DJIA Changes: Understanding the Latest Trends and Predictions

author:US stockS -

The Dow Jones Industrial Average (DJIA) is one of the most closely watched stock market indices in the United States. Its fluctuations can significantly impact investor sentiment and economic forecasts. In this article, we delve into the latest DJIA changes, analyze the factors driving these shifts, and offer predictions for the future.

What is the DJIA?

The DJIA is a price-weighted average of 30 large, publicly traded companies in the United States. These companies represent a variety of industries, including financials, technology, healthcare, and energy. The index serves as a benchmark for the overall performance of the U.S. stock market.

Recent DJIA Changes

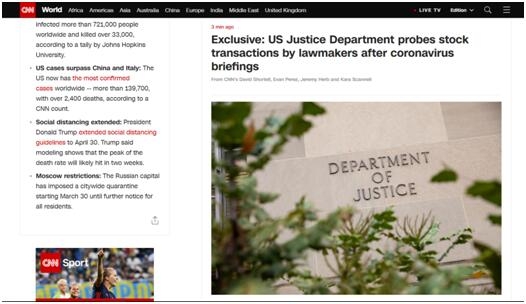

Over the past few years, the DJIA has experienced significant changes. In 2020, the index saw its largest one-day point decline on March 16th, marking the onset of the COVID-19 pandemic. However, it also recovered rapidly, reaching an all-time high by the end of the year. In 2021, the DJIA continued to climb, propelled by strong corporate earnings and low-interest rates.

Factors Driving DJIA Changes

Several factors contribute to the changes in the DJIA. These include:

- Economic Data: The release of economic data, such as unemployment rates, GDP growth, and inflation, can influence investor sentiment and the direction of the DJIA.

- Corporate Earnings: Companies reporting strong earnings can drive the DJIA higher, while disappointing results can lead to declines.

- Market Sentiment: Investor confidence and market sentiment play a crucial role in the DJIA's movements. Factors such as geopolitical tensions, political instability, and regulatory changes can impact investor sentiment.

- Interest Rates: Changes in interest rates can affect the DJIA, as lower rates can lead to increased borrowing and spending, which can boost corporate earnings.

Predictions for the Future

Predicting the future direction of the DJIA is challenging, but some experts offer insights into potential trends:

- Economic Growth: If the U.S. economy continues to grow, the DJIA is likely to rise. This is because the companies included in the index tend to perform well during periods of economic expansion.

- Corporate Earnings: As long as companies report strong earnings, the DJIA is likely to remain strong.

- Market Sentiment: If investor confidence remains high, the DJIA could continue to climb. However, if sentiment shifts negatively, the index could experience declines.

Case Studies

One notable case study involves the impact of the COVID-19 pandemic on the DJIA. In March 2020, the index plummeted, but it quickly recovered, reaching an all-time high by the end of the year. This rapid recovery can be attributed to several factors, including unprecedented stimulus measures from the government and central banks, as well as strong corporate earnings.

Conclusion

The DJIA is a vital indicator of the U.S. stock market's performance. By understanding the latest changes and factors driving these shifts, investors can make more informed decisions. While predicting the future direction of the DJIA remains challenging, keeping an eye on economic data, corporate earnings, and market sentiment can help investors stay ahead of the curve.

us stock market today