Is the Market Still Crashing?

author:US stockS -

The stock market's volatility has been a topic of concern for investors and analysts alike. With the recent downturn, many are asking: "Is the market still crashing?" This article delves into the current state of the market, analyzing factors contributing to the volatility and offering insights into the future of the market.

Understanding Market Crashes

A market crash refers to a significant decline in the value of financial assets, often characterized by a rapid and steep drop. The stock market has experienced several crashes throughout history, with the most notable being the 1929 Great Depression and the 2008 financial crisis.

Factors Contributing to Market Volatility

Economic Indicators: Economic indicators, such as GDP growth, inflation, and unemployment rates, play a crucial role in determining market trends. For instance, high inflation rates can lead to a decrease in purchasing power and, subsequently, a drop in stock prices.

Political Events: Political instability, such as elections, referendums, or international conflicts, can also impact the market. For example, the Brexit referendum in 2016 caused significant volatility in the global markets.

Technological Advancements: Technological advancements can disrupt industries and lead to a shift in market dynamics. Companies that fail to adapt to these changes may see their stock prices decline.

COVID-19 Pandemic: The COVID-19 pandemic has had a profound impact on the global economy and markets. The unprecedented lockdown measures, supply chain disruptions, and economic uncertainty have caused significant volatility.

Is the Market Still Crashing?

The short answer is no. The stock market has recovered from its lows in March 2020 and has seen a significant rebound. However, it is essential to understand that market volatility is a normal part of the investing process.

Insights into the Future of the Market

Economic Recovery: The global economy is expected to recover from the COVID-19 pandemic. As economies reopen, businesses will start to generate revenue, which could lead to a rise in stock prices.

Tech Sector: The tech sector has been a significant driver of market growth. Companies like Apple, Microsoft, and Amazon have seen their stock prices soar in recent years. As technology continues to advance, the tech sector is likely to remain a strong performer.

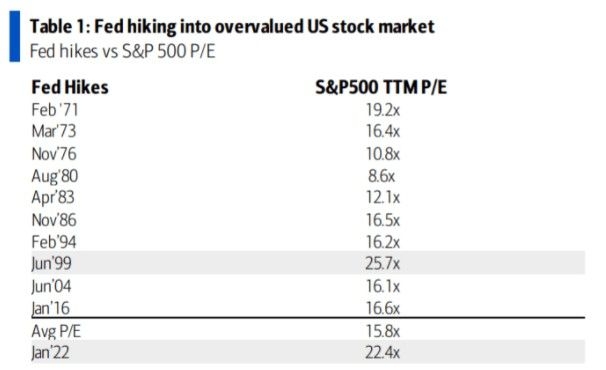

Interest Rates: Central banks, such as the Federal Reserve, have implemented various measures to stabilize the economy. These measures include lowering interest rates and implementing quantitative easing. However, higher interest rates can lead to a decrease in stock prices.

Geopolitical Tensions: Geopolitical tensions, such as trade wars and conflicts, can impact the market. Investors should keep an eye on these developments and their potential impact on the market.

Conclusion

In conclusion, while the market has experienced significant volatility, it is not currently in a state of crashing. Investors should focus on long-term strategies and consider the various factors that contribute to market movements. By staying informed and adapting to changing market conditions, investors can navigate the volatility and achieve their financial goals.

us stock market today