Dow Jones High Today: A Comprehensive Analysis

author:US stockS -

The Dow Jones Industrial Average (DJIA), often simply referred to as the Dow, has been a barometer of the US stock market since its inception in 1896. Its recent surge to an all-time high is a testament to the resilience and strength of the American economy. This article delves into the factors contributing to this significant milestone and offers insights into what it means for investors and the broader market.

Economic Recovery and Low Interest Rates

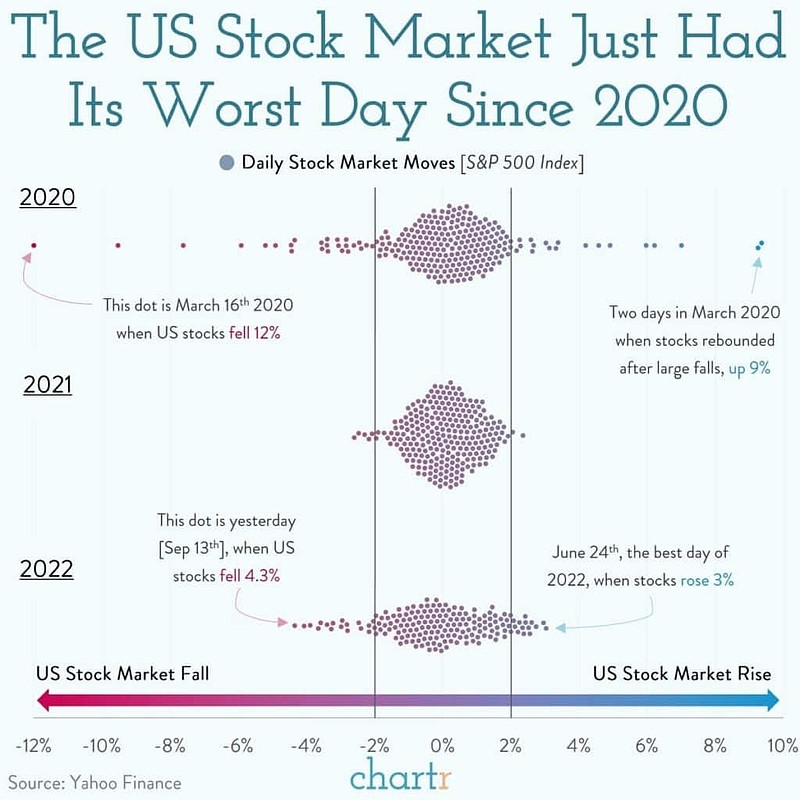

One of the primary drivers behind the Dow's record-breaking performance is the robust economic recovery. The US economy has shown remarkable resilience in the face of unprecedented challenges, including the COVID-19 pandemic. Low interest rates have also played a crucial role, as they encourage borrowing and investment, leading to increased stock prices.

Strong Corporate Earnings

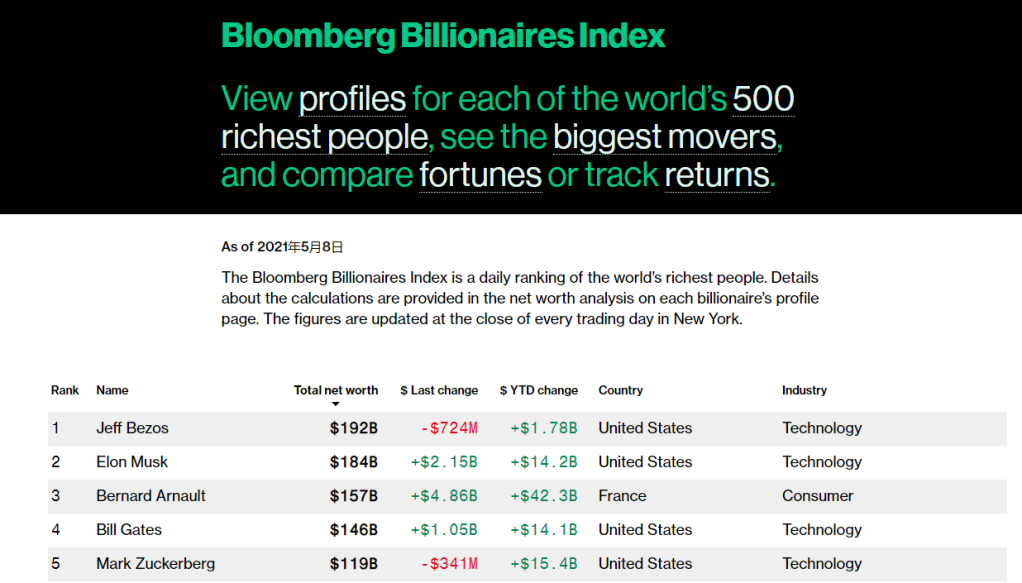

The strong performance of the companies included in the Dow has also contributed to its all-time high. Many of these companies, such as Apple, Microsoft, and Amazon, have reported robust earnings, driven by increased demand for their products and services during the pandemic.

Technology Sector Leading the Charge

The technology sector has been a significant driver of the Dow's growth. Companies like Apple and Microsoft have seen a surge in demand for their products, while Amazon has capitalized on the shift to online shopping. Tesla, another key player in the Dow, has also seen significant growth, driven by the increasing popularity of electric vehicles.

Market Sentiment and Foreign Investment

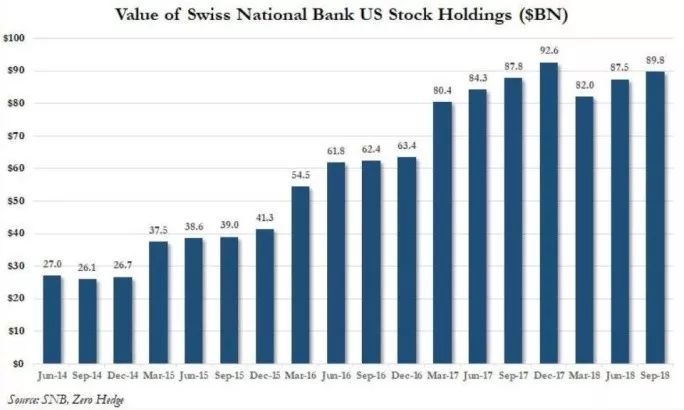

Positive market sentiment has also played a crucial role in the Dow's rise. The optimism surrounding the economy and the potential for continued growth has attracted both domestic and foreign investors to the US market. This influx of capital has further driven stock prices higher.

Impact on Investors

For investors, the Dow's all-time high presents both opportunities and challenges. Those looking to invest should consider the following:

- Diversification: It is crucial to diversify your portfolio to mitigate risk. Investing in a mix of assets, including stocks, bonds, and commodities, can help protect against market volatility.

- Long-Term Perspective: While the current market conditions are favorable, it is essential to maintain a long-term perspective. The stock market can be unpredictable, and short-term gains can be offset by sudden declines.

- Risk Management: As with any investment, it is crucial to understand the risks involved. This includes conducting thorough research and consulting with a financial advisor.

Case Studies

To illustrate the impact of the Dow's all-time high, let's consider two case studies:

- Apple: Since joining the Dow in 2015, Apple has seen significant growth, with its stock price increasing by nearly 300%. This growth has been driven by the company's strong performance and its position as a leader in the technology sector.

- Tesla: Tesla's inclusion in the Dow has been a significant event for the company. Since joining the index in December 2020, Tesla's stock price has surged by over 100%, driven by the increasing demand for electric vehicles and the company's expansion into new markets.

Conclusion

The Dow Jones' all-time high is a testament to the resilience and strength of the American economy. While it presents opportunities for investors, it is crucial to approach the market with a long-term perspective and a focus on risk management. By staying informed and making informed decisions, investors can navigate the complexities of the stock market and potentially benefit from the current market conditions.

us stock market today