Monthly Stock Market Performance: A Comprehensive Analysis

author:US stockS -

In the fast-paced world of finance, understanding the monthly stock market performance is crucial for investors and traders alike. This article delves into the factors that influence stock market performance on a monthly basis, offering insights and analysis to help you make informed decisions.

Understanding Monthly Stock Market Performance

Monthly stock market performance refers to the overall movement of stock prices over a period of one month. It is a critical indicator of market trends and investor sentiment. By analyzing monthly performance, investors can gain valuable insights into the market's direction and potential opportunities.

Key Factors Influencing Monthly Stock Market Performance

Several factors contribute to the monthly stock market performance. Here are some of the most significant ones:

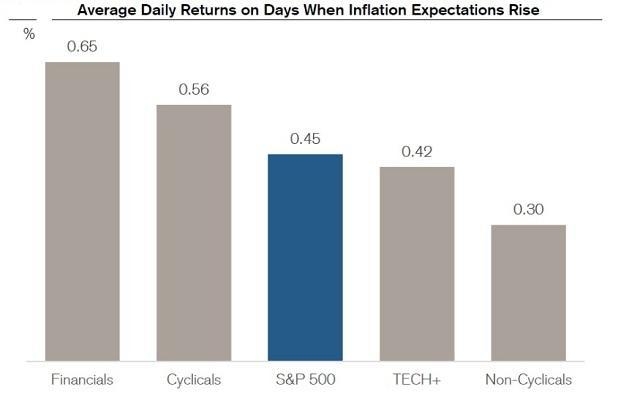

- Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation rates play a crucial role in determining stock market performance. Positive economic indicators often lead to a rise in stock prices, while negative indicators can cause a decline.

- Corporate Earnings: The financial performance of companies directly impacts stock prices. Strong earnings reports can drive up stock prices, while disappointing reports can lead to a decline.

- Market Sentiment: Investor sentiment can significantly influence stock market performance. Factors such as political events, geopolitical tensions, and economic uncertainties can cause investors to become either optimistic or pessimistic, leading to fluctuations in stock prices.

- Interest Rates: Interest rates are another critical factor. Lower interest rates can make stocks more attractive, leading to higher stock prices, while higher interest rates can make bonds more appealing, causing stock prices to fall.

Analyzing Monthly Stock Market Performance

To analyze monthly stock market performance, investors can use various tools and techniques. Here are some common methods:

- Technical Analysis: Technical analysis involves studying historical price and volume data to identify patterns and trends. Investors can use various technical indicators, such as moving averages, RSI, and MACD, to analyze monthly stock market performance.

- Fundamental Analysis: Fundamental analysis involves evaluating a company's financial health, business model, and industry position. By analyzing a company's financial statements, investors can gain insights into its potential for growth and profitability.

- Sentiment Analysis: Sentiment analysis involves analyzing investor sentiment through news, social media, and other sources. By understanding the mood of the market, investors can make more informed decisions.

Case Study: Monthly Stock Market Performance in 2021

In 2021, the stock market experienced significant volatility due to various factors, including the COVID-19 pandemic and economic uncertainties. Despite these challenges, the market posted strong gains for the year. Here's a breakdown of the monthly stock market performance in 2021:

- January: The market opened the year with a strong rally, driven by optimism about the economic recovery and vaccine distribution.

- February: The market experienced a pullback due to concerns about rising inflation and supply chain disruptions.

- March: The market recovered from the pullback and continued its upward trend, driven by strong corporate earnings and positive economic data.

- April: The market faced volatility due to concerns about rising interest rates and geopolitical tensions.

- May: The market stabilized and continued its upward trend, driven by strong corporate earnings and positive economic data.

- June: The market experienced a pullback due to concerns about rising inflation and supply chain disruptions.

- July: The market stabilized and continued its upward trend, driven by strong corporate earnings and positive economic data.

- August: The market faced volatility due to concerns about rising interest rates and geopolitical tensions.

- September: The market stabilized and continued its upward trend, driven by strong corporate earnings and positive economic data.

- October: The market experienced a pullback due to concerns about rising inflation and supply chain disruptions.

- November: The market stabilized and continued its upward trend, driven by strong corporate earnings and positive economic data.

- December: The market closed the year with a strong rally, driven by optimism about the economic recovery and vaccine distribution.

Conclusion

Understanding monthly stock market performance is essential for investors and traders. By analyzing the factors that influence stock market performance and using various tools and techniques, investors can gain valuable insights into the market's direction and potential opportunities. By staying informed and making informed decisions, investors can navigate the complexities of the stock market and achieve their financial goals.

us stock market today