Are Higher Stock Prices Good for Us?

author:US stockS -

In the volatile world of the stock market, higher stock prices often spark debate. Are they a sign of a thriving economy or a bubble about to burst? This article delves into the various perspectives and provides insights into whether higher stock prices are truly beneficial for us.

Understanding Stock Prices

Firstly, it's essential to understand that stock prices reflect the market's perception of a company's value. When stock prices rise, it typically means investors believe the company is performing well or has potential for growth. Conversely, falling stock prices may indicate a decline in the company's performance or future prospects.

The Benefits of Higher Stock Prices

Increased Wealth for Investors: Higher stock prices mean more money for investors when they sell their shares. This can lead to increased wealth and financial security.

Encouragement for Innovation and Growth: Companies with higher stock prices often have more capital to invest in research and development, expansion, and other growth initiatives. This can lead to improved products, increased market share, and job creation.

Attracting Foreign Investment: Higher stock prices can make a country's stock market more attractive to foreign investors. This influx of capital can stimulate economic growth and create jobs.

The Risks of Higher Stock Prices

Bubble Formation: When stock prices rise too rapidly, it can create a bubble. A bubble is an unsustainable increase in asset prices driven by excessive optimism and speculation. When the bubble bursts, it can lead to significant financial losses.

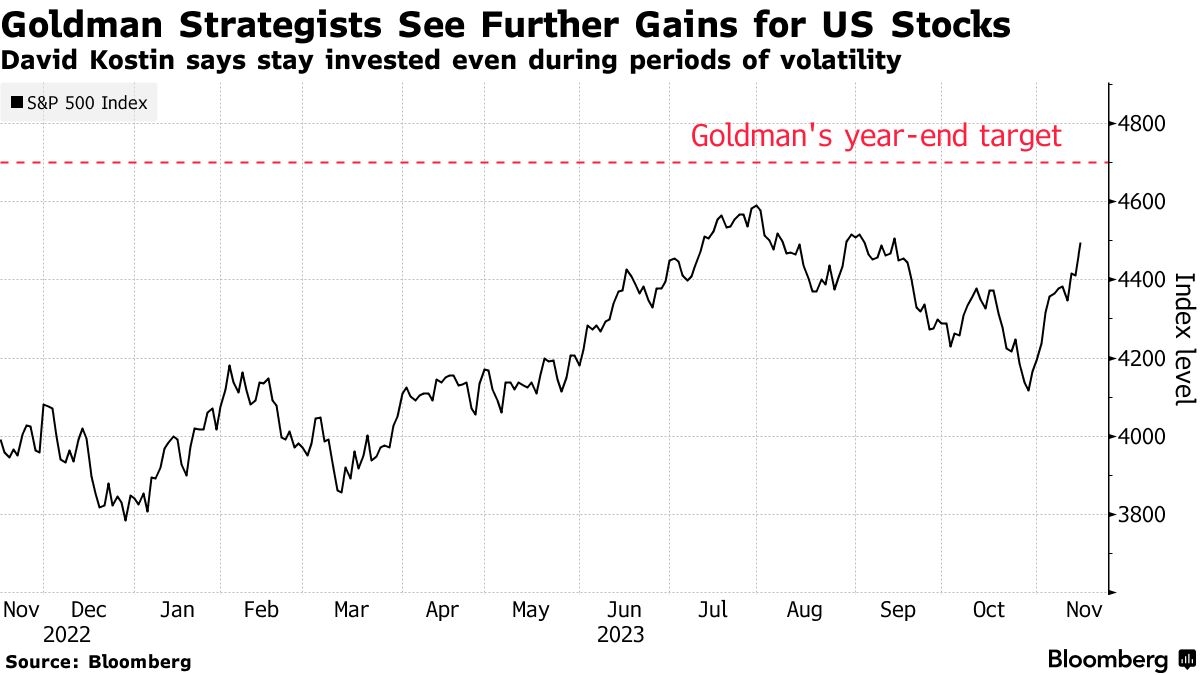

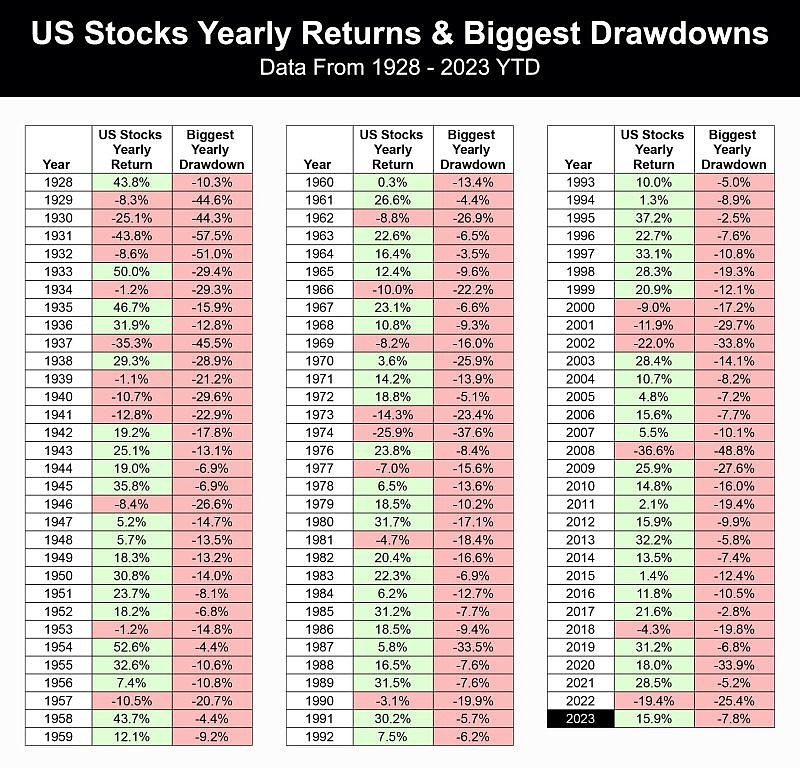

Market Volatility: Higher stock prices can lead to increased market volatility. This can make it challenging for investors to predict market trends and make informed decisions.

Income Inequality: If stock prices are rising primarily due to speculative bubbles, it can exacerbate income inequality. Wealthier individuals and institutions may benefit disproportionately, while others may miss out on the potential gains.

Case Study: The Dot-Com Bubble

One of the most famous examples of a stock market bubble is the dot-com bubble of the late 1990s. During this period, stock prices of technology companies skyrocketed, driven by speculative investment and excessive optimism. However, when the bubble burst in 2000, many investors lost significant amounts of money.

Conclusion

Higher stock prices can have both positive and negative implications. While they can lead to increased wealth and economic growth, they also carry risks such as bubble formation and market volatility. As investors, it's crucial to remain vigilant and make informed decisions based on thorough research and analysis.

us stock market today live cha