

- Exchange-Traded Funds (ETFs): ETFs are a popular way to invest in U.S. stocks. They are traded on exchanges like stocks and offer diversification, lower fees, and easier access to U.S. markets.

- Mutual Funds: Some mutual funds allow you to invest in U.S. stocks within a TFSA. These funds are managed by professionals and offer diversification, but they may come with higher fees.

Benefits of Investing in U.S. Stocks within a TFSA

- Diversification: Investing in U.S. stocks can provide diversification to your portfolio, reducing your exposure to Canadian market risks.

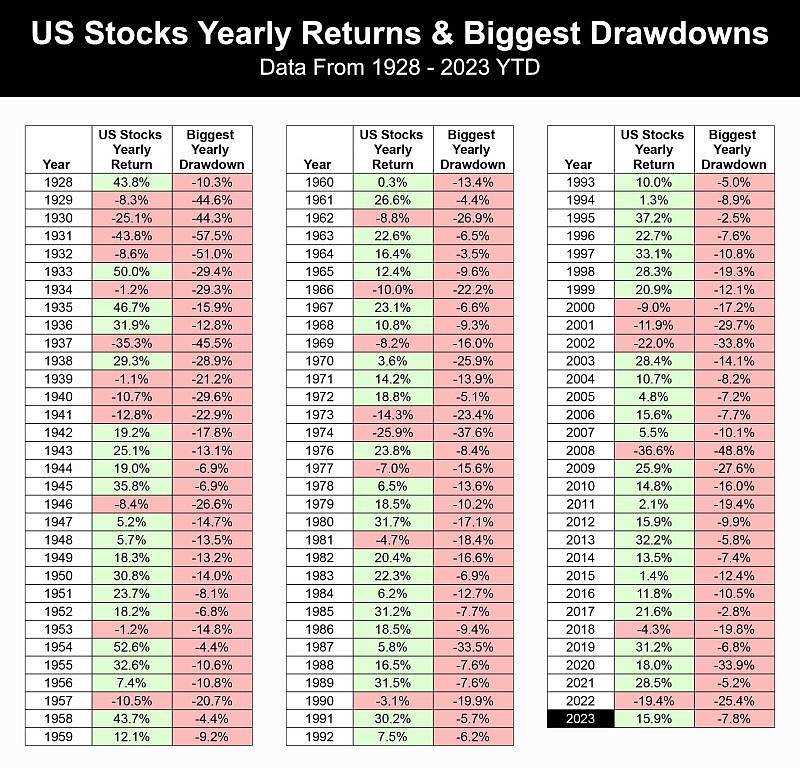

- Growth Potential: The U.S. stock market has historically offered higher returns compared to the Canadian market. Investing in U.S. stocks can help you achieve higher growth potential.

- Tax Efficiency: Since TFSAs offer tax-free growth, investing in U.S. stocks within your TFSA can help maximize your returns.

Tips for Investing in U.S. Stocks within a TFSA

- Research and Education: Educate yourself on the U.S. market and individual companies before investing. This will help you make informed decisions and reduce your risk.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversify your TFSA by investing in a mix of U.S. stocks, ETFs, and mutual funds.

- Monitor Your Investments: Regularly review your investments and make adjustments as needed. This will help you stay on track with your investment goals.

Case Study: Investing in U.S. Stocks through ETFs

Suppose you have a $10,000 TFSA and decide to invest in a U.S. stock ETF. This ETF holds a diversified portfolio of U.S. stocks, including companies like Apple, Amazon, and Microsoft.

After one year, your investment grows to $12,000, resulting in a 20% return. Since your investment is within a TFSA, this growth is tax-free. This example illustrates the potential benefits of investing in U.S. stocks within your TFSA.

Conclusion

Investing in U.S. stocks within a Canadian TFSA can be a great way to diversify your portfolio, achieve higher growth potential, and enjoy tax-free growth. By understanding your options, conducting research, and staying diversified, you can successfully invest in U.S. stocks within your TFSA.

us stock market today live cha