SP 500 Index YTD: A Comprehensive Analysis

author:US stockS -

The S&P 500 Index, often abbreviated as the SP 500, is a widely followed indicator of the stock market's performance. The year-to-date (YTD) figure provides a snapshot of how the index has performed since the beginning of the year. This article delves into the SP 500 YTD performance, offering insights into the key factors that have influenced it and highlighting the most significant trends.

Understanding the SP 500 YTD Performance

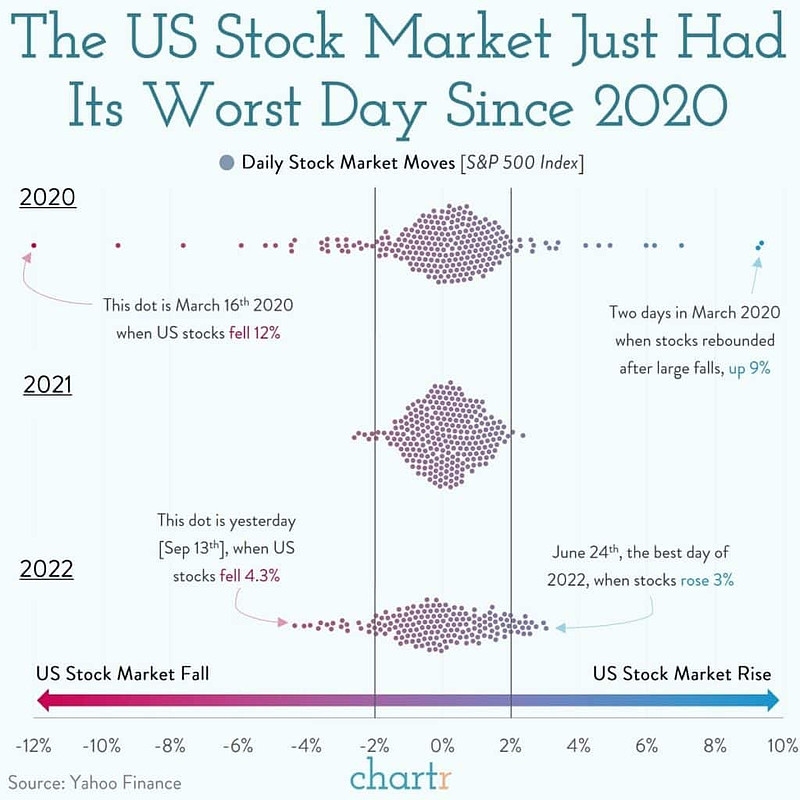

The SP 500 YTD performance is calculated by taking the percentage change in the index's value from the beginning of the year to the current date. This figure is a crucial indicator of the market's overall health and investor sentiment. A positive YTD figure suggests that the market is on an upward trend, while a negative figure indicates a downward trend.

Key Factors Influencing the SP 500 YTD Performance

Several factors have contributed to the SP 500 YTD performance. Here are some of the most significant ones:

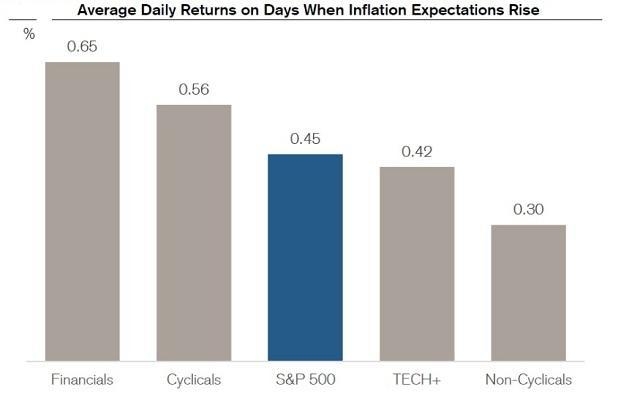

Economic Data: Economic indicators such as GDP growth, unemployment rates, and inflation data play a vital role in shaping the SP 500 YTD performance. Positive economic data tends to boost investor confidence and drive the index higher, while negative data can have the opposite effect.

Corporate Earnings: The earnings reports of companies listed on the SP 500 are a significant driver of the index's performance. Strong earnings reports can lead to higher stock prices, driving the index up, while weak earnings can have the opposite effect.

Political Events: Political events, such as elections or policy changes, can also impact the SP 500 YTD performance. For instance, the election of a new president or changes in government policies can lead to uncertainty and volatility in the market.

Global Events: Global events, such as trade wars or geopolitical tensions, can also influence the SP 500 YTD performance. These events can lead to increased volatility and uncertainty in the market, affecting the index's value.

Analysis of the SP 500 YTD Performance

As of the latest data, the SP 500 YTD performance has been mixed. Here are some key insights:

Economic Growth: The US economy has shown moderate growth in the past year, with GDP expanding at a steady pace. This has contributed to a positive SP 500 YTD performance.

Corporate Earnings: The earnings reports of companies listed on the SP 500 have been generally strong, with many companies reporting higher profits than expected. This has been a significant driver of the index's upward trend.

Political Events: The US presidential election and policy changes have created uncertainty in the market, leading to increased volatility. However, the market has generally held up well, despite these challenges.

Global Events: Global events, such as trade tensions between the US and China, have also created uncertainty in the market. However, the SP 500 has shown resilience, reflecting the overall strength of the US economy.

Case Studies

One notable example of the SP 500 YTD performance is the tech sector. Companies like Apple, Microsoft, and Amazon have been major contributors to the index's upward trend. These companies have reported strong earnings and have continued to innovate, driving their stock prices higher.

Another example is the healthcare sector. Companies like Johnson & Johnson and Pfizer have also contributed significantly to the SP 500 YTD performance. This sector has been driven by strong demand for pharmaceuticals and medical devices, as well as positive earnings reports.

Conclusion

The SP 500 YTD performance has been influenced by a variety of factors, including economic data, corporate earnings, political events, and global events. While the market has faced challenges, it has shown resilience and has generally held up well. As investors, it is crucial to stay informed about these factors and their impact on the market to make informed investment decisions.

us stock market today