Investing in the US Stock Market: A Comprehensive Guide

author:US stockS -

Are you considering investing in the US stock market but feeling overwhelmed by the vast array of options and strategies? Look no further! This comprehensive guide will walk you through the basics of investing in US stocks, providing you with the knowledge and confidence to make informed decisions.

Understanding the US Stock Market

The US stock market is one of the largest and most liquid in the world, offering a wide range of investment opportunities. It consists of two primary exchanges: the New York Stock Exchange (NYSE) and the NASDAQ. These exchanges list shares of publicly traded companies, allowing investors to buy and sell these shares.

Types of Stocks

When investing in the US stock market, you'll encounter several types of stocks:

- Common Stocks: These represent ownership in a company and provide voting rights. They offer the potential for higher returns but come with higher risk.

- Preferred Stocks: These provide fixed dividend payments but do not offer voting rights. They are considered less risky than common stocks but offer lower returns.

- Blue-Chip Stocks: These are shares of well-established, stable companies with a history of strong financial performance. They are considered less risky but offer lower returns than smaller, growth-oriented companies.

Investment Strategies

There are several investment strategies you can employ when investing in the US stock market:

- Buy and Hold: This strategy involves buying stocks and holding them for the long term, regardless of short-term market fluctuations.

- Dividend Investing: This strategy focuses on investing in companies that pay regular dividends, providing a steady income stream.

- Growth Investing: This strategy involves investing in companies with high growth potential, with the expectation that their stock prices will increase significantly over time.

Risk Management

It's crucial to understand the risks associated with investing in the US stock market. Here are some key points to consider:

- Market Risk: The stock market can be unpredictable, and prices can fluctuate significantly.

- Company Risk: The performance of a stock is directly tied to the performance of the company it represents. If the company performs poorly, its stock price may decline.

- Liquidity Risk: Some stocks may be less liquid, meaning it may take longer to buy or sell them at a fair price.

Finding the Right Stocks

To find the right stocks for your investment portfolio, consider the following factors:

- Company Financials: Analyze the financial statements of potential investments, including revenue, earnings, and debt levels.

- Industry Trends: Stay informed about industry trends and how they may impact the performance of specific companies.

- Management Team: Evaluate the track record and expertise of the company's management team.

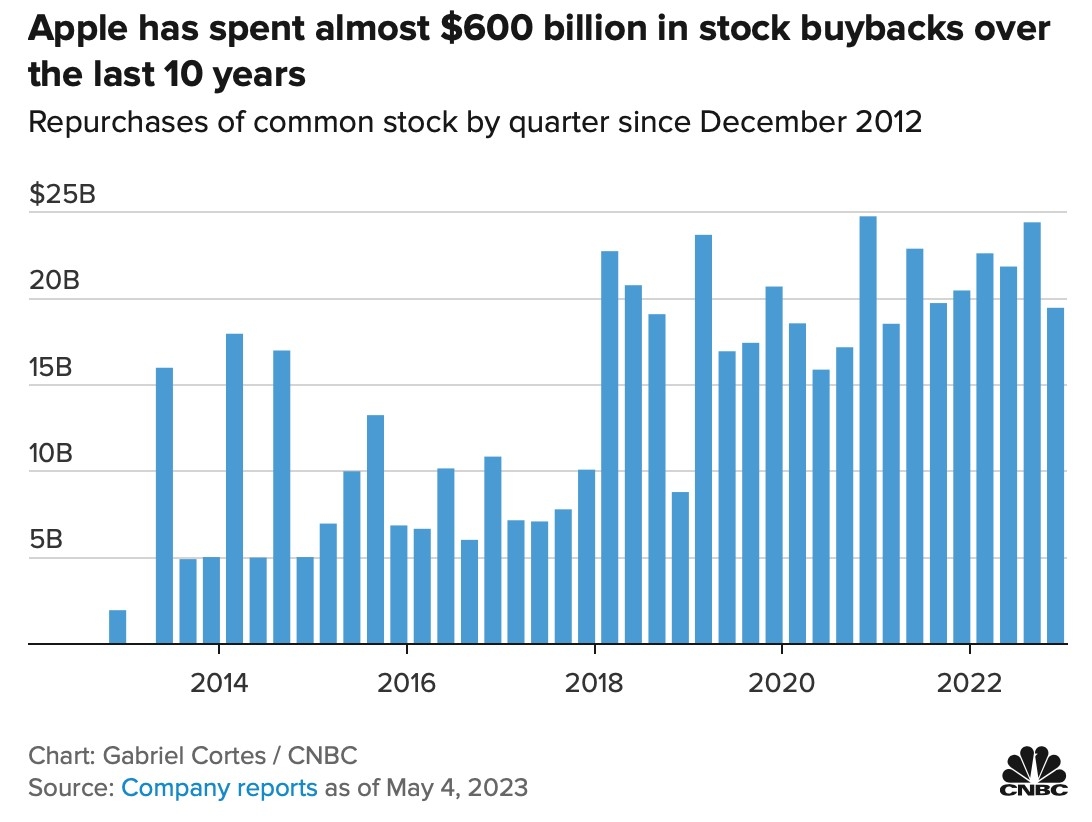

Case Study: Apple Inc.

Let's consider a real-world example of a successful investment in the US stock market. Apple Inc. (AAPL) is a leading technology company known for its innovative products and strong financial performance. Over the past decade, Apple's stock price has increased significantly, making it a valuable investment for many investors.

By focusing on long-term growth and innovation, Apple has been able to maintain its position as a market leader. Investors who bought Apple stock in 2010 and held onto it until 2020 would have seen a substantial return on their investment.

Conclusion

Investing in the US stock market can be a rewarding experience, but it requires knowledge, discipline, and a well-thought-out strategy. By understanding the basics of the stock market, employing sound investment strategies, and managing risk, you can build a successful investment portfolio. Remember to do your research and consult with a financial advisor if needed.

us stock market today