Unlocking the Potential of the Financial Data Market

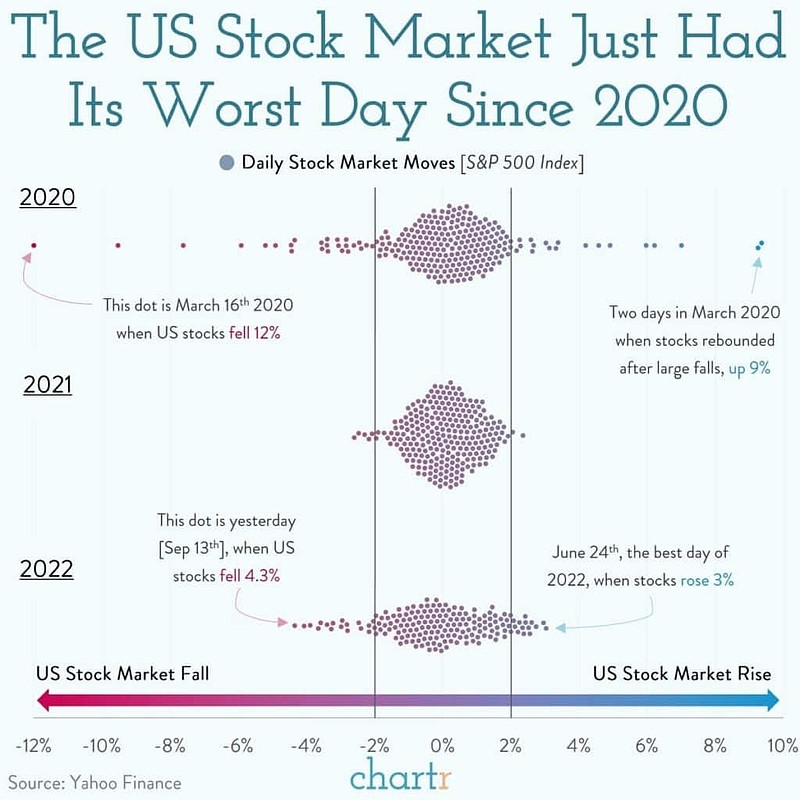

author:US stockS -

In today's digital age, the financial data market has emerged as a crucial sector for businesses seeking to gain a competitive edge. This market, characterized by the vast amount of financial information available, offers invaluable insights for investors, businesses, and policymakers. This article delves into the intricacies of the financial data market, highlighting its significance and exploring how it can be leveraged to drive success.

Understanding the Financial Data Market

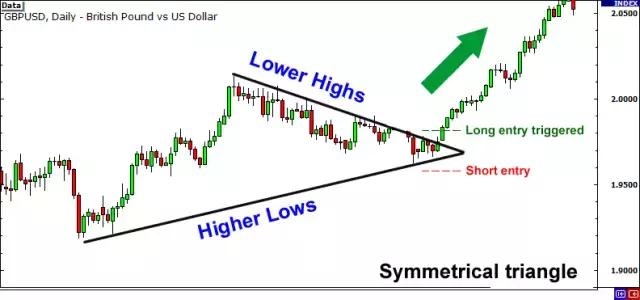

The financial data market encompasses a wide range of data, including stock prices, market trends, economic indicators, and corporate financial statements. This data is sourced from various platforms, such as stock exchanges, financial institutions, and government agencies. By analyzing this information, stakeholders can make informed decisions, identify investment opportunities, and anticipate market movements.

Key Players in the Financial Data Market

Several key players dominate the financial data market, including:

- Data Providers: Companies like Bloomberg, Reuters, and S&P Global provide comprehensive financial data to a wide range of clients.

- Technology Firms: Firms like IBM, Microsoft, and Oracle offer advanced analytics tools and platforms for processing and analyzing financial data.

- Financial Institutions: Banks, investment firms, and insurance companies utilize financial data to inform their business strategies and risk management practices.

The Benefits of Financial Data

The financial data market offers numerous benefits, including:

- Improved Decision-Making: Access to accurate and timely financial data enables stakeholders to make informed decisions, reducing the risk of financial loss.

- Enhanced Risk Management: Financial institutions can use data to identify and mitigate risks, ensuring the stability of their operations.

- Investment Opportunities: Investors can identify promising investment opportunities by analyzing market trends and economic indicators.

Case Studies

To illustrate the importance of the financial data market, consider the following case studies:

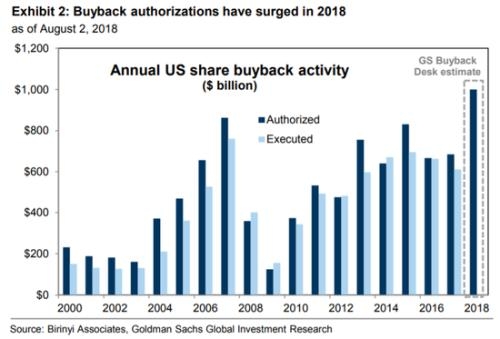

- Stock Market Analysis: A financial institution used data analytics to identify a potential stock market bubble. By taking proactive measures, the institution avoided significant losses.

- Economic Forecasting: A government agency utilized financial data to predict economic trends, enabling policymakers to implement effective economic strategies.

Challenges and Future Trends

Despite its numerous benefits, the financial data market faces several challenges, including:

- Data Quality: Ensuring the accuracy and reliability of financial data is crucial for stakeholders to make informed decisions.

- Data Privacy: Protecting sensitive financial data is a top priority for businesses and governments.

Looking ahead, several trends are shaping the future of the financial data market:

- Blockchain Technology: Blockchain can enhance data security and transparency in the financial data market.

- Artificial Intelligence: AI-powered analytics tools will become increasingly important for processing and analyzing vast amounts of financial data.

In conclusion, the financial data market is a vital sector for businesses and investors seeking to gain a competitive edge. By leveraging the vast amount of financial information available, stakeholders can make informed decisions, enhance risk management practices, and identify promising investment opportunities. As the market continues to evolve, it will become even more crucial for businesses to stay abreast of the latest trends and technologies.

us stock market today